Life as a mom is a beautiful whirlwind, isn’t it? We juggle endless tasks, nurture tiny humans, and often, somewhere in the midst of it all, we carry the weight of financial stress. The dream of a debt-free life isn’t just about money; it’s about freedom, peace of mind, and setting a strong example for our children. It’s about being able to breathe a little easier, knowing you’re building a secure future.

It can feel overwhelming to even know where to start when you’re looking to tackle debt while managing a household budget. That’s why having a clear, actionable plan is so incredibly valuable. A well-designed debt free mom budget template can be your secret weapon, providing a roadmap that helps you see where your money is going and, more importantly, where it needs to go to get you to your goal. It takes the guesswork out of financial planning and puts you firmly in control.

In this article, we’re going to walk through how to build and implement a budget that truly serves your family’s needs, helps you chip away at debt, and ultimately leads you towards that wonderful feeling of financial independence. We’ll explore practical steps and strategies tailored for busy moms like you, because your financial peace is worth every effort.

Crafting Your Personalized Budget Blueprint

Embarking on a debt-free journey isn’t just about numbers; it’s about a shift in mindset and commitment. Your budget isn’t a restrictive cage; it’s a powerful tool that gives you permission to spend mindfully and intentionally save. The first step is always acknowledging your current financial reality without judgment, just honest observation. Understanding exactly what comes in and what goes out is the foundation upon which your financial freedom will be built.

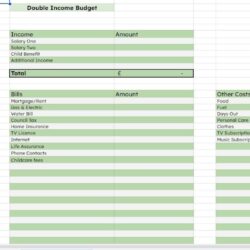

Start by gathering all your financial information. This means bank statements, credit card bills, loan documents, and pay stubs. You need to know your total household income for the month after taxes. This figure is your starting point, the amount of money you have available to allocate. Don’t forget any irregular income sources too, like side hustles or child support, and decide how you want to incorporate those into your monthly plan.

Next, it’s time to track your expenses. Many people find this step eye-opening. Categorize your spending into fixed expenses (like rent/mortgage, car payments, insurance) and variable expenses (groceries, dining out, entertainment, clothing). For variable expenses, try tracking everything for a month to get an accurate picture. This is where you might discover those little “money leaks” that add up quickly.

The true magic of a debt free mom budget template lies in its ability to highlight where your money is actually going versus where you intend it to go. This clarity empowers you to make informed decisions about your spending and saving habits. It’s about aligning your daily choices with your long-term financial goals, especially the big one of becoming debt-free.

Essential Budget Categories for Busy Moms

Creating specific categories will help you organize your finances effectively. Here are some key areas to consider including in your budget:

- Housing: Mortgage/rent, utilities (electricity, gas, water), internet.

- Transportation: Car payments, gas, public transport, maintenance.

- Groceries: Food for the family, household supplies.

- Childcare and Kids’ Activities: Daycare, school fees, extracurriculars, allowances.

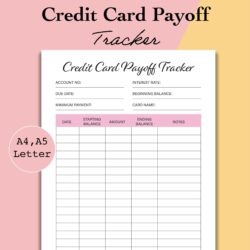

- Debt Payments: Minimum payments for credit cards, personal loans, student loans.

- Personal and Household Needs: Clothing, toiletries, entertainment, subscriptions, dining out.

- Savings and Emergency Fund: Dedicated funds for future goals and unexpected events.

Once you have your categories laid out and your income and expenses noted, you can begin to allocate funds. The goal is for your income to exceed your expenses, with the surplus directed towards debt repayment or savings. If you find your expenses are higher than your income, it’s time to get creative and find areas where you can trim back without compromising your family’s well-being. This might involve reducing discretionary spending or finding more cost-effective alternatives for necessities.

Smart Strategies to Accelerate Your Debt Payoff

Simply having a budget is a huge step, but to truly accelerate your journey to being debt-free, you need a proactive debt payoff strategy. This isn’t just about making minimum payments; it’s about channeling every extra dollar into diminishing your debt load as quickly and efficiently as possible. It involves a combination of smart planning and consistent effort that will yield significant results over time.

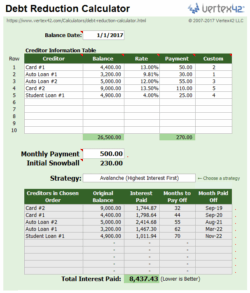

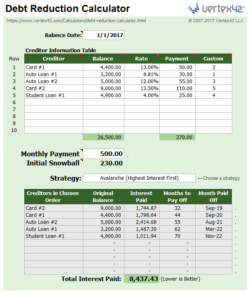

One popular approach is the “debt snowball” method, where you pay off your smallest debt first, regardless of interest rate, while making minimum payments on the rest. Once the smallest debt is gone, you roll that payment amount into the next smallest debt. This method provides powerful psychological wins, keeping you motivated as you knock off each debt. Another strategy, the “debt avalanche,” prioritizes debts with the highest interest rates first, saving you more money in interest over the long run. Choose the method that best resonates with your personality and keeps you engaged.

Beyond these strategies, actively looking for ways to increase your income or reduce your expenses even further can dramatically speed up your progress. Every extra dollar you can free up and put towards debt makes a difference. Even small, consistent efforts can compound over time, making your debt-free dream a tangible reality.

- Sell unused items around the house.

- Explore a side hustle or freelance work.

- Review all subscription services and cancel unnecessary ones.

- Implement strict meal planning to drastically reduce grocery bills and eating out.

Remember, achieving financial freedom is a journey, not a sprint. There will be good months and challenging months, but the key is consistency and not giving up on your goals. Each small step you take using your personalized budget moves you closer to a future where you have more choices, less stress, and the incredible satisfaction of knowing you’ve built a secure foundation for your family.

Embrace the power of your debt free mom budget template and the strategies we’ve discussed. You’re not just managing money; you’re building a legacy of financial wisdom for yourself and your children. Keep going, you’ve got this!