Navigating finances as a couple can sometimes feel like trying to solve a complex puzzle with missing pieces. You both bring different spending habits, financial histories, and future aspirations to the table, which is perfectly normal. However, when these differences aren’t openly discussed and aligned, money can quickly become a source of stress rather than a tool for building your shared dreams. It’s a common challenge, but certainly one that can be overcome with the right approach and resources.

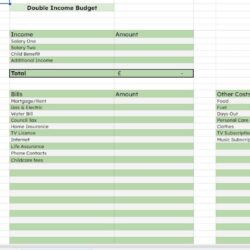

That’s where a clear and organized system comes into play. Imagine having a straightforward way to track your income, expenses, savings goals, and debt repayment together, making sure you’re both on the same page, every step of the way. Utilizing a dedicated husband and wife budget template can transform these potentially tricky conversations into productive planning sessions, laying a strong foundation for your financial future as a team.

Creating a budget isn’t about restricting your fun or limiting your individual choices; it’s about empowering yourselves to make intentional decisions about where your money goes. It’s about understanding your joint financial landscape, identifying opportunities for growth, and working together towards exciting milestones, whether that’s a down payment on a home, a dream vacation, or comfortable retirement.

Why a Shared Budget is Your Marriage’s Financial Superhero (and How to Make It Work)

Think of your shared budget as the ultimate team playbook for your money. In any successful partnership, communication and clear goals are paramount, and your finances are no exception. When both partners are actively involved in creating and maintaining a budget, it fosters a sense of unity and shared responsibility. You’re not just managing individual funds; you’re building a collective financial future, hand in hand. This collaborative effort helps to eliminate surprises and build mutual trust, which are priceless assets in any marriage.

A shared budget also brings much-needed transparency to your financial situation. No more wondering where money is going or having unspoken expectations about who pays for what. Everything is laid out clearly, allowing both of you to see the full picture. This clarity naturally leads to fewer disagreements about spending because decisions are made jointly, based on agreed-upon priorities and limits. It shifts the dynamic from blame to proactive problem-solving, creating a more harmonious environment for discussing money matters.

Beyond immediate benefits, a well-maintained budget is your roadmap to achieving significant long-term goals. Whether you dream of buying a home, starting a family, traveling the world, or simply having a comfortable retirement, these aspirations require careful planning and consistent saving. Your budget acts as a constant reminder of these goals, helping you make choices today that will pave the way for a brighter tomorrow. It turns abstract dreams into concrete, actionable steps.

The Core Components of Your Budget

Understanding what goes into your budget is the first step towards taking control. A good budget template will guide you through categorizing your finances effectively.

- Income: All money coming in from salaries, side hustles, investments, etc.

- Fixed Expenses: Costs that largely stay the same each month, like rent/mortgage, loan payments, insurance premiums.

- Variable Expenses: Costs that fluctuate, such as groceries, dining out, entertainment, utilities (depending on usage).

- Savings: Allocations for emergency funds, retirement, specific goals (down payment, vacation).

- Debt Repayment: Additional payments towards credit cards, student loans, or other debts beyond minimums.

Each of these components plays a crucial role in painting an accurate picture of your financial health. By clearly defining and tracking them, you gain invaluable insights into your spending patterns and where adjustments can be made. It’s about being honest with yourselves about your financial reality and then intentionally shaping it to better serve your joint ambitions. Remember, your budget is a living document, not a rigid set of rules; it’s meant to adapt and evolve with your life changes and evolving goals. The most successful budgets are those that couples find engaging and realistic for their specific circumstances, ensuring it becomes a helpful guide rather than a source of frustration.

Practical Steps to Implement Your Budget Template

Getting started with a budget might seem daunting at first, but breaking it down into manageable steps makes the process much smoother. The initial phase involves gathering all your financial information: bank statements, pay stubs, credit card bills, and any loan documents. Sitting down together with all these details allows you to see your collective income and expenses clearly. This transparency is key to building a budget that truly reflects your financial reality as a couple. Once you have this bird’s eye view, choosing a husband and wife budget template that resonates with both of you – whether it’s a simple spreadsheet, an app, or a printable document – becomes the next logical step.

After selecting your template, the real fun begins: allocating your funds. This is where you decide where every dollar goes, prioritizing needs, savings, debt repayment, and then wants. This collaborative discussion is vital, as it ensures both partners feel heard and invested in the plan. It’s not about one person dictating terms, but about finding common ground and mutual agreement. Remember that flexibility is crucial; life happens, and your budget should be able to accommodate unexpected expenses or shifts in income. Regularly scheduled check-ins, perhaps once a week or bi-weekly, are essential to track your progress and make any necessary adjustments.

Making your budget a consistent practice rather than a one-off event is what truly brings success. It’s about building a habit of financial awareness and open communication.

- Gather all financial information jointly.

- Choose a husband and wife budget template that suits your style.

- Collaboratively allocate funds to categories.

- Track your spending regularly against your plan.

- Review and adjust your budget as life changes.

By consistently engaging with your budget, you’re not just managing money; you’re strengthening your partnership. Each successful budget meeting, each achieved financial goal, reinforces your ability to work as a unified team, tackling challenges and celebrating victories together. It transforms potential points of conflict into opportunities for growth and deeper connection, fostering a sense of security and shared purpose.

Embarking on this financial journey together using a structured template can be one of the most empowering decisions you make as a couple. It provides the clarity, accountability, and shared vision needed to build a robust financial future. By working hand-in-hand to understand your money, you are not just reaching financial milestones; you are also reinforcing the strength and resilience of your marriage, paving the way for countless shared adventures and peace of mind.