Managing finances is at the heart of any successful business, and among the most critical expenditures is payroll. It’s not just about paying your team; it involves a complex web of salaries, wages, taxes, benefits, and potential bonuses. Without a clear financial roadmap for these costs, businesses can quickly find themselves in choppy waters, making it hard to plan for growth or even maintain stability.

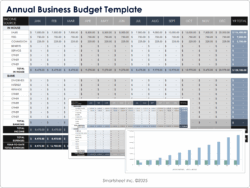

That’s where a robust 12 month payroll budget template comes in. Imagine having a crystal-clear forecast of your payroll expenses for the entire year ahead. This powerful tool isn’t just about crunching numbers; it’s about strategic foresight, enabling you to make informed decisions about hiring, expansion, and cash flow management. It transforms what can be a daunting, unpredictable expense into a manageable and predictable element of your financial strategy.

This article will guide you through the essentials of building and utilizing an effective payroll budget, highlighting why such a tool is indispensable for businesses of all sizes and how it contributes to overall financial health and operational efficiency.Unlocking Financial Clarity with a Detailed Payroll Budget

A well-structured payroll budget goes far beyond simply estimating employee salaries. It serves as a comprehensive financial blueprint for your human resources, offering insights into one of your largest operating costs. By meticulously planning your payroll over a 12-month period, you gain an invaluable perspective on your financial commitments, allowing for proactive adjustments rather than reactive damage control.

This level of detail means you can anticipate seasonal fluctuations in staffing, plan for potential raises or bonuses, and accurately forecast the impact of new hires. It helps identify periods of higher expenditure, allowing you to allocate resources more effectively across other departments. Ultimately, a detailed payroll budget empowers you to make smarter, data-driven decisions that support both your employees and your bottom line.

Ignoring the intricacies of payroll budgeting can lead to cash flow problems, overspending, or even understaffing when you truly need talent. Conversely, having a clear, forward-looking budget provides a safety net, ensuring that you always have the necessary funds to meet your commitments to your team.

Key Components of Your Payroll Budget

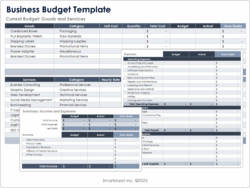

To truly be effective, your payroll budget needs to account for every facet of employee compensation. It’s more than just an hourly rate or a fixed salary; it encompasses a variety of costs that often get overlooked. Understanding these components is the first step towards building an accurate and reliable budget.

- Base Salaries and Wages: This is the foundation, covering regular pay for all employees, whether hourly or salaried.

- Overtime Pay: For roles that frequently require extra hours, forecasting potential overtime is crucial.

- Bonuses and Commissions: If your company offers performance-based incentives, these need to be projected as accurately as possible.

- Employer Payroll Taxes: Social Security, Medicare, federal and state unemployment taxes (FUTA, SUTA) are significant costs that vary by jurisdiction and salary.

- Employee Benefits: Health insurance premiums, retirement plan contributions, paid time off, and other perks represent a substantial part of your payroll budget.

- Workers’ Compensation Insurance: Essential for covering workplace injuries, this cost is often based on payroll figures.

- Training and Development: While not direct pay, investments in employee skills directly relate to your human capital and can be tied into the broader payroll strategy.

By breaking down these elements month-by-month within your 12 month payroll budget template, you create a dynamic tool that adapts to changes and provides a holistic view of your employee-related expenses. This comprehensive approach is what truly sets a powerful budget apart.

Moreover, the process of creating such a detailed budget often reveals inefficiencies or areas where costs could be optimized. Perhaps you identify a pattern of excessive overtime that could be mitigated with better scheduling, or realize certain benefits are underutilized. These insights are invaluable for refining your operational strategies and ensuring every dollar spent on your team is an investment yielding returns.

Implementing and Maintaining Your Payroll Budget

Once you have your 12 month payroll budget template in place, the real work begins: bringing it to life and ensuring it remains a living, breathing document. It’s not a set-it-and-forget-it tool; rather, it requires active engagement and regular review to stay relevant and effective throughout the year.

The initial step involves gathering all current data, from employee salaries and hours to tax rates and benefit premiums. Populate your template with these figures for the upcoming year, making reasonable projections for any expected changes like hires, departures, or salary adjustments. Be realistic in your estimates, erring on the side of caution where uncertainty exists.

Regularly reviewing your payroll budget against actual expenses is paramount. Monthly or quarterly checks allow you to identify any discrepancies early on, understand why they occurred, and make necessary adjustments to future projections. This iterative process helps refine your budgeting skills and ensures your template remains an accurate reflection of your financial reality.

- Gather Current Payroll Data: Collect all relevant salary, wage, tax, and benefits information.

- Populate the Template: Input your current data and make informed projections for the next 12 months.

- Forecast Future Changes: Account for anticipated hires, departures, raises, or shifts in benefits.

- Review and Adjust Regularly: Compare actual spending to your budget and update as needed.

- Communicate with Stakeholders: Share relevant insights with department heads or leadership to align on goals.

This ongoing management transforms your budget from a static spreadsheet into a dynamic financial management tool that evolves with your business. It allows for flexibility and responsiveness, crucial attributes in today’s fast-paced business environment.

Having a clear financial picture for your payroll can dramatically reduce stress and provide a solid foundation for all your business decisions. It’s about building confidence in your financial planning, knowing that you’re prepared for what the next year holds and that your most valuable asset—your people—is securely accounted for.

Embrace the power of proactive financial management. By adopting a detailed, forward-looking approach to your payroll expenses, you’re not just organizing numbers; you’re investing in the stability, growth, and overall success of your organization, ensuring a smoother journey through the fiscal year.