Navigating the financial landscape as a couple can sometimes feel like trying to solve a complex puzzle with moving pieces. You both work hard, you both bring in an income, and you both have financial hopes and dreams. But without a clear roadmap, it’s easy for money matters to become a source of stress rather than a tool for building a shared future. Understanding where your money goes and how to make it work for you, together, is absolutely crucial for financial harmony.

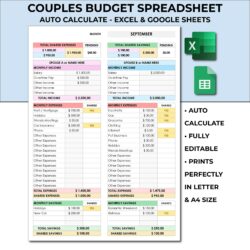

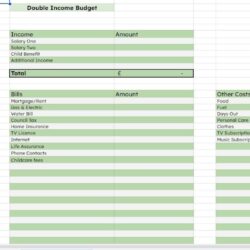

This is where a dedicated two income monthly budget template comes into play. It is more than just a spreadsheet; it’s a communication tool, a goal-setter, and a stress-reducer all rolled into one. By combining your financial efforts and tracking them in a structured way, you gain incredible clarity and control over your combined resources, moving from individual spending habits to a cohesive financial strategy.

In the following sections, we will explore why a joint budget is so vital for couples, dive into the essential categories you should consider, and guide you through the practical steps of setting up your very own template to achieve your financial aspirations as a team. Get ready to transform your money management from a chore into an empowering journey.

Why a Joint Budget Makes All the Difference

For many couples, combining finances can feel like a daunting step. There are often individual spending habits developed over years, different approaches to saving, and sometimes, a reluctance to fully merge financial identities. However, embracing a joint budget is perhaps one of the most powerful steps you can take to build a strong, transparent, and united financial future together. It stops financial discussions from being a point of contention and instead turns them into collaborative planning sessions.

The beauty of having two incomes is the increased financial power and flexibility it offers. Yet, without a shared system, this advantage can quickly be overshadowed by what is often called “lifestyle creep.” As incomes rise, so too do expenses, often subtly, making it feel like despite bringing in more money, you are never quite getting ahead. A joint budget tackles this head-on by providing a clear overview of all incoming funds and outgoing expenses, forcing you to consciously decide where every dollar goes. It helps you distinguish between shared responsibilities and individual desires, allowing both partners to feel heard and respected in the financial planning process.

One of the first steps in creating a robust budget is to clearly define and categorize your expenses. This might sound tedious, but it is the foundation upon which all successful budgeting rests. When you see your spending broken down, it’s much easier to identify areas where you might be overspending or where adjustments can be made to better align with your shared goals, whether that is saving for a down payment, paying off debt, or planning a dream vacation.

Essential Budget Categories for Couples

- Housing: Rent or mortgage payments, property taxes, home insurance.

- Utilities: Electricity, gas, water, internet, television subscriptions.

- Transportation: Car payments, fuel, public transport, car insurance, maintenance.

- Food: Groceries, dining out, coffee runs.

- Debt Repayment: Credit cards, student loans, personal loans.

- Savings and Investments: Emergency fund, retirement accounts, specific goal savings.

- Personal Spending: Hobbies, individual wants, clothing, personal care.

- Entertainment and Recreation: Movies, concerts, vacations, gym memberships.

- Healthcare: Insurance premiums, prescriptions, doctor visits not covered.

- Miscellaneous: Gifts, subscriptions, unexpected expenses.

Regularly tracking these categories will reveal patterns and habits that you might not have been aware of. It is not about restricting enjoyment, but rather about making informed decisions. For example, you might discover that you are spending more on dining out than you realized, and decide to reallocate some of that money towards a shared savings goal. This ongoing review is a critical component of any effective budget.

Setting Up Your Two Income Monthly Budget Template for Success

Once you understand the ‘why’ behind a joint budget, the ‘how’ becomes much simpler. The key to successfully implementing a two income monthly budget template is communication and consistency. Sit down together with all your financial documents including pay stubs, bank statements, and credit card bills. This collaborative effort sets a positive tone and ensures both partners are equally invested in the process from the very beginning.

Start by calculating your combined net income, which is the total amount of money you both bring home after taxes and deductions. This figure forms the basis of your budget. Next, list all your fixed expenses. These are the bills that largely stay the same each month, such as your rent or mortgage, loan payments, and insurance premiums. Seeing these laid out clearly allows you to quickly determine how much of your income is already committed.

The next step involves tackling variable expenses and setting aside funds for savings and debt repayment. This is where many couples find opportunities to optimize their spending. It is important to be realistic about these categories. If you love dining out, cutting it completely might lead to frustration. Instead, agree on a reasonable allocation and stick to it. Remember, a budget is a living document that should evolve with your life, so be prepared to revisit and adjust it regularly to ensure it continues to serve your shared financial goals effectively.

- Gather all financial information from both partners.

- Calculate your combined net monthly income.

- List all fixed expenses with their exact amounts.

- Estimate and allocate funds for variable expenses.

- Prioritize savings and debt repayment, treating them as fixed expenses.

- Agree on individual discretionary spending amounts.

- Schedule a regular monthly meeting to review and adjust your budget.

Embracing a two income monthly budget template is a powerful declaration of your financial partnership. It moves you beyond simply hoping for the best with your money and instead empowers you to actively shape your financial destiny together. By committing to this process, you are not just managing money; you are building a stronger foundation for your relationship, fostering trust, and working in unison towards a brighter future.

With a clear budget in place, you will find peace of mind knowing where your money is going and how it is working to achieve your shared aspirations. It truly is one of the most effective tools for creating financial clarity and harmony within your household.