Finding yourself buried under a mountain of debt can feel incredibly overwhelming, making financial freedom seem like an impossible dream. The stress of constant bills, minimum payments, and the feeling of never getting ahead is a burden many people carry. It’s a challenging situation, but one that countless individuals have overcome with the right tools and a solid plan.

That’s where a well-structured get out of debt budget template comes into play. It’s not just another spreadsheet; it’s your personal roadmap, designed to illuminate your financial landscape, identify where your money is going, and strategically guide you toward debt elimination. This powerful tool transforms vague anxieties into concrete actions, offering clarity and control over your financial journey.

This article will walk you through the essence of such a template, explaining its crucial components and how you can effectively use it to carve your path to a debt-free life. By understanding and implementing these strategies, you’ll gain the confidence and direction needed to tackle your debt head-on and build a more secure financial future.

Why a Budget Template is Your Debt-Busting Sidekick

Think of a budget template as your financial co-pilot, helping you navigate the sometimes turbulent skies of your personal finances. Without a clear overview, it’s easy to drift off course, making impulsive spending decisions or missing opportunities to accelerate debt repayment. A template brings all your financial data into one place, making it simple to see your income, your outgoings, and precisely how much you can allocate towards reducing your debt. It transforms abstract numbers into actionable insights.

The beauty of a dedicated template, especially one focused on getting out of debt, is its ability to highlight areas where you can trim expenses without sacrificing your quality of life too much. It forces you to confront your spending habits, whether it’s daily coffee runs, unused subscriptions, or unnecessary impulse buys. This isn’t about deprivation; it’s about intentional spending that aligns with your ultimate goal of becoming debt-free. When you see exactly how much those small, recurring expenses add up, the motivation to make changes often naturally follows.

Furthermore, a template provides a consistent framework for tracking progress. Imagine the satisfaction of filling in your budget each month and seeing your debt balances shrink! This visual and tangible evidence of your hard work is incredibly motivating and helps you stay committed to your plan, even when things get tough. It turns a daunting task into a series of achievable milestones, each one bringing you closer to financial freedom.

Key Components of an Effective Template

- **Income Sources:** A clear listing of all your net income streams.

- **Fixed Expenses:** Regular, unchanging bills like rent/mortgage, loan payments, insurance.

- **Variable Expenses:** Costs that fluctuate, such as groceries, utilities, transportation, and entertainment.

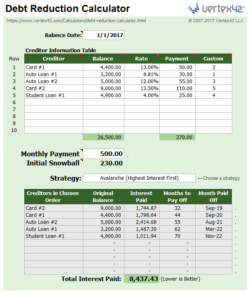

- **Debt Breakdown:** Detailed information on each debt (creditor, interest rate, minimum payment, balance).

- **Debt Repayment Strategy:** Space to plan extra payments using methods like the debt snowball or avalanche.

- **Savings Goals:** Even while getting out of debt, a small emergency fund is crucial.

An effective template isn’t just about listing numbers; it’s about structuring them in a way that tells a story about your financial health. It empowers you to analyze your spending, identify financial leaks, and strategize how to plug them, allowing more money to flow directly towards your debt. Regularly reviewing these components within your get out of debt budget template is key to adapting your strategy as your circumstances change and ensuring you remain on target.

Consistency is your best friend when using a budget template. It’s not a one-time setup; it’s a living document that needs regular attention. By checking in weekly or at least monthly, you keep your financial goals top of mind, make necessary adjustments, and celebrate your progress. This consistent engagement ensures your template remains a relevant and powerful tool in your quest for financial liberation.

Putting Your Template into Action: Practical Steps

Once you have your get out of debt budget template ready, the next step is to populate it with your real-world financial data. This initial phase requires a bit of homework, gathering all your bank statements, credit card bills, loan documents, and pay stubs. It might seem daunting at first, but collecting all this information in one sitting will give you a comprehensive picture of your current financial standing, which is essential for making informed decisions. Be honest and thorough; the more accurate your data, the more effective your budget will be.

After inputting your income and all your expenses, you’ll likely identify areas where you can cut back. This is where the strategic part begins. Look for non-essential spending that can be reduced or eliminated entirely, freeing up more cash to throw at your debts. Remember, every dollar you redirect from discretionary spending to debt repayment accelerates your journey to financial freedom. Consider implementing the debt snowball or debt avalanche method, which are powerful strategies that use your budget’s surplus to rapidly pay down balances, one by one.

The most crucial part of putting your template into action is commitment and consistency. A budget is only effective if you stick to it. This means regularly tracking your spending against your budgeted amounts and making adjustments as needed. Life happens, and your budget should be flexible enough to accommodate unexpected events while still keeping your debt-free goal in sight. Regularly review your progress, celebrate small victories, and don’t get discouraged by setbacks – simply adjust your plan and keep moving forward.

Embracing a get out of debt budget template is more than just a financial exercise; it’s a commitment to a healthier, more secure future. It provides the clarity and structure you need to systematically chip away at your debt, transforming what once seemed impossible into a series of manageable steps. By consistently applying the principles outlined here and engaging actively with your budget, you’re not just tracking money; you’re building a foundation for lasting financial peace and freedom.

The journey to becoming debt-free is a marathon, not a sprint, but with the right tools and a determined mindset, the finish line is well within reach. This template will serve as your unwavering guide, keeping you focused and motivated as you work towards achieving your financial goals. Take control, stay disciplined, and watch as your efforts transform your financial landscape, paving the way for a life unburdened by debt.