Venturing into commercial real estate can be an exciting journey, full of potential for significant returns and long-term wealth building. However, like any major investment, it comes with its fair share of complexities, particularly when it comes to managing finances. It’s not just about buying a property; it’s about understanding the ongoing costs, potential income, and unforeseen expenses that can impact your bottom line.

That’s where a robust financial plan becomes absolutely essential. Without a clear roadmap of your expected revenues and expenditures, you could easily find yourself navigating a turbulent sea without a compass. This isn’t just about tracking money; it’s about strategic planning that informs every decision you make regarding your property. Having a strong commercial real estate budget template at your disposal can make all the difference.

Imagine having all your financial data neatly organized, allowing you to see at a glance where your money is going and coming from. It empowers you to take control, anticipate challenges, and ultimately maximize the profitability of your commercial property investments.

Understanding the Core Components of Your Commercial Real Estate Budget

So, you’re ready to get serious about your commercial real estate finances. But what exactly should a comprehensive budget include? It’s more than just a simple tally of what you spend and what you earn. A truly effective budget delves into various categories, giving you a granular view of your property’s financial health. Let’s break down the essential elements you’ll want to track.

First and foremost, you need a clear picture of your income. This isn’t always as straightforward as it seems, as commercial properties can generate revenue from multiple sources. Thinking beyond just base rent is crucial for a complete financial overview.

Key Income Streams to Factor In

- Base Rental Income: The primary revenue from tenant leases, potentially including cost recovery from triple net leases.

- Parking Fees: Income generated from daily, monthly, or event-specific parking in dedicated areas.

- Utility Reimbursements: Payments received from tenants for their share of utility consumption.

- Amenity Charges: Fees collected for the use of shared property amenities like conference rooms or fitness centers.

- Advertising/Signage Income: Revenue from allowing third-party advertisements or prominent signage on the property.

Once you’ve cataloged your potential income, it’s time to face the expenses. These are often more numerous and can be less predictable, making careful budgeting all the more important. Overlooking even minor costs can lead to significant discrepancies over time.

Major Expense Categories You Can’t Afford to Miss

- Property Taxes: Non-negotiable annual costs based on property valuation.

- Insurance: Premiums for policies protecting against various risks such as fire, liability, and natural disasters.

- Utilities: Costs for common area lighting, heating/cooling, and utilities for vacant units.

- Maintenance and Repairs: Expenses ranging from routine cleaning and landscaping to unexpected repairs like plumbing or roof issues.

- Property Management Fees: Significant operational costs if you employ a professional management company, often a percentage of gross income.

- Legal and Accounting Fees: Costs for professional services related to leases, tax filings, and legal advice.

- Vacancy Costs: Financial implications of empty units, including lost rental income and ongoing utility or marketing expenses.

- Capital Expenditures (CapEx): Larger, infrequent expenses for major property improvements or replacements like HVAC systems or roofs, requiring proactive saving.

By breaking down your budget into these detailed components, you gain incredible insight into the financial mechanics of your commercial property. It helps you identify areas for potential savings, anticipate future needs, and make more informed decisions about rent increases or expense reductions.

How a Commercial Real Estate Budget Template Simplifies Your Financial Management

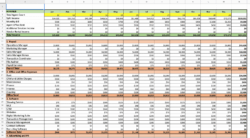

Now that we’ve outlined the extensive list of income and expense categories, you might be thinking, “How do I keep track of all this?” This is precisely where a dedicated commercial real estate budget template becomes an invaluable tool. It’s not just a spreadsheet; it’s a structured system designed to streamline your financial oversight, saving you time, reducing errors, and empowering smarter decisions.

Think of it as your financial co-pilot. A good template comes pre-organized with all the common income and expense categories we just discussed, ensuring you don’t overlook critical line items. Instead of starting from scratch every time, you have a ready-made framework that guides your input. This standardization is key to comparing performance over different periods or even across multiple properties in your portfolio.

Beyond organization, these templates often include built-in formulas for calculations. This means less manual number crunching for you, reducing the risk of human error when calculating net operating income, cash flow, or return on investment. It transforms what could be a tedious, error-prone task into a clear, efficient process. You gain a clearer picture of your property’s profitability, helping you forecast future performance and identify areas for improvement or potential investment.

- Standardized Categories: Ensures consistency and helps you capture all relevant financial data without missing anything important.

- Automated Calculations: Reduces manual effort and errors, providing instant insights into key financial metrics.

- Easy Comparison: Allows you to compare monthly, quarterly, or annual performance with ease, and even benchmark against other properties.

- Improved Forecasting: Helps you project future income and expenses, aiding in long-term strategic planning.

- Enhanced Communication: Provides a clear, organized document for discussions with partners, lenders, or property managers.

- Better Decision-Making: With clear, up-to-date financial data, you can make informed choices about property improvements, tenant negotiations, and overall strategy.

In the complex world of commercial real estate, financial clarity isn’t a luxury; it’s a necessity. By embracing a detailed budgeting process, supported by a well-designed template, you’re not just tracking numbers – you’re building a foundation for sustainable success. It’s about proactive management, not reactive problem-solving, ensuring that every dollar earned and spent is accounted for and optimized.

Taking the time to implement a comprehensive budget will undoubtedly pay dividends, literally and figuratively. It provides peace of mind, strategic foresight, and the control you need to navigate the market effectively. Empower yourself with the financial tools necessary to turn your commercial real estate ventures into truly thriving assets.