Heading off to college is an incredibly exciting time, full of new experiences, learning, and independence. However, it also often means navigating your finances for the very first time, which can feel a little overwhelming. Between tuition, textbooks, rent, and the occasional coffee run with friends, managing your money effectively becomes crucial to enjoying your college years without unnecessary stress.

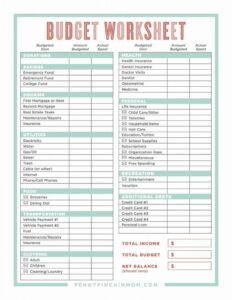

That’s where a reliable college student monthly budget template comes into play. It’s more than just a spreadsheet; it’s your personal financial roadmap designed to help you understand where your money comes from and, more importantly, where it all goes. Setting up a budget doesn’t mean you have to live like a hermit or cut out all your fun; it simply means making informed choices about your spending.

By taking control of your financial situation now, you’ll not only survive your college years comfortably but also build invaluable money management skills that will benefit you long after graduation. It’s about empowering yourself with knowledge and making your money work for you, rather than constantly worrying about running short.

Why Every College Student Needs a Budget

Let’s be honest, financial planning probably isn’t at the top of your “fun things to do” list, but trust me, it’s one of the most impactful habits you can cultivate during your college journey. Without a clear picture of your income and expenses, it’s incredibly easy to fall into common student money traps, like accumulating unnecessary debt, constantly feeling broke, or missing out on opportunities because you can’t afford them. A budget acts as your financial compass, guiding you through the often-turbulent waters of student finances.

Think about it this way: your classes have syllabi, your essays have rubrics, and your social life often has plans. Why should your money be any different? A budget provides that structure for your financial life, helping you avoid those “where did all my money go?” moments. It allows you to prioritize your needs, allocate funds for your wants, and even start saving for future goals, however small they might seem right now.

Many students receive funds in large chunks, perhaps from student loans, scholarships, or parental contributions, which can give a false sense of security. It’s easy to spend freely at the beginning of a semester, only to find yourself struggling to afford essentials a few months down the line. A budget helps you stretch those funds across the entire period they’re meant to cover.

Understanding Your Income Streams

Before you can start allocating money, you need to know exactly how much you have coming in. For college students, income can be quite varied. It might come from part-time jobs, internships, scholarships, grants, student loans (which, while technically debt, are often treated as income for budgeting purposes), or regular contributions from family members. List out all your predictable sources and their amounts. If some income is irregular, try to estimate a conservative average, or only budget for it once it’s actually in your bank account.

Breaking Down Your Expenses

Once you know your income, the next step is to categorize your expenses. This is where most of your money management efforts will focus. It helps to divide expenses into “fixed” (those that are the same every month) and “variable” (those that change). Don’t forget to include those less frequent but significant costs like textbooks, even if they only hit once a semester. Here’s a common breakdown:

- Tuition and Fees: The big one, often paid in lump sums but needing to be accounted for monthly.

- Housing: Rent, utilities, internet, and any other housing-related costs, whether on-campus or off.

- Food: Groceries, dining out, coffee runs, and snack breaks.

- Textbooks and Supplies: Can be surprisingly expensive each semester.

- Transportation: Gas, public transport passes, ride-shares, or bike maintenance.

- Personal Care: Toiletries, haircuts, laundry, and health-related items.

- Social and Entertainment: Movies, concerts, going out with friends, subscriptions, and hobbies.

- Miscellaneous: Unexpected costs, emergency fund contributions, or gifts.

Be honest with yourself about where your money actually goes. Those daily coffees or late-night takeout orders might seem small individually, but they can quickly add up and derail your budget if not accounted for.

Making Your Budget Work For You

The beauty of a college student monthly budget template is its adaptability. It’s not a rigid set of rules designed to make your life harder; it’s a flexible tool to empower you. Once you have a clear picture of your income and expenses, the real work—and fun—begins. You can start making conscious decisions about your spending. Are you spending too much on eating out? Perhaps you can reallocate some of that money to save for a spring break trip or a new gadget you’ve been eyeing.

The key to a successful budget isn’t just creating it; it’s sticking to it and adjusting it as needed. Life as a college student is constantly changing, and your budget should evolve with you. Maybe you picked up an extra shift at your part-time job, or perhaps a sudden expense popped up. Don’t view these as failures, but rather opportunities to learn and refine your financial plan. Regular check-ins, even just 15 minutes once a week, can make a huge difference in keeping you on track.

Remember, the goal is not perfection, but progress. Start tracking your spending, compare it to your budgeted amounts, and identify areas where you can make improvements. Over time, you’ll develop a natural instinct for financial management, allowing you to live comfortably within your means, reduce stress, and even begin building a foundation for future financial stability. The skills you develop now will serve you well beyond your campus days, preparing you for a lifetime of smart money choices.