Getting a handle on your personal finances or business spending can sometimes feel like trying to solve a complex puzzle. Many of us know that budgeting is crucial, but actually sitting down and organizing our income and expenses often feels overwhelming. It is about more than just tracking how much money comes in and goes out; it is about gaining clarity and control over your financial journey.

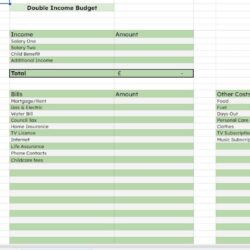

One of the most effective ways to simplify this process is by understanding the different types of costs you incur. This distinction is vital, and that is precisely where a well-designed budget template with fixed and variable costs comes into play. By categorizing your spending, you can see exactly where your money is going, identify areas for potential savings, and make informed decisions that align with your financial goals.

Whether you are saving for a down payment, planning for retirement, or simply aiming to reduce debt, a structured budget empowers you to achieve those aspirations. It turns abstract financial ideas into concrete, actionable steps, giving you the peace of mind that comes from knowing you are in charge of your money, not the other way around.

Understanding Fixed Costs: The Steady Foundation of Your Financial Plan

Fixed costs are the bedrock of any budget, whether personal or business. These are the expenses that generally remain the same each month, regardless of your activity level or income fluctuations. Think of them as the predictable pillars supporting your financial structure. They are relatively easy to anticipate and budget for because their amounts do not change much from one period to the next.

For example, your rent or mortgage payment is a classic fixed cost. It is the same amount every month, and you know exactly what to expect. Similarly, car payments, insurance premiums, and many subscription services fall into this category. Knowing these figures upfront allows you to allocate a significant portion of your budget with certainty, making financial planning much more straightforward.

Identifying your fixed costs is the first critical step in building a robust budget. By listing them out, you create a clear picture of your essential, non-negotiable expenses. This clarity helps you understand your financial baseline and determine how much income is required just to cover your basic living or operating needs each month. It is your minimum financial obligation before any discretionary spending.

Common Examples of Fixed Costs

- Rent or Mortgage Payments: Your consistent housing expense.

- Car Loan Payments: The regular amount you pay for your vehicle.

- Insurance Premiums: Monthly or annual payments for health, car, or home insurance.

- Subscription Services: Streaming services, gym memberships, software licenses.

- Loan Repayments: Personal loans, student loans, or business loan installments.

Once you have a firm grasp on your fixed costs, you gain a powerful insight into your financial stability. These expenses dictate a significant part of your financial commitment, and understanding them helps you assess your financial resilience. It allows you to plan for the long term, knowing what consistent outflow to expect, and can inform larger decisions, such as whether you can comfortably afford a new commitment.

Navigating Variable Costs: The Flexible Elements of Your Spending

In contrast to fixed costs, variable costs are the expenses that fluctuate from month to month. These are the “flexible elements” of your budget, and they can often be a bit trickier to manage because their amounts are not always predictable. While they offer more opportunities for adjustment and savings, they also require more careful tracking and mindful spending habits.

Examples of variable costs include groceries, utilities like electricity and water (which can change based on usage), transportation (gasoline, public transport fares), and entertainment. The amount you spend on these items can differ significantly depending on your choices and needs within a given period. One month you might host a dinner party and spend more on food, while the next month you might eat out less and save.

Effectively managing variable costs is where much of the power of a budget truly lies. Since these expenses are not set in stone, you have more control over them. By monitoring your spending in these categories, you can identify patterns, set realistic limits, and make conscious choices to reduce outflows when necessary. This active management is what allows for true financial flexibility and growth within your overall financial strategy. A well-designed budget template with fixed and variable costs provides the framework for this essential tracking, ensuring you can visualize and control these fluctuating expenses with ease.

- Groceries and Dining Out: Food expenses that vary based on shopping and eating habits.

- Utilities: Electricity, water, and gas bills that change with usage.

- Transportation: Fuel costs, public transport tickets, or ride-share expenses.

- Entertainment and Hobbies: Spending on leisure activities, movies, concerts, or personal interests.

- Clothing and Personal Care: Purchases that are made as needed and not on a fixed schedule.

By meticulously tracking both your fixed and variable costs, you transform your financial outlook from a hazy uncertainty into a clear, actionable plan. This comprehensive approach empowers you to make informed decisions, identify opportunities for savings, and ultimately work towards achieving your most important financial goals, giving you a greater sense of security and control.

Ultimately, mastering your finances begins with a clear understanding of where your money goes. Distinguishing between fixed and variable costs provides the foundational insight needed to build a resilient and adaptable budget. This knowledge empowers you to not only track your spending but also to strategically allocate your resources, ensuring every dollar works harder for you.

Embracing this methodical approach to budgeting is more than just an accounting exercise; it is an investment in your financial well-being. With a clear picture of your income and expenses, you gain the confidence to navigate economic shifts, pursue ambitious savings targets, and build a more secure financial future for yourself and your loved ones.