Navigating your finances can sometimes feel like trying to solve a complex puzzle, especially when you are aiming for both current enjoyment and future security. Many people find themselves wondering how to balance paying bills, saving for big goals, and still having enough left over for the fun things in life. It is a common challenge, but thankfully, there are straightforward strategies that can help bring clarity and control to your money management.

One of the most popular and effective methods for simplifying personal finance is the 50/30/20 rule. This easy-to-understand guideline offers a practical framework for allocating your income, making it accessible even if you are new to budgeting. By dividing your after-tax earnings into three clear categories, you can gain a strong sense of where your money is going and ensure that your spending aligns with your financial priorities. This approach is so straightforward that many financial experts recommend using a 50/30/20 budget template to get started.

This article will guide you through the ins and outs of the 50/30/20 rule, explaining each component and offering actionable steps to implement it successfully in your own life. Whether you are looking to pay down debt, boost your savings, or simply achieve a better balance in your everyday spending, understanding this budget can set you on a clear path towards financial well-being.

Understanding the Core Components of the 50/30/20 Rule

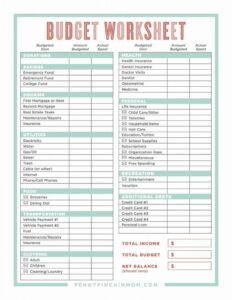

The beauty of the 50/30/20 rule lies in its simplicity. It suggests that you divide your after-tax income, meaning the money you actually receive in your bank account, into three main categories: 50% for Needs, 30% for Wants, and 20% for Savings and Debt Repayment. This allocation provides a broad yet flexible guideline, allowing you to tailor it to your unique financial situation while maintaining the core principles of balanced spending. Let’s break down what each of these percentages truly represents and how to categorize your expenses within them.

The largest portion, 50%, is dedicated to your “Needs.” These are the non-negotiable expenses that are absolutely essential for your survival and maintaining your basic standard of living. Think of these as the bills you must pay, without which you would face significant hardship. It is crucial to be honest with yourself about what truly falls into this category, as sometimes we might mistakenly label wants as needs.

50% for Needs: The Essentials

This category covers everything you need to live and work. If you couldn’t pay for these things, your life would be significantly impacted.

- Housing costs (rent or mortgage payments)

- Utility bills (electricity, water, gas)

- Groceries (basic food supplies)

- Transportation (car payments, public transport, gas, car insurance for essential travel)

- Minimum loan payments (student loans, personal loans, credit cards)

- Health insurance premiums

Next up, 30% of your income is allocated to “Wants.” These are the expenses that improve your quality of life and bring you joy, but are not strictly necessary for survival. This is where you have the most flexibility and control, as cutting back on wants is often the first step when you need to free up more money for savings or debt repayment.

30% for Wants: Enjoying Life

These are the discretionary expenses that you choose to spend money on. You could live without them, but they certainly make life more enjoyable.

- Dining out or ordering takeout

- Entertainment (movies, concerts, streaming subscriptions)

- Vacations and travel

- New clothes and accessories (beyond basic necessities)

- Hobbies and leisure activities

- Gym memberships (if not medically necessary)

- Upgraded internet or phone plans

Finally, 20% of your income should be directed towards “Savings and Debt Repayment.” This category is vital for building your financial future and achieving long-term security. It encompasses saving for emergencies, investing, and accelerating the payment of high-interest debts. This percentage is arguably the most impactful for your financial health over time.

20% for Savings and Debt Repayment: Building Your Future

This portion of your income is dedicated to improving your financial standing and preparing for the future.

- Emergency fund contributions

- Retirement savings (401k, IRA)

- Investment contributions

- Additional payments towards high-interest debt (credit cards, personal loans)

- Saving for a down payment on a house or car

- Education savings

By clearly defining these categories, you gain a powerful lens through which to view your spending. It is not about deprivation, but about intentional allocation. Understanding that you have dedicated portions for essential living, personal enjoyment, and future growth can alleviate financial stress and empower you to make smarter money choices.

Putting the 50/30/20 Budget Template into Action

Now that you understand the different components of the 50/30/20 rule, it’s time to put it into practice. Implementing this budget doesn’t have to be complicated; it simply requires a bit of honest assessment and consistent tracking. The first step is always to get a clear picture of your income, as all your percentages will be based on this crucial number. Remember, we are talking about your net income, which is the amount of money that actually lands in your bank account after taxes, health insurance, and retirement contributions are deducted.

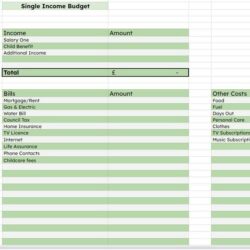

Once you know your exact net income, the next critical step is to track all your expenses for a month or two. This can be done using a spreadsheet, a budgeting app, or even just a notebook. The goal is to see where your money is currently going before you start making any adjustments. Don’t worry if your initial spending doesn’t fit the 50/30/20 mold perfectly; that’s entirely normal and the whole point of using a budget like this is to identify areas for improvement.

After you have a good understanding of your income and expenses, you can begin categorizing each outflow into Needs, Wants, or Savings/Debt Repayment. This is where the real work of budgeting begins. You might find that your “Wants” category is much larger than 30%, or that you’re not saving as much as 20%. This insight is valuable because it shows you exactly where you need to make adjustments to align with the 50/30/20 budget template.

Here’s a simple breakdown of the implementation steps:

- Calculate Your Net Income: Determine your take-home pay after all deductions.

- List All Your Expenses: Track every penny you spend for at least one month.

- Categorize Everything: Assign each expense to either Needs (50%), Wants (30%), or Savings/Debt (20%).

- Adjust and Optimize: If your categories don’t align with the rule, look for areas to cut back on wants or increase savings. This might involve reducing discretionary spending or exploring options to lower your fixed costs.

- Track and Review Regularly: Budgeting is an ongoing process. Regularly review your spending to ensure you’re staying on track and make adjustments as your income or expenses change.

Adopting the 50/30/20 rule can truly transform your financial outlook, providing a clear roadmap for managing your money effectively. It simplifies the often daunting task of budgeting into an easily digestible and actionable plan. By consistently applying this straightforward framework, you can gain greater control over your finances, reduce stress, and actively work towards your financial aspirations.

Starting your budgeting journey, regardless of your current financial situation, is a powerful step towards building a more secure and prosperous future. This flexible guideline empowers you to make conscious decisions about your money, ensuring that you are not just spending, but strategically allocating your resources to achieve both immediate satisfaction and long-term financial health.