Dealing with credit card debt can often feel like an uphill battle, a relentless tide of minimum payments and accruing interest that seems to get nowhere fast. It is a common struggle for many, creating stress and hindering financial goals. The good news is that feeling overwhelmed by debt doesn’t have to be your permanent state. There are tools and strategies available to help you regain control and work towards a debt-free future.

One of the most powerful tools in your arsenal for tackling credit card debt head-on is a structured plan, and that’s exactly where a credit card payoff budget template comes into play. It transforms the abstract idea of "paying off debt" into a concrete, actionable roadmap. This isn’t just about cutting expenses; it’s about strategically allocating your funds to maximize your debt reduction efforts and clearly visualizing your progress.

In this article, we’ll explore how such a template can empower you to take charge of your finances, break down the intimidating task of debt payoff into manageable steps, and ultimately guide you towards achieving financial freedom. We’ll delve into what makes these templates so effective and how you can best utilize one to suit your personal financial situation.

Why a Credit Card Payoff Budget Template is Your Secret Weapon

Imagine trying to navigate a complex maze without a map. That’s often what it feels like when you’re trying to pay off credit card debt without a clear budget. You might be making payments, but without understanding your full financial picture, it’s hard to tell if you’re making the most efficient progress. A dedicated template brings clarity and structure to what can otherwise be a chaotic and disheartening process. It allows you to see exactly where your money is going and, more importantly, where you can redirect it to make a bigger impact on your debt.

The primary benefit of using a template isn’t just organization; it’s empowerment. When you see your income, expenses, and debt balances laid out clearly, you gain a sense of control. This visibility helps you identify areas where you can save more, perhaps by cutting back on discretionary spending, and then funnel those extra dollars directly towards your highest-interest credit cards. It turns a vague wish into a concrete plan with measurable milestones, making the journey feel less daunting and more achievable.

Beyond the numbers, a good template offers a psychological advantage. It provides a visual representation of your progress, showing you how much you’ve paid off and how much is left. This tangible evidence of your hard work can be incredibly motivating, helping you stay committed even when the road gets tough. Celebrating small victories, like paying off one card or reaching a specific debt reduction percentage, becomes easier when you can track it all in one place. It reinforces positive financial habits and builds momentum towards your ultimate goal.

Key Components of an Effective Template

A robust credit card payoff budget template isn’t just a spreadsheet; it’s a comprehensive tool designed to guide your entire debt reduction journey. To be truly effective, it should capture several vital pieces of information and provide various tracking features.

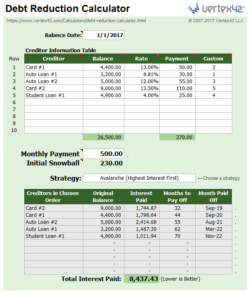

It starts with clearly documenting your income from all sources. This foundational step ensures you know exactly how much money you have coming in each month. Next, you need a detailed breakdown of your expenses, both fixed (like rent and utilities) and variable (like groceries and entertainment). Categorizing these helps you spot areas for potential savings. Then comes the core debt information: a list of all your credit cards, their current balances, interest rates (APR), and minimum payments. This allows you to apply debt payoff strategies like the debt snowball or avalanche method with precision. Finally, and crucially, an effective template includes sections for allocating extra payments beyond the minimums and a progress tracker to visually monitor your dwindling balances over time.

- Income Tracking: All sources of monthly income.

- Expense Categorization: Detailed breakdown of fixed and variable spending.

- Debt Listing: Balances, interest rates, and minimum payments for each credit card.

- Extra Payment Allocation: A section to plan where any surplus funds will go.

- Progress Tracker: Visuals or charts to show debt reduction over time.

These components work in harmony to give you a complete and actionable overview, turning complex financial data into a clear path forward.

Making Your Credit Card Payoff Budget Template Work for You

Once you have your credit card payoff budget template in hand, the real work, and the real magic, begins. The first step is to be brutally honest with your numbers. Input every single dollar of income and every single expense. This initial assessment might be eye-opening, but it’s essential for creating a realistic and effective plan. Don’t be afraid to adjust your spending habits based on what you uncover; that’s the whole point of creating this budget. Remember, this template is a living document, not a rigid set of rules, and it should evolve as your financial situation or goals change.

Next, decide on your debt payoff strategy. Are you going to tackle the card with the highest interest rate first (the avalanche method), which saves you the most money in the long run? Or would you prefer to pay off the smallest balance first (the snowball method) to gain psychological momentum? Both are effective, and your template can help you model the impact of either approach. Seeing the potential payoff dates accelerate as you allocate extra funds can be a huge motivator. Be sure to build in a little wiggle room for unexpected expenses, so you’re not derailed by minor financial surprises.

Finally, consistency is key. Review your template regularly, perhaps weekly or bi-weekly, to track your spending and make sure you’re sticking to your plan. Celebrate every milestone, no matter how small, as it reinforces your commitment and reminds you of how far you’ve come. Don’t get discouraged if you hit a bump in the road; simply adjust your budget and keep moving forward. The power of this tool lies in its ability to keep you focused and accountable, steadily guiding you towards a healthier financial future.

Embracing a structured approach to your credit card debt, leveraging the clarity and guidance of a well-designed template, truly sets the stage for success. It transforms the overwhelming into the manageable, giving you the power to not just dream of financial freedom, but to actively build it. With consistency and a clear plan, you are well on your way to closing that chapter of debt and opening a new one focused on stability and growth.