Navigating the dynamic world of real estate investing requires more than just a keen eye for properties; it demands meticulous financial planning. That’s where a robust real estate investor business budget template comes into play. It serves as your financial roadmap, guiding you through potential pitfalls and ensuring every dollar is allocated strategically, whether you are flipping houses, managing rental properties, or delving into commercial ventures.

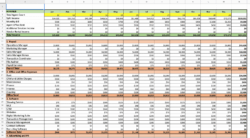

Without a clear financial outline, even the most promising investment can quickly turn into a money pit. Understanding your income streams, meticulously tracking expenses, and anticipating future costs are fundamental pillars of sustainable growth in this competitive industry. A well-designed budget isn’t just about cutting costs; it’s about optimizing your resources to maximize returns and mitigate risks.

This guide will walk you through the essential elements of creating and utilizing an effective budget, ensuring you have the clarity and control needed to make informed decisions. We will explore key components, common pitfalls to avoid, and how to adapt your financial strategy as your portfolio expands.

Why a Robust Budget is Your Real Estate Business’s Best Friend

A well-crafted budget is the cornerstone of any successful real estate investment business. It transforms abstract financial goals into concrete, actionable plans, providing unparalleled clarity on where your money is going and where it needs to be. For real estate investors, this means being able to accurately assess the profitability of a deal, understand cash flow, and build a resilient financial foundation that can withstand market fluctuations. It helps you avoid overspending on renovations, underestimate holding costs, or miscalculate potential rental income, all of which can severely impact your bottom line.

One of the primary benefits is risk mitigation. Real estate investing, while lucrative, carries inherent risks. A detailed budget allows you to identify potential financial weaknesses before they become critical issues. You can allocate funds for unforeseen repairs, vacancies, or market downturns, essentially creating a financial buffer that protects your investments. This proactive approach ensures you are prepared for various scenarios, from minor maintenance issues to significant economic shifts.

Moreover, a budget fosters accountability and discipline. When you have a clear financial blueprint, it becomes easier to stick to your spending limits and evaluate the return on every dollar invested. This discipline is crucial for long-term success, helping you make rational decisions based on data rather than emotion. It enables you to compare actual performance against projected figures, providing valuable insights into the efficiency of your operations and the accuracy of your initial projections.

For those involved in property flips, understanding renovation costs versus after-repair value (ARV) is paramount. A budget allows you to meticulously track every expense from material purchases to labor costs, ensuring you don’t exceed your allocated rehab budget. Similarly, for rental property owners, it helps in forecasting rental income, anticipating vacancy rates, and planning for property management fees, maintenance, and capital expenditures.

Ultimately, a comprehensive budget empowers you to make strategic decisions that drive growth. It highlights areas where you might be overspending and opportunities where you could invest more for greater returns. It also makes it easier to secure financing from lenders, as a well-documented financial plan demonstrates your professionalism and understanding of your business’s fiscal health. This level of transparency is invaluable, not just for you but for any potential partners or financiers.

Breaking Down Acquisition Costs

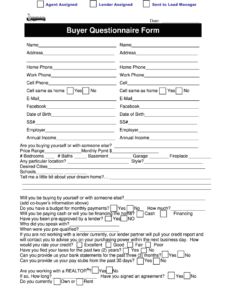

When acquiring a property, costs go beyond the purchase price. Your budget needs to account for closing costs, appraisal fees, inspection fees, legal fees, and sometimes even environmental assessments. These can add up significantly, so failing to budget for them can derail your initial investment plan.

Understanding Operating Expenses

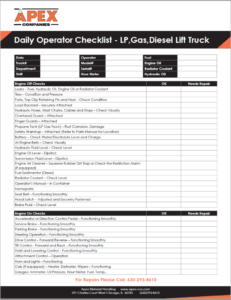

Beyond the initial purchase and renovation, properties incur ongoing expenses. These include property taxes, insurance premiums, utilities, HOA fees if applicable, marketing costs for rentals, and regular maintenance. A thorough budget anticipates these recurring costs to ensure positive cash flow and prevent financial surprises down the road.

Key Components to Include in Your Template

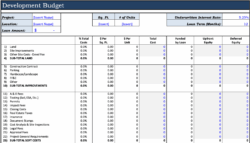

Creating a truly effective real estate investor business budget template involves more than just listing income and expenses. It requires a structured approach that categorizes financial data in a way that provides meaningful insights. Think of it as building different rooms in your financial house, each serving a specific purpose and contributing to the overall stability and functionality. This systematic breakdown ensures that no significant financial aspect is overlooked, from initial capital outlays to the smallest operational expenses.

Your template should ideally have distinct sections for all potential income streams. This includes not only projected rental income from individual properties but also any income from property sales, wholesaling fees, or even consulting services if those are part of your business model. Clearly delineating these income sources allows you to understand which aspects of your business are performing best and where you might focus more resources for growth. It helps you identify your most profitable ventures and adjust your strategy accordingly.

Equally important is a detailed breakdown of all expenses, both fixed and variable. Fixed expenses, like property taxes and insurance, tend to be predictable, while variable expenses, such as repair costs or marketing spend, can fluctuate. Incorporating an emergency fund within your budget is also crucial, providing a cushion for unexpected events that are common in real estate. Regularly reviewing and updating your real estate investor business budget template allows you to adapt to market changes and refine your financial forecasts, ensuring your business remains agile and profitable in the long term.

Here are some essential line items to consider:

- Property Acquisition Costs: Purchase price, closing costs, legal fees, appraisal, inspection.

- Renovation and Rehab Costs: Materials, labor, permits, architect fees, contingency fund for overruns.

- Holding Costs: Property taxes, insurance, utilities (during vacancy), mortgage payments, HOA fees.

- Marketing and Advertising: Photography, listing fees, signage, online ads.

- Operational Expenses: Property management fees, bookkeeping, legal counsel, office supplies, software subscriptions.

- Debt Service: Principal and interest payments on loans.

- Capital Expenditures: Funds reserved for major repairs or upgrades beyond routine maintenance.

- Emergency Fund: A dedicated allocation for unexpected repairs, prolonged vacancies, or market downturns.

Taking the time to meticulously build and maintain such a financial framework will undoubtedly set your real estate investment business on a path toward enduring success. It provides clarity, reduces stress, and empowers you to make confident, data-driven decisions at every turn, ultimately helping you achieve your financial goals with greater certainty. The discipline instilled by a solid budget is a powerful asset that will serve your ventures well, ensuring sustainable growth and resilience through various market conditions.