Are you constantly wondering where all your money goes, especially when it comes to eating out or grocery shopping You are definitely not alone. Managing daily expenses can feel like a never-ending puzzle, and food and drink often take up a significant chunk of our hard-earned cash. It is one of those categories that seems to expand to fill whatever budget you do or do not have.

That is precisely why having a clear plan is so crucial. A robust food and beverage budget template can be your secret weapon in gaining control over your finances. It helps you see exactly where your money is going and allows you to make informed decisions about your spending habits without feeling deprived or overwhelmed.

Think of it as a personalized roadmap for your culinary adventures. Whether you are aiming to save for a big goal, reduce unnecessary spending, or simply want a clearer picture of your monthly outflows, this tool offers the structure and insight you need to achieve your financial objectives. It transforms vague intentions into actionable steps.

Why a Food and Beverage Budget Template is Your Financial Best Friend

Taking charge of your food and beverage spending is one of the most impactful steps you can take toward overall financial wellness. For many households, food is the second or third largest expense category, right after housing and transportation. Yet, it is often an area where spending can easily spiral out of control due to impulsive purchases, frequent dining out, or simply not knowing how much you are truly spending each month. Without a clear system in place, it is incredibly challenging to identify areas where you can save.

This is where the magic of a dedicated food and beverage budget template comes in handy. It provides a structured framework to monitor and categorize all your food related expenses. Instead of a vague notion of “too much,” you will gain precise figures that reveal your spending patterns. This clarity empowers you to make conscious choices, distinguishing between needs and wants, and aligning your spending with your financial goals. It is not about restricting yourself to dry toast, but rather about intentionality.

The template encourages you to think about your food purchases before they happen. It prompts you to plan meals, create grocery lists, and even set limits for restaurant visits. This proactive approach not only saves you money but can also lead to healthier eating habits and less food waste. When you know your limits, you are less likely to succumb to spontaneous, expensive takeout orders that derail your budget.

Categorizing Your Culinary Spending

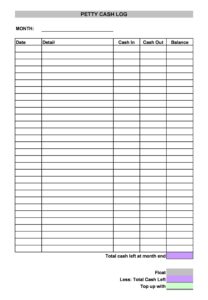

To truly understand your food budget, breaking it down into specific categories is essential. A good food and beverage budget template will include sections that allow you to distinguish between different types of food related expenses. This level of detail helps pinpoint exactly where your money is flowing, making it easier to identify areas for adjustment.

Consider these common categories to help organize your spending:

- Groceries This covers all your supermarket runs for ingredients to cook at home.

- Restaurants and Takeaways This includes dining out, fast food, and meal delivery services.

- Coffee and Snacks Daily coffee runs, vending machine purchases, and convenience store snacks.

- Special Occasions Any food or drink related expenses for celebrations or entertaining guests.

- Alcohol and Beverages Separate tracking for alcoholic drinks purchased for home or while out.

By meticulously tracking these distinct areas, you can see if you are spending too much on impulse buys at the coffee shop or if your restaurant bill is consistently exceeding your allocation. This granular insight is invaluable for making targeted adjustments and ensuring your spending aligns with your overall financial picture. It is about understanding the small leaks that can collectively become a significant drain.

Making Your Food Budget Template Work For You

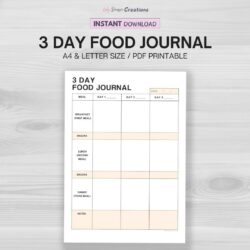

Once you have your food and beverage budget template set up, the real work and the real rewards begin. The key to its success lies in consistent engagement and honest tracking. It is not a set-it-and-forget-it tool; rather, it is a living document that needs regular attention to provide accurate insights. Make it a habit to input your expenses daily or at least several times a week. The more diligent you are with tracking, the clearer picture you will have of your spending patterns and where you might need to make adjustments.

Remember that a budget is not a rigid cage but a flexible guide. Life happens, and there will be months where unforeseen events or celebrations might cause you to go over in one category. The beauty of a template is that it highlights these variances, allowing you to learn from them and adjust future months. Perhaps you need to allocate more for groceries next month if you ate out less, or maybe you need to consciously cut back on dining out if you exceeded your limit for a special event.

Finally, be patient and kind to yourself. It takes time to find the right balance and adjust your habits. Regularly review your budget at the end of each month to compare your actual spending against your planned amounts. This review process is crucial for refining your budget, setting realistic expectations, and identifying areas where you have made great progress. The more you use and adapt your template, the more effectively it will serve as a powerful tool for achieving your financial goals.

Embracing a systematic approach to your food and beverage spending through a dedicated template is a foundational step towards greater financial literacy and freedom. It transforms the often-stressful task of managing money into an empowering journey of awareness and intentional choice.

By understanding where every dollar for your food and drinks goes, you unlock the potential to redirect those funds towards savings, investments, or other cherished goals. This simple yet powerful tool is more than just numbers on a page; it is a pathway to a more secure and mindful financial future, allowing you to enjoy your meals without the side dish of financial worry.