Embarking on the journey of building a new home is an incredibly exciting prospect. It is a dream come true for many, envisioning every detail from the foundation to the finishes. However, the excitement can quickly turn into anxiety if the financial aspect is not meticulously managed. Without a clear roadmap for your spending, costs can spiral out of control, turning your dream home into a financial nightmare.

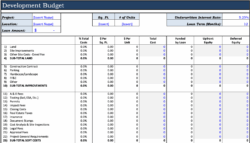

That is where a well-structured plan comes into play. A comprehensive new home construction budget template is not just a suggestion; it is an absolute necessity for anyone looking to build a house without breaking the bank. It serves as your financial compass, guiding you through the myriad of expenses involved in bringing your architectural vision to life. From purchasing the land to landscaping the yard, every single cost needs to be accounted for.

Think of your budget template as your personal financial project manager, helping you organize, track, and control every dollar spent. It empowers you to make informed decisions, negotiate effectively, and ensure that your construction project stays on track and within your financial comfort zone. It is the key to transforming a complex undertaking into a manageable and enjoyable experience.

Understanding the Layers of Your Home Construction Costs

Building a new home involves a fascinating array of expenditures, far beyond just the bricks and mortar. To truly master your finances, you need to understand these different layers of cost. They typically fall into two main categories: soft costs and hard costs, with a crucial contingency fund sitting alongside them. Neglecting any of these can lead to unpleasant surprises down the road, so let us break them down thoroughly.

Soft costs are often overlooked but are absolutely vital. These are the expenses not directly related to the physical construction of the house itself. They include architectural fees for designing your home, engineering fees to ensure structural integrity, and various permit fees required by your local government before you can even break ground. Do not forget about surveying costs to properly define your property lines, and any legal fees associated with land purchase or construction contracts. These initial outlays set the stage for everything else.

Hard costs are what most people immediately think of when imagining construction expenses. This category encompasses all the materials and labor required to physically build your home. From excavation and foundation work to framing, roofing, plumbing, electrical systems, and HVAC installation, these are the tangible elements. Interior finishes like flooring, cabinets, countertops, paint, and fixtures also fall under hard costs. Exterior elements such as siding, windows, doors, and even driveways and walkways are part of this substantial category. Getting multiple quotes for each phase is crucial here.

Anticipating the Unexpected with a Contingency Fund

Even the most meticulously planned budget can face unforeseen challenges. That is why a contingency fund is perhaps the most important element of any new home construction budget template. This is a dedicated pot of money set aside specifically for unexpected expenses or changes that inevitably arise during construction.

It is highly recommended to allocate at least ten to fifteen percent of your total estimated construction cost to this fund. This protects you from issues like unexpected soil conditions, changes in material prices, delays due to weather, or minor design alterations you might decide on mid project. Having this buffer means you will not have to scramble for funds or compromise on other aspects of your home when an unforeseen cost emerges. It provides peace of mind and financial flexibility, ensuring your project can adapt without derailing your entire budget.

Finally, remember that land acquisition costs are often separate from construction costs but must be included in your overall financial plan. The price of the plot itself, closing costs, and any site preparation like clearing or grading should be factored in from the very beginning. By meticulously detailing each of these layers, you gain a clear and realistic picture of your entire financial commitment.

Maximizing the Effectiveness of Your Budget Template

Having a robust new home construction budget template is a powerful tool, but its true value comes from how you use it. It is not a static document you create once and forget; it is a living, breathing financial roadmap that needs constant attention and updates. Think of it as your project dashboard, giving you real time insights into your spending and helping you stay on track.

One of the most critical steps is to be as detailed as possible from the outset. Do not just put a lump sum for “materials.” Break it down into categories like lumber, drywall, roofing materials, and so on. The more granular your initial estimates, the easier it will be to track actual expenses and identify areas where you might be overspending. Research average costs in your area and get multiple bids from contractors and suppliers for each specific task. This due diligence can save you significant amounts of money.

Regularly reviewing and updating your template is equally important. Set aside time each week or bi weekly to compare actual expenditures against your budgeted amounts. This proactive approach allows you to catch any discrepancies early on and make necessary adjustments. If one area comes in under budget, you might have some flexibility to reallocate funds elsewhere, or simply enjoy the savings. Conversely, if an expense is higher than anticipated, you can look for ways to trim costs in other areas before it becomes a major issue.

Building your dream home is a monumental undertaking, both emotionally and financially. With careful planning, diligent tracking, and a flexible mindset, you can navigate the complexities of construction confidently. Your well organized budget template will be your steadfast companion, helping you make informed decisions every step of the way.

By staying on top of your finances and understanding where every dollar is going, you empower yourself to achieve your home building goals without undue stress. This proactive approach ensures that your beautiful new home is not only a physical reality but also a testament to smart financial management.