Navigating the financial landscape of a software company can feel like trying to hit a moving target. Unlike traditional businesses, software companies often deal with rapidly evolving technologies, recurring revenue models, and significant investment in research and development. This unique environment makes a robust financial plan not just beneficial, but absolutely essential for survival and growth. That’s precisely why a well-structured software company operating budget template isn’t just a good idea, it’s a critical tool for strategic planning and decision-making.

The inherent dynamism of the software industry, from agile development sprints to the constant demand for innovation, means that static, rigid budgets simply won’t cut it. Companies need a flexible framework that can adapt to changing market conditions, unexpected development costs, and fluctuating customer acquisition expenses. Without a clear financial roadmap, even the most innovative software products can struggle to find sustainable footing.

This article will guide you through the essential components of building and utilizing an effective operating budget for your software venture. We’ll explore how to account for the unique revenue streams and expenditure categories common in the tech world, ensuring your financial plan supports your growth ambitions and keeps your operations lean and efficient.

Understanding the Core Components of Your Software Company’s Operating Budget

Building an effective operating budget starts with a clear understanding of where your money comes from and where it goes. For software companies, this often involves a mix of conventional business expenses alongside highly specialized costs related to technology development and intellectual property. Thinking broadly about both your income sources and your outgoing payments will lay a solid foundation for your financial framework.

Revenue Streams

Software companies typically generate income from several distinct sources, and accurately forecasting these is crucial. Subscription fees are a common model, whether monthly or annual, for SaaS products. Perpetual license sales, often seen with on-premise software, represent a one-time income stream. Beyond the core product, many companies also earn revenue from professional services, such as implementation, customization, training, and ongoing support contracts. Advertising or freemium models, where a basic version is free but premium features are paid, also contribute. Understanding the velocity and predictability of each stream is key to accurate budgeting.

Operational Expenses

This category covers the ongoing costs of running your business day-to-day. For a software company, these expenses can be quite diverse and often include significant investments in human capital and technology infrastructure.

Employee salaries and benefits usually form the largest part of operational expenses. This encompasses everyone from developers and product managers to sales, marketing, and administrative staff. Given the competitive landscape for tech talent, these figures often require careful projection and allocation. Beyond personnel, office rent, utilities, internet services, and general administrative supplies are standard overheads.

Then there are the technology-specific operational costs. This includes subscriptions for essential development tools, project management software, design platforms, and continuous integration/continuous delivery (CI/CD) services. Cloud hosting expenses, which can scale rapidly with user growth or data storage needs, are a major consideration for most modern software companies. Marketing and sales expenditures, covering everything from digital advertising campaigns to trade show participation and CRM software, are vital for customer acquisition and retention.

Finally, research and development costs are paramount. This isn’t just about salaries for developers; it includes expenses for prototyping, testing environments, acquiring new software libraries, patent filings, and potential outsourcing to specialized contractors. Intellectual property protection and legal fees associated with maintaining compliance and contracts are also critical, though often overlooked until they become urgent. Properly categorizing and forecasting these expenditures ensures that the budget reflects the true cost of innovation and operation.

Building and Utilizing Your Operating Budget Template Effectively

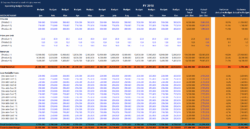

Once you understand the various components, the next step is to actually build out your operating budget and integrate it into your company’s financial rhythm. An operating budget template isn’t a static document; it’s a dynamic tool that should evolve with your business and market conditions. The process involves gathering historical data, making informed projections, and establishing a system for regular review and adjustment.

Start by populating your template with all known fixed costs and reasonable estimates for variable expenses based on past performance and future strategic goals. Don’t be afraid to forecast different scenarios – optimistic, pessimistic, and realistic – to understand the potential range of outcomes. Engaging department heads in this process is invaluable, as they often have the most accurate insights into their specific needs and spending patterns. Their input ensures buy-in and a more practical budget.

The true power of a comprehensive software company operating budget template lies in its ongoing utility. It serves as a benchmark for performance, allowing you to compare actual expenditures and revenues against your plan. This continuous monitoring helps identify areas where you might be overspending or underperforming, enabling swift corrective action. Regular reviews, perhaps quarterly or even monthly, are crucial to keep the budget relevant and responsive to the fast-paced software industry.

Here are some key steps for effective budget management:

- Gather Historical Data: Analyze past financial statements to understand spending patterns and revenue trends.

- Forecast Future Revenues and Expenses: Use a combination of historical data, market research, and strategic goals to project future financial activity.

- Allocate Resources Strategically: Ensure funds are directed to areas that will drive the most growth and align with company objectives.

- Monitor and Adjust Regularly: Compare actuals to budgeted figures and make necessary revisions to stay on track.

- Involve Key Stakeholders: Encourage participation from department heads to foster ownership and improve accuracy.

Remember, your operating budget is more than just a spreadsheet of numbers; it’s a strategic roadmap for your company’s financial health. It empowers you to make informed decisions, allocate resources efficiently, and anticipate challenges before they become critical. Embracing this disciplined approach to financial planning can be the differentiator between merely surviving and truly thriving in the competitive software market.

A well-constructed and diligently managed operating budget provides unparalleled clarity and control over your software company’s financial destiny. It empowers leadership to make data-driven decisions, anticipate cash flow needs, and strategically invest in growth opportunities. By systematically tracking revenues and expenses, you gain a holistic view of your operational efficiency and overall financial health.

Ultimately, mastering your budget translates directly into a more resilient and sustainable business. It fosters a culture of fiscal responsibility and ensures that every dollar spent aligns with your strategic objectives, paving the way for consistent innovation and long-term success in the ever-evolving software industry.