Keeping a close eye on your finances is a cornerstone of a healthy financial life, and among the many aspects of money management, handling credit card payments responsibly stands out. It is easy to feel overwhelmed by multiple cards, varying due dates, and different minimum payment amounts. Without a clear system, you might find yourself missing a payment, incurring late fees, or even damaging your credit score without intending to.

Imagine having a simple, straightforward way to track every payment, every due date, and every amount, giving you peace of mind and full control. This is where a dedicated tool for tracking your credit card obligations becomes invaluable. It transforms a potentially confusing task into a manageable routine, allowing you to stay ahead of your financial commitments and achieve your goals.

Why a Payment Log is Your Financial Co-Pilot

In today’s fast-paced world, managing multiple credit cards can sometimes feel like juggling flaming torches. Each card comes with its own statement date, due date, and minimum payment. Missing a payment, even by accident, can lead to steep late fees and an unwelcome ding on your credit report. This is where a systematic approach, like using a credit card payment log template, becomes not just helpful but essential for maintaining financial well-being and avoiding unnecessary stress.

Beyond simply avoiding penalties, a payment log empowers you with a clearer picture of your spending habits and debt repayment progress. It serves as a visual reminder of your financial commitments, helping you to prioritize payments and allocate funds more effectively. This proactive approach can significantly reduce financial anxiety, allowing you to focus on saving and investing for your future rather than constantly worrying about upcoming bills.

Key Benefits of Using a Payment Log

One of the most significant advantages is the immediate reduction in missed payments. With all your credit card information centralized, you have a single source of truth for payment dates and amounts. This eliminates the need to jump between different banking apps or dig through stacks of statements, saving you time and ensuring you meet your obligations promptly. Consistent on-time payments are a major factor in building and maintaining an excellent credit score, which opens doors to better loan rates and other financial opportunities.

Furthermore, a payment log offers valuable insights into your overall financial health. By tracking your payments over time, you can observe patterns in your spending. Are certain cards being used more frequently for discretionary purchases? Are you consistently making only minimum payments, indicating a need to re-evaluate your budget or accelerate debt repayment? These insights are crucial for making informed financial decisions and adjusting your strategies as needed.

Finally, a robust payment log serves as an excellent record-keeping tool. Should there ever be a dispute with a credit card company regarding a payment, or if you need to review your payment history for tax purposes or personal audits, having a detailed log readily available can be incredibly beneficial. It provides tangible proof of your actions, offering an extra layer of security and confidence in your financial dealings. It’s a simple step that yields significant returns in peace of mind and financial control.

Making the Most of Your Credit Card Payment Log

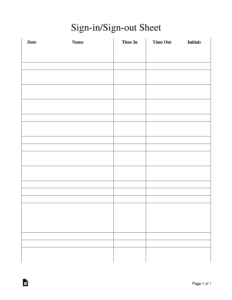

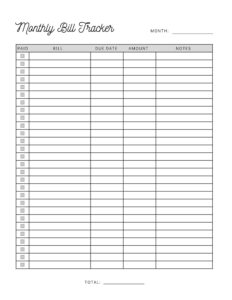

Once you understand the ‘why,’ the next step is to embrace the ‘how.’ Choosing and consistently using a credit card payment log template is key to unlocking its full potential. There are various formats available, from digital spreadsheets you can customize, to printable PDFs, or even a dedicated section in a physical planner. The best template is one that you find intuitive and are most likely to use regularly, so consider your preferred method of organization.

When selecting your template, look for essential fields that capture all the necessary information at a glance. A good template should be clear, concise, and easy to update. It is not about making it overly complicated but rather ensuring all critical data points are covered. The simplicity of a well-designed log encourages consistent use, which is far more important than a template packed with too many unnecessary features.

To ensure your log is effective, aim to fill it out as soon as a statement arrives or, even better, right after you make a payment. This keeps the information current and accurate, preventing any last-minute scramble or forgotten details. Set a regular reminder, perhaps weekly, to review your log and verify that all upcoming payments are noted and that past payments have been recorded correctly. This habit will solidify your financial management routine.

- Credit Card Name or Issuer

- Statement Closing Date

- Payment Due Date

- Minimum Payment Due

- Actual Amount Paid

- Date Payment Was Made

- Confirmation Number (if applicable)

- Notes (for any specific details or issues)

The power of a credit card payment log template lies in its ability to transform a potentially stressful aspect of personal finance into a manageable and even empowering routine. By diligently tracking your payments, you are not just avoiding fees; you are building a stronger financial foundation, improving your credit standing, and gaining invaluable insights into your spending habits. This simple tool becomes a robust ally in your journey toward financial freedom and stability, allowing you to navigate your financial landscape with greater confidence and clarity.

Embracing this organized approach to your credit card payments empowers you to make informed decisions, reduce financial stress, and work proactively towards your long-term goals. It’s about taking control of your financial narrative, one payment at a time, and fostering habits that will serve you well for years to come. Start today, and experience the profound peace of mind that comes with knowing exactly where you stand with your credit card obligations.