Running a real estate company can feel like a whirlwind of property showings, client meetings, and market analysis. Amidst all the hustle, it’s easy to lose sight of the financial rudder that steers your ship. That’s where a well-crafted real estate company business budget template becomes absolutely essential. It’s not just about tracking money; it’s about understanding your financial health, making informed decisions, and planning for sustainable growth in a dynamic industry.

Imagine navigating a complex deal without a clear strategy. You wouldn’t, right? The same principle applies to your company’s finances. A budget acts as your financial roadmap, guiding you through revenue peaks and operational valleys. It helps you anticipate costs, identify potential savings, and allocate resources where they’ll have the biggest impact.

This isn’t about rigid restrictions; it’s about empowerment. A clear budget allows you to seize opportunities, mitigate risks, and ensure that every dollar works as hard as you do. Let’s explore how a structured financial approach can transform your real estate venture from merely surviving to truly thriving.

Why a Detailed Budget is Your Real Estate Company’s Best Asset

In the fast-paced world of real estate, economic shifts and market fluctuations are constant companions. Without a robust budget, your company is essentially flying blind, reacting to events rather than proactively shaping its future. A detailed budget isn’t just an accounting chore; it’s a strategic tool that empowers you to make smarter, more confident decisions, ensuring your company remains resilient and competitive.

Think about it. How do you decide whether to invest in new marketing campaigns, hire more agents, or upgrade your office technology? Without a clear financial picture, these decisions become guesswork. A budget provides that clarity, allowing you to align your spending with your strategic goals. It reveals where your money is truly going and, more importantly, where it should be going to maximize returns.

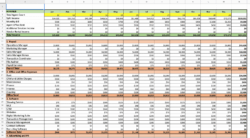

Understanding Your Income Streams

The foundation of any good budget starts with a thorough understanding of your income. For a real estate company, this typically involves commissions from sales, rental management fees, referral fees, and possibly other ancillary services. It’s crucial to itemize these streams, forecast their potential based on market trends and your sales pipeline, and track them diligently. This granular view helps you identify your most profitable services and areas, allowing you to focus your efforts for maximum impact. Are some property types yielding higher commissions? Is your rental management portfolio growing steadily? Your budget helps answer these vital questions.

Mapping Out Your Expenses

Once you know what’s coming in, the next critical step is to understand what’s going out. Real estate companies have a wide array of expenses, both fixed and variable. Fixed costs might include office rent, salaries, and insurance premiums, while variable costs could cover marketing ad spend, client entertainment, travel for property showings, and continuing education. Categorizing these expenses allows you to identify areas where costs can be optimized without compromising service quality. Are you overspending on a particular marketing channel? Can you negotiate better terms with suppliers? A detailed expense breakdown highlights these opportunities for efficiency.

Forecasting for Growth and Contingencies

A truly effective budget looks beyond the present. It incorporates projections for future growth, anticipating increased revenue from an expanding team or new market segments. Equally important is allocating funds for contingencies. Unexpected repairs to office equipment, sudden market downturns, or even legal fees can quickly derail an unbudgeted company. A contingency fund, built into your budget, acts as a financial safety net, providing peace of mind and protecting your operations from unforeseen shocks. This forward-thinking approach ensures your real estate company business budget template isn’t just a snapshot but a dynamic tool for future success.

Structuring Your Real Estate Company’s Budget Template for Clarity

Now that we’ve established the ‘why,’ let’s delve into the ‘how’ of structuring your budget. A well-organized template isn’t just a spreadsheet; it’s a living document that provides actionable insights. It should be intuitive, easy to update, and comprehensive enough to capture all the relevant financial data. The goal is to create a framework that simplifies complex financial information, making it accessible for strategic decision-making.

A good starting point involves breaking down your budget into logical sections. Typically, this includes revenue, operating expenses, marketing costs, administrative overhead, and capital expenditures. Each of these broad categories can then be further subdivided to provide more detail. For instance, under operating expenses, you wouldn’t just list “Utilities,” but perhaps “Electricity,” “Water,” and “Internet” separately, especially if these costs fluctuate significantly or need individual monitoring for cost-saving initiatives.

Consider incorporating these key components into your budget template for maximum effectiveness:

- Gross Commission Income: Total commissions earned before splits or deductions.

- Agent Splits and Referrals: The portion of commissions paid out to agents or other brokers.

- Marketing and Advertising: Website maintenance, SEO, social media ads, print ads, open house expenses, photography.

- Office Overhead: Rent, utilities, office supplies, software subscriptions, insurance.

- Salaries and Benefits: For administrative staff, assistants, and any salaried employees.

- Professional Development: Training courses, licensing fees, industry conference attendance.

- Technology and Software: CRM systems, property management software, listing services.

- Legal and Accounting Fees: For compliance, audits, and professional advice.

- Contingency Fund: Allocated for unforeseen expenses or emergencies.

By clearly defining each line item, you gain unparalleled visibility into your company’s financial flow. This transparency not only aids in cost control but also highlights areas of potential investment that could yield significant returns, such as upgrading to a more efficient CRM system or investing in advanced market analysis tools.

Embracing a structured financial approach doesn’t mean stifling creativity or agility; quite the opposite. It provides the freedom and confidence to innovate, take calculated risks, and expand your reach within the competitive real estate market. With a clear understanding of your financial landscape, you can respond swiftly to market changes, capitalize on emerging opportunities, and invest wisely in your company’s future.

Ultimately, a meticulously planned budget transforms abstract financial figures into a powerful narrative of your company’s journey and aspirations. It’s an indispensable tool for steering your real estate business toward long-term prosperity, ensuring that your hard work and dedication are consistently translated into tangible success and sustainable growth.