As a real estate professional, your car is more than just transportation; it’s an essential part of your office on wheels. From showing properties and meeting clients to attending open houses and running errands for listings, the miles add up incredibly fast. While all this driving is integral to your success, it also presents a significant opportunity for tax deductions that many agents might overlook or fail to track properly.

That’s where meticulous record-keeping comes into play. Trying to recall every trip at the end of the year can be a daunting, if not impossible, task. Fortunately, a well-designed real estate mileage log template can transform this potential headache into a simple, straightforward process, ensuring you capture every eligible mile and maximize your savings.

Why a Real Estate Mileage Log Template is Your Best Business Partner

For real estate agents, the Internal Revenue Service (IRS) views business mileage as a legitimate and deductible expense. This isn’t just a small perk; it can translate into thousands of dollars in deductions annually, directly impacting your bottom line. However, the IRS also requires strict documentation to substantiate these deductions. Without proper records, you risk losing out on significant savings or, worse, facing complications during an audit. This is precisely why a robust real estate mileage log template isn’t just a suggestion; it’s a critical tool for your financial well-being.

Think about the sheer volume of driving you do. Showing properties across different neighborhoods, picking up lockboxes, meeting contractors, attending training seminars – each journey has a business purpose. Each journey, therefore, represents a potential deduction. A dedicated log ensures you don’t miss a single one, providing an accurate, detailed account that stands up to scrutiny. It also helps you differentiate between personal and business use of your vehicle, a crucial distinction for tax purposes.

Beyond just tax time, maintaining a precise mileage log offers other business benefits. It provides a clearer picture of your operational costs, helping you budget more effectively for fuel, maintenance, and vehicle depreciation. It can also serve as a professional record of client visits, proving the effort you put into each listing or buyer search, which can be valuable for client relations or dispute resolution.

Key Elements of an Effective Mileage Log

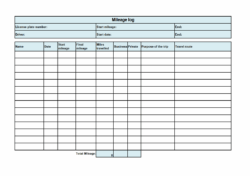

To be IRS-compliant and truly useful, your mileage log needs to capture specific pieces of information for every business trip. Simply jotting down the total miles at the end of the week won’t cut it. Each entry should tell a complete story of your travel.

A good template will prompt you for all the necessary details, making it easy to fill out consistently. Here’s what you should be tracking for every business drive:

* The date of the trip

* The starting odometer reading

* The ending odometer reading

* The total miles driven for that specific trip

* The destination or client’s address

* The clear business purpose of the trip (e.g., “Show property at 123 Main St,” “Client meeting for new listing,” “Open house prep”).

By diligently recording these details, you create an undeniable paper trail that validates your deductions. Whether you prefer a digital spreadsheet or a physical notebook template, consistency is key. Make it a habit to log your miles immediately after each trip, rather than trying to remember them days later.

Choosing and Implementing Your Real Estate Mileage Log Template

The beauty of a real estate mileage log template is its versatility. You have several options when it comes to choosing the format that best suits your workflow and technological comfort level. Many agents opt for simple printable PDF templates that they keep in their car, allowing for quick handwritten entries. Others prefer digital solutions, utilizing spreadsheets in Excel or Google Sheets, which offer easy calculation and cloud-based access. There are also dedicated mileage tracking apps for smartphones that automate much of the process, though these often come with a subscription fee.

When deciding which template to use, consider what will make it easiest for you to maintain regularly. If you’re constantly on the go and prefer minimal fuss, a simple, print-and-go option might be best. If you’re tech-savvy and want automated features and digital storage, a spreadsheet or app could be more efficient. The best template is the one you will actually use consistently, so prioritize ease of access and input.

Implementing your chosen real estate mileage log template successfully means integrating it seamlessly into your daily routine. Don’t view it as an extra chore, but rather as an integral part of closing out a client visit or finishing a property tour. Make it a habit to record your mileage before you even leave the property or client meeting. Set a reminder on your phone, or simply place your physical log in an obvious spot in your car.

Regular review is also important. Whether it’s weekly or monthly, take a moment to look over your entries, ensuring accuracy and catching any missed trips. This also provides an opportunity to calculate your running totals, giving you a clearer picture of your expenses throughout the year. At the end of the day, having a robust system in place offers unparalleled peace of mind, especially when tax season rolls around.

By taking proactive steps to track your business mileage, you’re not just complying with tax regulations; you’re actively safeguarding your income. A dedicated system ensures that every mile driven for your real estate business contributes to your financial benefit, simplifying tax preparation and potentially saving you significant money. Embrace the simplicity and power of consistent mileage tracking to elevate your financial management and focus more on what you do best: helping clients.