Managing personal or business finances can often feel like navigating a ship through a perpetual fog. Traditional budgeting methods, while useful, sometimes only offer a snapshot of your financial landscape at a single moment. They tell you where you are right now, but what about where you are headed next week, next month, or even next quarter? This is where a more dynamic approach becomes not just beneficial, but essential for true financial clarity and control.

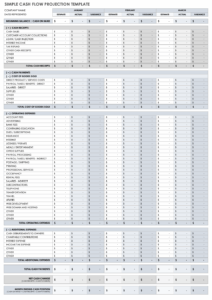

Imagine having a clearer view of the financial tides, anticipating inflows and outflows before they happen. That’s precisely the power of a cashflow forecast style budget template. It moves beyond simply tracking past expenses and revenue, shifting your focus to the future, helping you predict potential surpluses or shortfalls well in advance. This proactive stance can transform your financial planning from reactive to strategic.

By integrating forecasting into your budgeting process, you gain an invaluable tool for decision-making. Whether you’re planning for a major purchase, assessing a new investment, or simply ensuring you have enough liquidity to cover upcoming expenses, a forward-looking budget provides the insights you need. It helps you steer your financial ship with confidence, no matter how choppy the waters might seem.

Why a Cashflow Forecast Style Budget is a Game-Changer

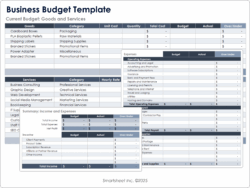

Most people are familiar with static budgets – a list of expected income and expenses for a set period. While these serve as a good starting point, they often lack the agility required in today’s fast-paced world. Life and business are rarely static, and your financial planning shouldn’t be either. A cashflow forecast style budget template, on the other hand, is built on the principle of anticipation, giving you a living, breathing financial document that adapts as your circumstances evolve.

The core difference lies in its predictive nature. Instead of just noting what you spent, you’re projecting what you *will* spend and what you *will* earn. This means looking at scheduled income, recurring bills, and even variable expenses you expect to incur. It’s about asking “what if?” and having a structured way to find the answers, identifying potential cash crunches or opportunities for growth long before they become immediate concerns.

This proactive approach empowers you to make informed decisions. Got a big invoice coming due? Your forecast will highlight it. Expecting a significant payment from a client next month? Your forecast will factor it in, showing you the resulting surplus. It turns financial planning into a strategic exercise, allowing you to allocate funds more effectively, negotiate payment terms with suppliers, or even plan investments with greater assurance.

Think of it as having a radar for your money. You can spot potential icebergs (cashflow gaps) from a distance and adjust your course, or identify clear sailing ahead, indicating a good time to expand or save. It moves you away from the anxiety of not knowing and towards the confidence of informed financial management.

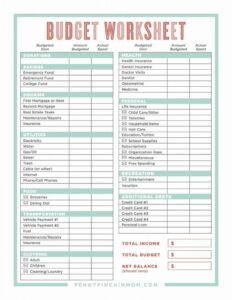

Key Components You’ll Find

- Income Streams: List all expected money coming in, with projected dates and amounts.

- Fixed Expenses: Regular, predictable costs like rent, loan payments, or subscriptions.

- Variable Expenses: Costs that fluctuate, such as utilities, groceries, or marketing spend, with your best estimates.

- Cash Inflow Projections: Anticipated dates and amounts of money entering your accounts.

- Cash Outflow Projections: When you expect money to leave your accounts, and how much.

- Opening and Closing Balances: The cash you start with, and the projected cash you’ll end with for each period.

These components work in harmony to give you a clear line of sight into your financial future. By regularly updating your projections with actual figures, your cashflow forecast style budget template becomes an increasingly accurate and reliable tool, helping you fine-tune your financial strategies and achieve your goals with greater certainty.

Building Your Own Dynamic Financial Picture

Creating your own cashflow forecast style budget template doesn’t have to be complicated. Start by gathering all your financial information: bank statements, income records, bill schedules, and any anticipated one-off expenses or revenues. The goal is to build a picture of what your finances look like today and then extend that vision into the coming weeks and months.

While you can certainly start with a simple spreadsheet, many software solutions and dedicated templates are available that can automate much of the heavy lifting. These tools often allow for easy input of recurring transactions and offer visual summaries of your financial health. The key is to find a system that you feel comfortable using consistently, as regularity is crucial for the effectiveness of any forecast.

Remember, this isn’t a one-and-done task. For your cashflow forecast to remain relevant and useful, it needs regular attention. Set aside time each week or month to review your actual income and expenses against your projections. This comparison allows you to identify discrepancies, understand trends, and make necessary adjustments to your future forecasts, continually refining your financial foresight.

- Identify all income sources and their expected receipt dates.

- List every expense, distinguishing between fixed and variable costs.

- Estimate future inflows and outflows based on historical data and upcoming plans.

- Track actuals against your forecasts regularly to refine your predictions.

- Adjust your budget as circumstances change, making it a living document.

Embracing a forward-looking budgeting approach shifts your financial management from a reactive chore to a powerful strategic advantage. It provides the clarity and control needed to navigate economic uncertainties, plan for growth, and achieve your financial aspirations, both personal and professional. The insights gained from actively forecasting your cash flow are truly invaluable.

With a comprehensive understanding of your money’s movement, you’re not just hoping for the best; you’re actively preparing for it. This proactive stance cultivates financial peace of mind, allowing you to make confident decisions about spending, saving, and investing. Start building your dynamic financial picture today, and unlock a new level of financial empowerment.