In the dynamic world of business, planning for the future isn’t just a good idea, it’s an absolute necessity. Whether you’re a burgeoning startup or an established enterprise, understanding where your significant investments will go over the next several years can make all the difference between thriving and merely surviving. This long-term foresight is particularly crucial when it comes to capital expenditures, those big-ticket items that drive growth and operational efficiency.

Imagine being able to clearly visualize your organization’s major financial commitments five years down the line. Picture having a strategic roadmap that guides your decisions, ensures resources are allocated effectively, and minimizes unwelcome surprises. This level of clarity is not just a pipe dream; it’s a tangible outcome of diligent financial planning, specifically through a well-crafted capital budget.

That’s precisely where a robust 5 year capital budget template comes into play. It acts as your crystal ball, offering a structured framework to project, analyze, and manage your substantial investments, ensuring every dollar spent contributes meaningfully to your long-term vision.Understanding the Core of a 5-Year Capital Budget

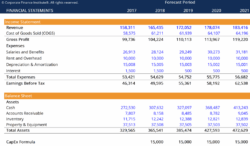

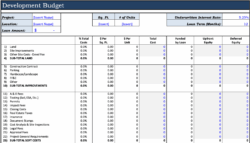

A capital budget is essentially a detailed plan for your organization’s significant long-term investments. These aren’t your everyday operational expenses; we’re talking about assets that will benefit the company for more than one fiscal year, such as new machinery, building expansions, technology upgrades, or even a fleet of vehicles. The “5-year” aspect refers to the strategic time horizon, providing a balance between immediate needs and distant aspirations, allowing for comprehensive planning and adaptability.

Why is this five-year outlook so critical? Firstly, many capital projects have extended lifecycles, from planning and acquisition to implementation and depreciation. A shorter timeframe might miss the complete picture, while a longer one could become too speculative. Secondly, a five-year window aligns well with most strategic business plans, enabling the capital budget to directly support overarching organizational goals. It helps businesses anticipate future needs, allocate resources wisely, and mitigate financial risks before they escalate.

The benefits of a well-structured capital budget are numerous. It facilitates informed decision-making by providing a clear financial context for each potential investment. It optimizes resource allocation by ensuring that capital is directed to projects with the highest strategic value and return on investment. Furthermore, it enhances financial stability by allowing organizations to forecast cash flow needs and secure necessary funding in advance. Ultimately, it’s a proactive tool that helps businesses grow sustainably and predictably.Key Components to Include in Your Template

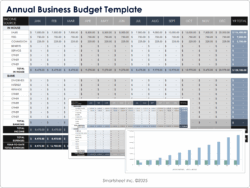

To be truly effective, your 5 year capital budget template should encompass a comprehensive set of data points. Think of each element as a piece of a larger puzzle, contributing to a complete and accurate financial picture. Without these details, your budget might lack the precision needed for sound decision-making.

- Project Name and Description: A clear, concise identification of the capital project.

- Estimated Cost: Detailed breakdown of expenses, ideally year-by-year across the five-year period.

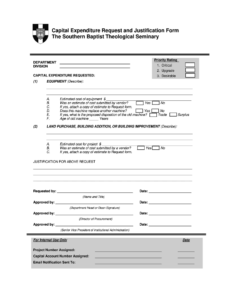

- Funding Source: How will this project be financed? (e.g., retained earnings, debt, equity).

- Expected Return on Investment (ROI) or Benefits: Quantification of the value the project brings.

- Projected Start and End Dates: Timelines for the project’s execution.

- Department Responsible: Clear accountability for project oversight.

- Priority Level: Ranking projects based on strategic importance and urgency.

Each of these components plays a vital role. For instance, understanding the estimated cost over time allows you to manage cash flow effectively, while knowing the funding source ensures financial feasibility. The expected ROI or benefits help justify the investment, ensuring it aligns with business objectives. By meticulously documenting these details within your capital budget, you create a robust framework for financial governance and strategic growth.

Crafting Your Capital Budget: A Step-by-Step Approach

Building a comprehensive capital budget might seem daunting at first, but by breaking it down into manageable steps, the process becomes much clearer. It starts with a thorough understanding of your organization’s needs and extends to rigorous financial analysis and strategic prioritization. This systematic approach ensures that every proposed capital expenditure is carefully considered and aligned with your long-term objectives.

Begin by soliciting input from all relevant departments. What equipment is nearing the end of its life? Are there any anticipated expansions or technological upgrades needed to maintain competitiveness or improve efficiency? Encourage team leaders to think proactively about their five-year capital needs. This initial brainstorming phase is crucial for capturing all potential projects that might require significant investment, laying the groundwork for a robust 5 year capital budget template.

Once you have a list of potential projects, the next step involves detailed cost estimation and research into potential funding sources. This means getting quotes, understanding market prices, and assessing internal financial capacity or external financing options. Simultaneously, analyze the potential return on investment or strategic benefits for each project. Prioritization follows, where projects are ranked based on urgency, strategic alignment, financial viability, and overall impact on the business. This careful evaluation ensures that your capital is allocated to projects that will yield the greatest value and support your long-term vision.

- Identify Capital Needs: Gather requirements from across the organization.

- Estimate Costs and Research Funding: Obtain detailed cost breakdowns and explore financing options.

- Prioritize Projects: Rank investments based on strategic importance and financial impact.

- Review and Approve: Seek formal approval from leadership or the board.

- Monitor and Adjust: Continuously track project progress and adapt the budget as circumstances change.

Embracing a systematic approach to capital budgeting provides your organization with unparalleled clarity and control over its future. It transforms what could be a series of reactive decisions into a proactive, well-thought-out strategy, positioning your business for sustained success and growth.

By meticulously planning your capital expenditures, you empower your organization to make intelligent, data-driven decisions that propel you towards achieving your strategic goals, ensuring every investment is a step forward.