Stepping into married life is an exciting adventure, full of shared dreams, laughter, and the promise of a beautiful future together. Amidst all the romance and planning for your life ahead, there’s one practical step that can truly strengthen your bond and secure your future: merging your finances. It might not sound as glamorous as picking out honeymoon destinations, but creating a joint financial plan is one of the most loving and responsible things you can do as a new couple.

Many couples find that combining their money can feel a little daunting. You each come with your own financial habits, preferences, and possibly even some hidden anxieties. That’s where a clear, easy-to-use system comes in handy. It’s not about restricting your spending, but rather about creating a roadmap for your money so it works for both of you, towards your shared goals.

Imagine having a clear picture of where your money is going and knowing exactly how you’re tracking towards your next big milestone, whether it’s buying a home, planning a trip, or starting a family. That peace of mind is invaluable, and it all starts with finding the right new married couple budget template to guide your financial journey together.

Your First Power Couple Move: Building a Budget Together

Deciding to combine finances and create a budget is a powerful statement of unity and shared responsibility. It transforms two individual financial narratives into a single, collaborative story. This isn’t just about tracking numbers; it’s about transparency, trust, and setting yourselves up for success from day one. Many financial disagreements stem from a lack of clarity or differing expectations, and a budget is the ultimate tool for prevention.

When you sit down to build your budget, you’re not just crunching numbers; you’re having crucial conversations about your values, your priorities, and what financial security looks like for both of you. It’s an opportunity to understand each other’s spending habits without judgment and to align on what truly matters. This collaborative approach ensures that the budget isn’t one person’s rigid set of rules, but a flexible plan you both own and believe in.

Think of it as laying the groundwork for all your future ambitions. Do you dream of early retirement, extensive travel, or supporting a cause close to your hearts? A well-structured budget is the vehicle that will get you there. It allows you to consciously allocate funds towards these aspirations, rather than just hoping you’ll have enough left over at the end of the month.

Getting Started: The First Few Conversations

- **Share Your Financial Histories:** Be open about your current income, any debts you might have (student loans, credit cards), and your current savings. No surprises down the road!

- **Discuss Spending Habits:** What do you individually love to spend money on? Where do you tend to overspend? Understanding these patterns is key to creating a realistic budget.

- **Define Joint Financial Goals:** What do you want to achieve together in the next 1, 5, or 10 years? This could be a down payment on a house, a new car, a dream vacation, or starting an emergency fund.

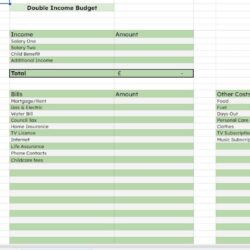

Using a template simplifies this entire process. Instead of starting from scratch and trying to figure out what categories to track, a new married couple budget template provides a ready-made framework. It prompts you to consider all the essential aspects of your financial life, making sure no important area is overlooked. This allows you to focus more on the discussion and less on the structure, making your initial budgeting sessions more productive and less overwhelming.

Crafting Your Personalized Budget and Staying on Track

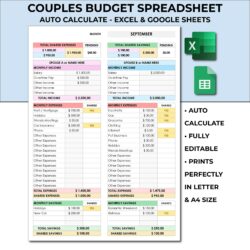

Once you’ve had those initial important conversations, it’s time to fill in the numbers. Your budget will essentially have two main components: your income and your expenses. List out all your combined monthly income first. Then, move on to categorizing your expenses. It’s helpful to think of these in terms of fixed expenses (rent/mortgage, loan payments, insurance) and variable expenses (groceries, dining out, entertainment, utilities). Don’t forget a category for savings and debt repayment, as these are crucial for your long-term health.

There are many digital tools and apps available today that can make this process incredibly smooth, but a simple spreadsheet can also be highly effective. The key is to choose a method you both feel comfortable using and that you can access easily. The goal is to make budgeting a regular, integrated part of your financial routine, not a chore you dread. Regularly reviewing your budget, perhaps once a week or bi-weekly, will help you stay accountable and make necessary adjustments.

Here are some essential categories to consider for your new married couple budget template:

- **Housing:** Rent/mortgage, property taxes, home insurance.

- **Utilities:** Electricity, gas, water, internet, cell phones.

- **Transportation:** Car payments, fuel, public transport, maintenance.

- **Food:** Groceries, dining out, coffee runs.

- **Debt Repayment:** Student loans, credit cards, personal loans.

- **Insurance:** Health, life, car.

- **Savings:** Emergency fund, retirement, specific goals (down payment, vacation).

- **Personal Spending/Fun:** Hobbies, entertainment, personal care, clothes.

- **Miscellaneous:** Gifts, charitable donations, unexpected costs.

Remember, your budget isn’t set in stone. Life changes, and so should your financial plan. As you settle into married life, you might find certain categories need more or less allocation. The beauty of a shared budget is its flexibility and your ability to adapt it together. Regular check-ins will help you both remain aware of your progress, celebrate successes, and calmly address any areas where you might be veering off course.

By thoughtfully creating and maintaining your budget, you’re building more than just a financial plan; you’re building a stronger, more resilient partnership. It’s a testament to your commitment to each other and your shared future, ensuring that you navigate the financial landscape of life as a united team. This proactive approach will undoubtedly set a solid foundation for many happy and financially secure years ahead.