Running a restaurant is an exciting venture, filled with the aroma of delicious food, the buzz of happy customers, and the constant hustle of a dedicated team. However, beneath the culinary magic lies a complex financial engine that needs careful management to keep everything running smoothly. It is easy to get caught up in daily operations and overlook the bigger financial picture, but ignoring it can lead to unexpected challenges down the line.

That is where a solid financial plan comes into play. Knowing how to fill in restaurant budget template is a game-changer for financial health and stability. It is not just about tracking expenses but actively planning for success, making informed decisions, and steering your business towards profitability. Think of it as your financial compass, guiding you through the often unpredictable culinary landscape.

A well-constructed budget helps you understand where every dollar comes from and, more importantly, where every dollar goes. It provides clarity, reduces stress, and empowers you to make strategic choices that will benefit your restaurant in the long run. Embracing this essential tool transforms financial guesswork into confident management.

Unpacking the Power of a Restaurant Budget

Budgeting might sound like a tedious chore, but for a restaurant owner or manager, it is an incredibly empowering tool. It transforms financial uncertainty into a clear roadmap, allowing you to make proactive and informed decisions rather than simply reacting to circumstances. This foresight is invaluable in an industry known for its tight margins and dynamic environment.

One of the immediate benefits of a robust budget is gaining a transparent picture of your cash flow. You will begin to understand your peak revenue periods and your leaner months, which is absolutely vital for making smart decisions about staffing levels, ingredient purchasing, and even marketing efforts. This clear understanding prevents those unwelcome financial surprises that can disrupt operations.

Furthermore, a budget provides an objective benchmark for your restaurant’s performance. Without a financial plan, how do you truly measure if you are profitable or merely busy. A carefully developed budget sets realistic targets for income and expenses, allowing you to measure your actual results against these goals and identify areas of strength or concern.

Cost control is another area where a budget truly shines. It compels you to scrutinize every single expense, from the price of your raw ingredients and supplies to utility bills and maintenance costs. This detailed examination helps you pinpoint areas where you can optimize spending without ever compromising the quality of your food, service, or customer experience.

Moreover, a well-structured budget is an indispensable tool for future growth. Whether your ambitions include planning significant renovations, introducing a new menu concept, or even expanding to an additional location, a realistic financial budget provides the solid foundation needed for these ambitious endeavors. It also demonstrates to potential investors that you are a serious, organized, and financially astute business owner.

Key Areas Your Budget Should Cover

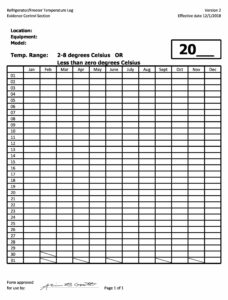

When you fill in restaurant budget template, you will typically encounter several critical categories that demand your careful attention. Thoroughly addressing each of these helps ensure your financial plan is comprehensive and accurate.

- Revenue Projections: This includes estimated sales from food, beverages, catering services, merchandise, and any other income streams your restaurant generates.

- Food and Beverage Costs: Detailed expenses for all raw ingredients, produce, meats, dairy, liquor, wine, beer, and non-alcoholic beverages.

- Labor Costs: Encompasses wages for all staff members, including kitchen, front-of-house, and management, along with payroll taxes, benefits, and any overtime.

- Operating Expenses: Covers a wide array of costs such as rent, utilities, marketing and advertising, insurance premiums, equipment repairs and maintenance, cleaning supplies, and general administrative costs.

- Fixed vs. Variable Costs: Differentiating between expenses that remain relatively constant regardless of sales volume (fixed costs) and those that fluctuate with your business activity (variable costs).

Making Your Budget Template Work for You

Simply having a restaurant budget template is only the first step. The real magic happens when you actively engage with it, treating it as a dynamic and evolving document rather than a static spreadsheet. It is not a one-time task but an ongoing process that demands regular review, analysis, and adjustment to remain effective and relevant to your business.

To begin, gather all your historical financial data. Look back at past sales figures, expenditure reports, and profit and loss statements. This information provides a realistic baseline for your future projections. When making estimates, it is often wise to project conservatively for revenue and slightly liberally for expenses. This approach helps you avoid disappointment and prepares you for potential challenges.

Once your initial budget is in place, consistent monitoring is key. Compare your actual income and expenses against your budgeted figures on a weekly or monthly basis. This regular check-in allows you to quickly identify any discrepancies, understand the reasons behind them, and make timely adjustments. Perhaps a key supplier raised prices, or a new marketing campaign generated unexpectedly high sales; your budget should reflect these changes to stay accurate.

- Be Realistic: Set achievable goals for both revenue and expenses. Overly optimistic forecasts can lead to frustration and poor decision-making.

- Review Regularly: Schedule monthly or at least quarterly check-ins. This frequency ensures your budget remains a relevant tool, not just an outdated document.

- Be Flexible: The restaurant industry is constantly changing. Your budget should be adaptable enough to accommodate market shifts, new opportunities, or unforeseen challenges.

- Involve Your Team: Encourage input from managers or department heads who oversee specific cost centers. Their insights can be invaluable for accurate budgeting and cost control.

Embracing the discipline of budgeting is one of the most impactful steps you can take to secure your restaurant’s financial future. It shifts your approach from reactive problem-solving to proactive strategic planning, providing you with a greater sense of control and confidence in every decision you make. This methodical approach is a cornerstone of sustainable business growth.

By consistently managing your finances with a clear, well-maintained budget, you are not just striving to survive; you are actively building a resilient, thriving establishment ready to face any challenge and seize every opportunity the vibrant culinary world presents. It is truly a fundamental recipe for lasting success and peace of mind.