Are you tired of financial budgets that feel like straitjackets, rigid and unforgiving when life inevitably throws a curveball? Many of us have been there, starting a budget with the best intentions only to abandon it a few weeks later because it just couldn’t keep up with the real world. This frustration often stems from static budgeting methods that don’t account for fluctuating incomes, unexpected expenses, or even just a change in priorities. What if there was a better way? Imagine a system designed to evolve with you, a dynamic tool that adapts to your unique financial journey rather than forcing you into a one-size-fits-all mold. This is precisely the promise of a self adjusted financial budget template.

Traditional budgeting often leads to feelings of guilt and failure when spending deviates from the plan, which is almost guaranteed to happen. Life is messy, and our financial pictures rarely remain perfectly still. From a sudden car repair to an unexpected bonus, these shifts can derail a static budget and leave you feeling demotivated. The beauty of an adaptive approach is its inherent flexibility, built to absorb these changes without crumbling.

Instead of a strict set of rules, an adaptive budget offers a framework that learns and grows with your financial habits and life circumstances. It’s about building a sustainable financial rhythm that promotes understanding and control, reducing the stress commonly associated with money management. By embracing this flexible mindset, you’re not just creating a budget; you’re developing a resilient financial strategy designed for long-term success.

Why a Self Adjusting Budget is Your Financial Game Changer

The concept of a self adjusting budget might sound like magic, but it’s rooted in smart financial planning and consistent review. It’s not about an AI automatically moving your money around; it’s about you setting up a system where adjustments are built into the process, making it simple and intuitive to modify your spending and saving goals as your life circumstances evolve. This proactive approach prevents the common pitfalls of budget burnout and the feeling of constantly failing to meet unrealistic targets.

One of the greatest benefits is its inherent flexibility. Life rarely follows a predictable script. Your income might vary from month to month, you might have seasonal expenses, or an unforeseen event like a home repair or a medical bill could crop up. A traditional budget often fails to accommodate these shifts gracefully, leading to either constant revision headaches or outright abandonment. An adaptive budget, however, anticipates these changes, providing a framework that allows you to pivot without derailing your entire financial plan.

This adaptability significantly reduces financial stress. When your budget is designed to flex with you, the pressure to adhere rigidly to an outdated plan diminishes. You gain the peace of mind knowing that your financial system can handle the unexpected, allowing you to focus on your goals rather than worrying about minor deviations. It transforms budgeting from a punitive exercise into an empowering tool that supports your lifestyle.

Furthermore, a self adjusting budget encourages a deeper understanding of your financial habits. By regularly reviewing and adjusting your budget, you become more aware of where your money is going, identify spending patterns, and discover opportunities for optimization. This continuous learning process fosters better financial literacy and empowers you to make more informed decisions about your money. It moves you from merely tracking expenses to actively managing your financial future.

Ultimately, this type of budget empowers you to take control. It acknowledges that your financial life is dynamic and provides the tools to navigate its complexities with confidence. It shifts the focus from restriction to strategic resource allocation, helping you align your spending with your values and long-term aspirations, whether that’s saving for a down payment, an early retirement, or simply enjoying life without financial worry.

Crafting Your Own Adaptive Financial Blueprint

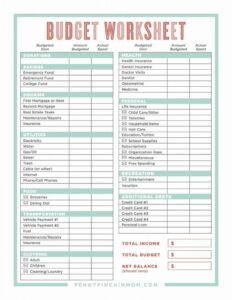

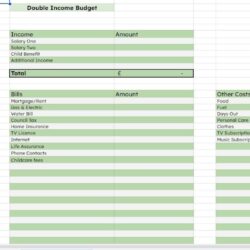

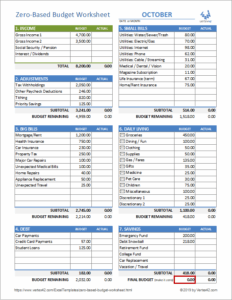

Building your own adaptive financial budget template doesn’t require complex algorithms or specialized software, though many tools can assist. It begins with a clear understanding of your current financial situation, including all income sources and typical expenditures. The goal is to establish a baseline, identifying both fixed and variable expenses, so you have a realistic starting point from which to adjust. This foundational step is crucial for any effective budget, flexible or not.

The key to its self adjusting nature lies in establishing clear categories and setting up regular review periods. Instead of creating a hard limit for every single item, consider creating flexible spending categories where you allocate a certain amount but understand that it can fluctuate within a reasonable range. For instance, your “entertainment” budget might have a baseline, but you know you can reduce it if an unexpected car repair crops up, reallocating funds without breaking the entire budget.

Regularly reviewing your budget, perhaps weekly or bi-weekly, is where the “self adjusted” aspect truly comes into play. This isn’t about guilt-tripping yourself; it’s about actively engaging with your money and making minor course corrections before they become major problems. During these reviews, you can assess if your spending aligns with your goals, if any categories need more or less allocation, and how unexpected events have impacted your plan.

Here are key components to integrate into your adaptive template:

- Track Your Income and Expenses Religiously: Consistent data is essential for informed adjustments.

- Categorize Thoughtfully: Break down spending into manageable, reviewable categories like housing, food, transport, savings, and discretionary.

- Establish Flexible Spending Categories: Designate areas where you can easily shift funds when needed, such as dining out or entertainment.

- Schedule Regular Reviews: Set aside dedicated time each week or bi-week to check in, assess, and make small, necessary changes.

- Automate Savings and Investments: Pay yourself first by automating transfers to savings and investment accounts right after payday.

- Build an Emergency Fund: Prioritize building a financial cushion to handle unforeseen expenses without derailing your budget.

Embracing an adaptive budgeting approach reshapes your relationship with money, transforming it from a source of stress into a powerful tool for achieving your goals. It provides the flexibility needed to navigate life’s unpredictable path while maintaining a clear focus on your financial aspirations. By consistently engaging with your finances in this dynamic way, you are not just managing money; you are actively designing a life of greater financial freedom and peace.

This systematic yet flexible method empowers you to maintain control over your finances, even when circumstances change. It fosters a proactive mindset, allowing you to respond to financial shifts with confidence and clarity. The journey to financial well-being is continuous, and a responsive financial plan ensures you’re always moving forward, adapting and thriving with every step.