Keeping track of money, whether it’s what you owe, what you’re owed, or simply where your funds are going, can feel like a never-ending chore. In our busy lives, payments flow in and out constantly, making it surprisingly easy to lose sight of important financial details. Without a clear system, you might find yourself scrambling to remember if a bill was paid, if a client settled their invoice, or even what that mysterious charge on your bank statement was for. This lack of organization can lead to unnecessary stress, missed payments, or even financial disputes that are tricky to resolve without proper documentation.

Fortunately, there’s a simple yet incredibly powerful tool that can bring order to this financial chaos: a well-designed payment record payment log template. This isn’t just about recording numbers; it’s about creating a clear, comprehensive history of all your financial transactions. By centralizing this information, you gain peace of mind, ensure accuracy, and empower yourself with the data needed to make smart financial decisions, avoid mistakes, and easily recall past transactions whenever necessary. It transforms a potentially overwhelming task into a straightforward, manageable process.

Why Keeping a Detailed Payment Log is Absolutely Essential

You might think a quick glance at your bank statement is enough, but a dedicated payment log goes so much further. Think of it as your personal financial historian, meticulously documenting every single transaction. This isn’t just for big businesses; individuals, freelancers, small business owners, and even families can benefit immensely from having a structured way to record payments. It’s about taking proactive control of your financial narrative rather than reacting to surprises.

One of the most immediate benefits is crystal-clear financial visibility. When you actively log each payment, you develop a much deeper understanding of your income and expenditure patterns. You’ll see exactly where your money is coming from and where it’s going, allowing you to identify unnecessary spending, spot areas for savings, and ultimately, build a more realistic budget. This insight is invaluable for both short-term money management and long-term financial planning, helping you achieve your goals faster.

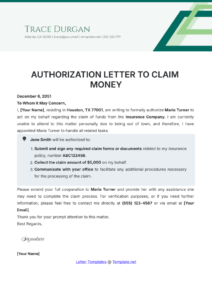

Beyond personal insight, a robust payment log is your best friend when it comes to dispute resolution. Let’s face it, misunderstandings happen. A vendor might claim an invoice wasn’t paid, or a client might forget they owe you for a service. With a comprehensive record, you have irrefutable proof of every transaction: the date, the amount, the method, and who was involved. This concrete evidence can swiftly clear up any confusion and protect you from baseless claims or accidental double payments, saving you time, money, and a whole lot of frustration.

Moreover, preparing for tax season becomes significantly less daunting with a well-maintained payment log. Instead of sifting through stacks of receipts and bank statements at the last minute, all your relevant financial data is neatly organized and easily accessible. This not only streamlines the tax preparation process but also ensures accuracy, helping you maximize deductions and avoid errors that could lead to audits. For businesses, this level of organization is not just helpful, it’s a legal and operational necessity.

Ultimately, using a payment record payment log template empowers you to make informed decisions about your money. It gives you the confidence to manage your finances effectively, knowing that every transaction is accounted for. It’s a fundamental step towards financial literacy and stability, providing a clear picture of your financial health at any given moment.

Key Advantages of Implementing a Payment Log

- Eliminates confusion over who paid what, when, and how much.

- Provides concrete evidence in case of payment disputes.

- Simplifies tax preparation by consolidating all payment information.

- Helps in tracking recurring expenses and income streams.

- Offers a clear overview of your financial health for better budgeting.

- Ensures timely follow-ups for outstanding payments.

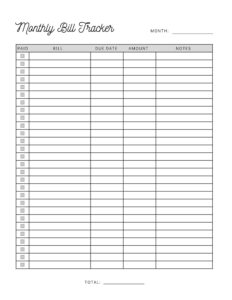

What to Include in Your Payment Record Payment Log Template

Creating an effective payment record payment log template isn’t about just scribbling down a few numbers. It’s about structuring your information so that it’s immediately useful, clear, and comprehensive. The goal is to capture all the critical details of a transaction in a way that makes sense to you, whether you’re reviewing it next week or next year. The beauty of a template is its adaptability; you can tailor it precisely to your unique needs, adding or removing fields as necessary.

At its core, any good payment log needs the basics. The date of the transaction is fundamental, providing a chronological anchor for all your records. Equally important are the names of the payer and payee, clearly identifying who initiated and who received the funds. The amount of the payment is, of course, crucial, detailing the exact sum of money involved. Finally, noting the payment method – whether it was cash, bank transfer, credit card, or something else – adds another layer of important context for verification.

However, to elevate your log from basic to truly powerful, consider incorporating additional details. A description or purpose field is incredibly helpful, explaining what the payment was for. This can be anything from “rent for May” to “consulting fee for Project Alpha.” For businesses, an invoice number or reference number is indispensable for cross-referencing with other financial documents. Including a “status” column can also be very useful, noting if a payment is paid, pending, partially paid, or even refunded.

You might also want to add fields specific to your situation. For instance, if you’re tracking installment payments, a “balance due” or “remaining balance” column would be highly relevant. Freelancers or small businesses might benefit from a “client name” field or a project identifier. The key is to think about what information you frequently need to access or what details would be crucial if a dispute were to arise. A well-thought-out payment record payment log template becomes a custom tool that serves your exact financial tracking requirements, making your life significantly easier.

- Date of Transaction: The precise day the payment occurred.

- Payer or Payee Name: Who sent the money or who received it.

- Amount: The exact financial sum of the transaction.

- Payment Method: How the money was exchanged (e.g., cash, bank transfer, credit card, check).

- Description or Purpose: A brief explanation of what the payment was for.

- Reference or Invoice Number: Any unique identifier associated with the transaction.

- Status: Indicates if the payment is paid, pending, due, or refunded.

- Category: Optional but useful for budgeting (e.g., utilities, salary, supplies).

Taking control of your financial records doesn’t have to be a daunting task. By utilizing a structured approach to payment logging, you’re not just recording data; you’re building a foundation for greater financial clarity and security. It’s about empowering yourself with knowledge, ensuring that every financial interaction is accounted for and easily traceable, giving you the confidence to manage your money effectively.

Embracing the habit of consistently updating your payment log will quickly become second nature. The benefits of having all your payment information readily available far outweigh the small effort required to maintain it. Start today, and experience the peace of mind that comes with knowing exactly where you stand financially, always.