Starting a lawn care business can be an incredibly rewarding venture. The appeal of working outdoors, providing valuable services, and building something of your own is strong. However, like any business, success isn’t just about sharp shears and a powerful mower; it’s also about sharp financial planning. Many enthusiastic entrepreneurs dive in headfirst, only to find themselves overwhelmed by unexpected costs and fluctuating income.

That’s where a robust financial plan comes into play. Having a clear roadmap for your money is crucial, and understanding every dollar that comes in and goes out will make all the difference. This is precisely why having a solid lawn care business budget template isn’t just a good idea, it’s an absolute necessity for sustainable growth and peace of mind.

In the competitive world of landscaping and lawn maintenance, guesswork simply won’t cut it. This guide will walk you through the essential components of building a budget that will help your business not only survive but thrive, ensuring you’re prepared for every season and every financial decision.

Why a Solid Budget is Your Lawn Care Business’s Best Friend

Think of your business budget as the blueprint for your financial house. Without it, you might find yourself building on shaky ground, unaware of potential weaknesses until it’s too late. A well-constructed budget offers clarity, control, and confidence, allowing you to make informed decisions rather than reactive ones. It’s not just about tracking expenses; it’s about strategizing for profitability and growth.

For a lawn care business specifically, a budget helps you navigate seasonal fluctuations. You’ll know how much cash you need to set aside during peak seasons to cover slower months, ensuring steady operations year-round. It also highlights areas where you might be overspending or identify opportunities to invest more strategically, perhaps in new equipment that boosts efficiency or marketing efforts that bring in more clients.

Moreover, a budget acts as an early warning system. If your expenses are consistently exceeding your income, your budget will flag this issue promptly, giving you time to adjust your pricing, reduce costs, or increase your client base before financial trouble escalates. This proactive approach is invaluable for long-term stability.

Creating your budget involves dissecting all your financial activities, from the smallest purchase to the largest investment. Understanding these categories is the first step toward gaining comprehensive financial control over your enterprise.

Let’s break down the two main categories of costs you’ll encounter when setting up and running your lawn care operation, because a comprehensive understanding is key to accurate planning.

Understanding Your Startup Costs

These are the initial expenses incurred before you even mow your first lawn. They represent the investment required to get your business off the ground. Getting a clear picture of these one-time costs is vital to ensure you have enough capital to launch successfully without immediate financial strain.

- Professional-grade lawn mowers (zero-turn, walk-behind)

- Weed eaters, trimmers, edgers, blowers

- Safety equipment (gloves, eye protection, ear protection)

- Work vehicle (truck or trailer) for transport

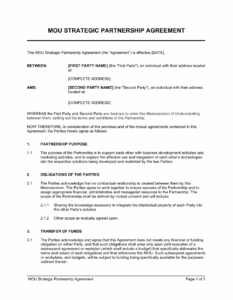

- Business registration fees and licenses

- Initial marketing materials (website, business cards, flyers)

- Insurance premiums (liability, vehicle, workers’ comp if applicable)

- Initial inventory of fuel, oil, and small parts

Navigating Ongoing Operational Expenses

Once your business is up and running, you’ll face recurring costs that are essential for daily operations. These expenses can be fixed (staying roughly the same each month) or variable (changing based on your activity level). Understanding and tracking these is key to calculating your true profitability.

- Fuel for mowers, trimmers, and vehicles

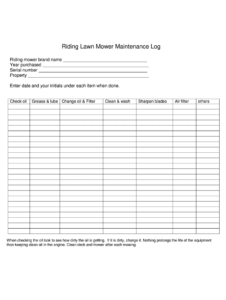

- Equipment maintenance and repair parts

- Employee wages and payroll taxes (if you have staff)

- Business insurance renewals

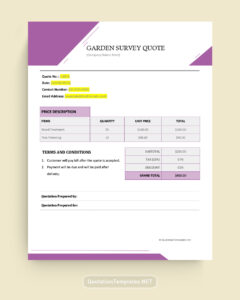

- Marketing and advertising costs

- Software subscriptions (scheduling, accounting)

- Office supplies and administrative costs

- Disposable supplies (string trimmer line, mower blades, oil)

- Vehicle maintenance and registration

- Loan payments for equipment or vehicle financing

Crafting Your Personalized Budget

While a generic template provides a great starting point, the most effective budget is one tailored specifically to your business’s unique circumstances, location, and goals. It’s not just about plugging numbers into a spreadsheet; it’s about deeply understanding your financial flow and making conscious decisions about where your money goes. This customization is what transforms a simple document into a powerful strategic tool for your lawn care business.

To really make your budget work for you, start by meticulously gathering all your financial data – past income, receipts, invoices, and bank statements. Once you have a clear picture, you can begin to assemble your personalized budget by following a few key steps:

- Calculate your projected income for the season or year, considering seasonal variations.

- List all your fixed expenses, such as insurance, loan payments, and software subscriptions.

- Identify and track your variable expenses like fuel, equipment repairs, and disposable supplies.

- Allocate a contingency fund for unexpected costs and emergencies.

- Set clear financial goals, such as profit targets or investment in new equipment.

A well-structured budget is an active document, not something you create once and forget. Regularly review your actual income and expenses against your budgeted figures. This comparison will help you identify trends, make necessary adjustments, and refine your financial predictions. Perhaps you discover that fuel costs are higher than anticipated, or maybe a new marketing strategy is bringing in more clients than expected, allowing you to allocate funds to new equipment or expand your team. This ongoing evaluation is essential for maintaining financial health and ensuring your lawn care business budget template remains a relevant and powerful tool.

Embracing a systematic approach to your finances will transform how you manage your lawn care business. It empowers you to make confident decisions, allocate resources wisely, and plan strategically for future growth and expansion. You’ll gain a deeper understanding of your business’s financial health, allowing you to spot opportunities and mitigate risks effectively, season after season.

By diligently tracking your income and expenses, you’re not just creating a financial document; you’re building a foundation for sustained profitability and peace of mind. Your business will be better equipped to weather any economic storms and capitalize on every opportunity, ensuring a prosperous future for your hard work and dedication.