Running a farm is a unique blend of passion, hard work, and business acumen. You are not just planting seeds or raising livestock; you are managing a complex enterprise susceptible to weather patterns, market fluctuations, and unpredictable expenses. Understanding where your money comes from and where it goes is absolutely crucial for your farm’s survival and growth, yet it is often one of the most overlooked aspects until a crisis hits.

Imagine having a clear roadmap for your finances, allowing you to anticipate lean times and capitalize on good seasons. That is exactly what a robust farm cash flow budget template offers. It is a powerful tool that transforms vague financial worries into actionable insights, helping you make informed decisions about everything from equipment purchases to expansion plans.

This article will delve into the vital role of cash flow planning for agricultural businesses, explore the essential elements that make a budget truly effective, and show you how embracing this financial discipline can lead to greater stability and success for your farm.

Why Every Farm Needs a Robust Cash Flow Plan

Farming is inherently cyclical. You have planting seasons, growing seasons, and harvest seasons, each with distinct income and expenditure patterns. Unlike many businesses with relatively stable monthly revenues, a farm often sees large income spikes followed by periods of minimal sales, while expenses like feed, fuel, and labor can be ongoing. This uneven flow of money makes managing your finances a constant challenge.

Many farmers understandably focus on profit and loss statements, which are excellent for understanding overall financial performance over a period. However, a profit does not always mean you have cash in the bank to pay immediate bills. You might have sold a large crop on credit, or invested heavily in equipment, making your profit look good on paper but leaving your cash reserves low. This is precisely where cash flow comes into play; it tracks the actual movement of money in and out of your farm business.

Without a clear understanding of your cash flow, you might find yourself struggling to meet payroll, pay suppliers, or even cover personal living expenses during slower periods, despite your farm being profitable in the long run. Unforeseen repairs, sudden drops in commodity prices, or unexpected weather events can quickly drain your reserves if you are not prepared. Proactive cash flow management is not just good practice; it is a necessity for navigating the agricultural landscape.

A well-structured cash flow budget helps you visualize future financial scenarios, allowing you to forecast potential shortfalls or surpluses. This foresight empowers you to make timely adjustments, such as securing a line of credit before you actually need it, postponing non-essential purchases, or strategically timing sales to optimize your financial position. It shifts your perspective from reactive problem-solving to proactive strategic planning.

Ultimately, a robust cash flow plan provides peace of mind. It allows you to sleep better at night, knowing you have a handle on your farm’s financial health and are prepared for whatever comes your way. It transforms financial uncertainty into a predictable and manageable aspect of your farm operation.

Understanding Your Inflows and Outflows

To truly master your cash flow, you must itemize every single source of money coming into your farm and every expense going out.

- Inflows typically include crop sales, livestock sales, government payments, custom work, lease income, and any other revenue streams.

- Outflows encompass operating expenses like feed, fertilizer, seed, fuel, repairs, utilities, labor costs, insurance, property taxes, loan payments, and capital expenditures.

The Power of Proactive Decision Making

When you have a clear picture of your cash flow, you are equipped to make smarter, more timely decisions. This foresight can prevent financial stress and unlock growth opportunities.

- Identify periods of cash surplus to invest in farm improvements or save for future needs.

- Anticipate cash deficits and arrange financing in advance, potentially securing better terms.

- Evaluate the financial impact of new projects or investments before committing.

Key Components of an Effective Farm Cash Flow Budget Template

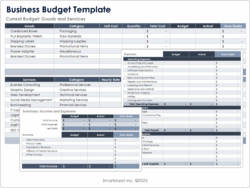

When you are looking for or creating a farm cash flow budget template, it is essential that it is not just a static document but a dynamic tool that can adapt to your farm’s unique operations and the ever-changing agricultural environment. A truly effective template will allow you to track, project, and adjust your finances with ease, providing clarity over complexity. It should be intuitive enough for you to update regularly without becoming a chore.

The best templates break down your financial year into manageable periods, usually months, and distinguish between various types of income and expense. This granularity helps you pinpoint specific areas where your farm is excelling or where there might be opportunities for cost savings or revenue enhancement. It moves beyond simple totals to show you the ebb and flow of your money throughout the year, reflecting the seasonal nature of farming.

Remember, a cash flow budget is a living document. It is not meant to be created once and then forgotten. Regular review and comparison of actual cash flow against your budgeted figures are critical. This comparison helps you refine your future projections, identify trends, and make timely operational adjustments. The more you use and refine your template, the more accurate and valuable it becomes in guiding your farm’s financial journey.

Here are some crucial components you should expect in a comprehensive template:

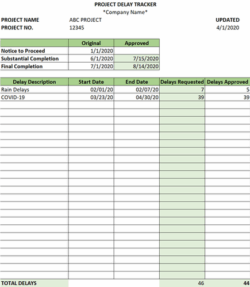

- Monthly or Quarterly Projections: Breaking down cash flow over shorter periods to reflect seasonality.

- Detailed Income Sources: Specific categories for crop sales, livestock sales, custom work, grants, and other revenue.

- Categorized Expenses: Clear sections for operating costs like feed, fuel, labor, repairs, utilities, and debt service.

- Beginning and Ending Cash Balances: Tracking how much cash you start and end each period with, including bank accounts.

- Loan Repayment Schedules: Integrating principal and interest payments for all outstanding loans.

- Capital Expenditure Planning: Accounting for major purchases like new machinery, land, or building improvements.

Taking control of your farm’s cash flow is one of the most empowering steps you can take toward securing its future. It is not just about crunching numbers; it is about gaining a deeper understanding of your business, enabling you to make more confident and strategic decisions.

Embracing this level of financial insight paves the way for greater resilience against market volatility and unexpected challenges, ultimately fostering a more sustainable and prosperous agricultural operation for years to come.