Navigating the financial landscape of the real estate industry can feel like orchestrating a symphony where every instrument plays a crucial role. From the excitement of closing a deal to the challenge of managing overheads, every penny counts. It’s a dynamic environment, full of opportunities, but also one that demands meticulous financial planning to truly thrive. Without a clear picture of where your money is coming from and where it’s going, even the most promising ventures can stumble.

That’s where a well-crafted real estate business budget template becomes your most valuable ally. It’s more than just a spreadsheet; it’s a strategic roadmap that empowers you to make informed decisions, identify areas for growth, and proactively address potential financial pitfalls. Think of it as your business’s financial GPS, guiding you toward profitability and sustainability.

By taking the time to outline your income and expenses, you gain unparalleled control over your financial destiny. This proactive approach not only helps you weather unexpected storms but also enables you to strategically invest in marketing, technology, and talent, ultimately propelling your real estate business to new heights. It’s about turning uncertainty into confidence, one budget line item at a time.

What Goes Into Your Real Estate Budget?

Building an effective budget means looking at your business through a financial lens, categorizing everything from your primary income sources to the smallest incidental expenses. It’s a comprehensive overview that provides clarity on your financial health, allowing you to allocate resources wisely and identify areas for potential savings or increased investment. This detailed breakdown ensures you aren’t leaving any stone unturned in your quest for financial efficiency.

Understanding Your Income Streams

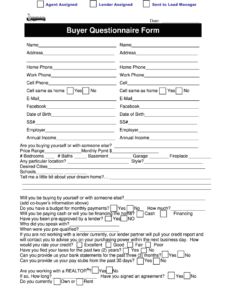

Your income streams in real estate typically revolve around commissions from sales, buyer representation, and possibly referral fees or property management income. It’s vital to project these as accurately as possible, perhaps based on historical data or conservative forecasts, to set realistic revenue expectations for your budget. This forms the foundation upon which all your spending decisions will be made.

Core Operating Expenses

These are the non-negotiable costs of doing business, the expenses that keep your operations running day-to-day. They can vary widely depending on whether you’re a solo agent, a small team, or a larger brokerage. Careful tracking here is paramount, as these are often consistent and can quickly eat into profits if not managed.

- Marketing and Advertising: This includes everything from online ads and social media campaigns to print materials and open house signage.

- Technology and Software: CRM systems, listing management tools, website hosting, and communication platforms are essential in today’s digital age.

- Professional Development: Courses, certifications, and industry seminars are investments in your expertise and future growth.

- Association Dues and Licensing: Mandatory fees to maintain your real estate license and membership in professional organizations.

- Office Expenses: Rent, utilities, internet, and supplies if you operate from a physical office space.

- Transportation and Travel: Fuel, vehicle maintenance, and travel for client meetings or property showings.

- Legal and Accounting Fees: Essential services for compliance, tax preparation, and contract review.

It’s crucial to distinguish between fixed costs, which remain constant month to month, and variable costs, which fluctuate based on your activity levels. For instance, office rent is a fixed cost, while the cost of staging a new listing is variable. A good budget template will help you separate these, providing a clearer picture of your financial commitments.

Variable Costs

Beyond the core operating expenses, you’ll encounter variable costs that are directly tied to your business volume. These might include professional photography for listings, staging costs, lead generation services based on performance, or even client appreciation gifts. These expenses are often directly related to generating revenue, so while they fluctuate, they are usually a sign of active business. Anticipating these fluctuations is key to preventing cash flow surprises.

How to Effectively Use Your Budget Template

Once you have your real estate business budget template filled out, the real work begins: using it as a living document to guide your financial decisions. It’s not a set-it-and-forget-it tool; rather, it requires regular attention and adjustment to remain relevant and effective. Think of it as a constant conversation with your business’s finances.

A great starting point is to consistently track every single transaction, both income and expense. This might seem tedious at first, but with good accounting software or even a simple spreadsheet, it becomes a habit that pays dividends. Comparing your actual spending against your budgeted amounts allows you to quickly identify where you’re overspending or perhaps underspending on critical areas. This real-time feedback loop is essential for maintaining financial discipline.

Furthermore, schedule regular reviews, perhaps monthly or quarterly, to assess your budget’s performance. Are your income projections still realistic? Have any new expenses emerged? Is there an opportunity to reallocate funds to more profitable activities? Being flexible and willing to adapt your budget based on market changes or business performance ensures that it remains a powerful tool for strategic planning and growth, not just a historical record.

Keeping a close eye on your budget empowers you to make proactive, informed decisions rather than reactive ones. It provides the clarity needed to identify opportunities for investment, cut unnecessary costs, and ultimately steer your real estate business towards greater profitability and stability. With a well-maintained budget, you’re not just managing money; you’re building a stronger, more resilient business foundation for the long run.