Embarking on a financial fast can feel like a daunting challenge, but it is also one of the most empowering steps you can take toward gaining clarity and control over your money. It is a dedicated period, typically 21 days, where you consciously cut back on non-essential spending, allowing you to refocus your financial habits and identify where your money truly goes.

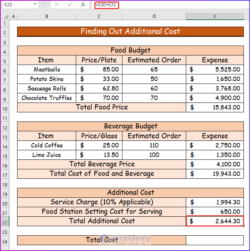

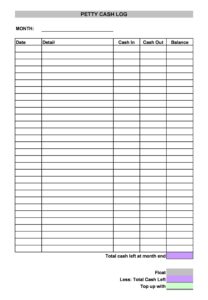

To successfully navigate this period of intense financial discipline, a well-structured plan is crucial. This is where a robust 21 day financial fast budget template becomes your most valuable ally. It provides the framework you need to track income, identify essential expenses, and most importantly, pinpoint those areas where you can significantly reduce or eliminate spending for the duration of the fast.

Think of it as a reset button for your finances. For three weeks, you commit to living on only the bare necessities, prioritizing needs over wants, and creating a clear picture of your actual financial landscape without the clutter of impulse purchases or habitual discretionary spending.

Diving Deep into Your 21-Day Financial Fast

A financial fast isn’t just about cutting expenses; it’s about building awareness. For 21 days, you intentionally remove financial distractions to see your spending patterns more clearly. This deep dive helps you distinguish between true necessities and things you spend on out of habit or convenience. It’s an opportunity to recalibrate your relationship with money, understanding its flow in and out of your life on a minute-by-minute basis.

The success of this intensive period hinges heavily on preparation, and that’s precisely why a detailed 21 day financial fast budget template is indispensable. It transforms an abstract goal into a concrete, actionable plan. Without a clear budget, it’s easy to get lost in the day-to-day decisions, unsure of what is truly allowed and what should be paused. A template provides that unwavering guide, helping you stay disciplined and focused on your objective.

Your template should be comprehensive, yet simple enough to use consistently. It needs to account for every dollar, helping you visualize your financial commitments and the areas ripe for temporary reduction. This isn’t about deprivation; it’s about conscious allocation and intentional living for a set period.

Key Components of Your Fasting Budget

- **Income Tracking:** Start by listing all expected income sources for the 21-day period. This gives you a clear picture of what you have available to work with.

- **Fixed Expenses (Essentials Only):** Identify bills that absolutely cannot be paused, such as rent/mortgage, minimum loan payments, essential utilities, and insurance premiums. These are your non-negotiables.

- **Variable Expenses (Strict Essentials):** This is where the fast truly takes shape. Budget very tightly for food (groceries only, no eating out), transportation (fuel for work, public transport), and essential hygiene items.

- **Non-Essential Spending (Zero Budget):** This category should ideally be empty. This means no dining out, no entertainment, no new clothes, no subscriptions you can pause, no fancy coffees, and minimal social spending.

- **Debt Repayment/Savings Goals (Optional but Recommended):** If possible, redirect any money saved from non-essential spending towards a specific debt or savings goal. This gives your fast an even greater purpose.

Regularly tracking your actual spending against your budgeted amounts is the bedrock of this fast. Whether you prefer a digital spreadsheet, a dedicated app, or a simple notebook, commit to logging every single transaction. This real-time data will reveal any slip-ups instantly and allow you to adjust course, reinforcing your commitment and highlighting areas where you might need more discipline or a clearer strategy.

Beyond the numbers, a significant part of the 21-day financial fast is the mental shift it encourages. It forces you to get creative, find free forms of entertainment, cook at home more often, and truly appreciate what you already have. This mindset of intentionality often leads to long-term changes that extend far beyond the fasting period.

Beyond the 21 Days: Sustaining Your Progress

Completing a 21-day financial fast is a remarkable achievement. It’s a testament to your discipline and a powerful learning experience. The real power, however, lies not just in surviving the fast, but in integrating the lessons learned into your everyday financial life. You’ve likely discovered spending habits you didn’t even realize you had and uncovered hidden pockets of money you can redirect towards your larger financial goals.

As the fast concludes, the challenge shifts from strict elimination to mindful incorporation. Instead of reverting to old patterns, consider how you can selectively reintroduce certain discretionary spending in a way that aligns with your newly defined values and goals. The awareness you’ve built regarding your true needs versus wants is an invaluable asset that can continue to guide your decisions moving forward.

- **Keep Tracking:** Even if not as strictly, continue tracking your spending to maintain awareness.

- **Automate Savings:** Use the insights from your fast to set up automatic transfers to savings or investment accounts.

- **Review Goals Regularly:** Revisit your financial aspirations and adjust your budget to ensure you are consistently moving towards them.

- **Conscious Spending:** Before making a purchase, ask yourself if it truly aligns with your long-term financial health.

The structured approach provided by a budget template, combined with the intense focus of a financial fast, offers a powerful springboard for lasting financial transformation. It’s a journey that starts with a temporary reset but has the potential to redefine your financial future permanently, empowering you to make smarter, more intentional choices every single day.

This period of intentional frugality is more than just about saving money; it’s about building financial muscles, gaining invaluable insights into your habits, and setting a robust foundation for future prosperity. Embrace the clarity and confidence that emerge from this focused financial journey, knowing you’ve taken a significant step toward a healthier financial life.