Embarking on a new product launch is an incredibly exciting journey, brimming with potential and innovative ideas. However, beneath all that enthusiasm lies the critical need for a solid financial roadmap. Without a clear understanding of where your money is going and what resources you’ll need, even the most brilliant product can stumble right out of the gate. It’s not just about having enough cash; it’s about allocating it wisely to maximize your impact.

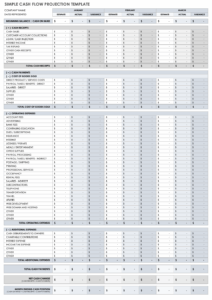

That’s precisely where a comprehensive new product launch budget template becomes your best friend. Think of it as your financial blueprint, guiding every decision from initial development to post-launch marketing pushes. It helps you anticipate costs, avoid nasty surprises, and ensures that every dollar spent contributes effectively to your product’s success and market penetration. It’s the difference between hoping for success and actively planning for it.

A well-structured budget doesn’t just list expenses; it empowers you to make strategic choices, prioritize investments, and justify your spending to stakeholders. It offers clarity, reduces financial risk, and ultimately paves the way for a smoother, more successful introduction of your fantastic new offering to the world.

Unpacking the Essentials of Your Launch Budget

Crafting a robust budget for your new product isn’t just about tallying up numbers; it’s a strategic exercise that forces you to consider every facet of the launch process. From the moment an idea sparks to the point customers are holding your product in their hands, there are countless investments to make. Many businesses often underestimate the full scope of these expenses, leading to unforeseen financial pressures down the line. A truly effective new product launch budget template will meticulously break down these areas, ensuring nothing vital is overlooked.

It’s crucial to start thinking about your budget very early in the product development cycle, not just a few weeks before launch. This proactive approach allows you to iterate on your financial plan as the product evolves, making adjustments based on market research, development milestones, and anticipated marketing efforts. By establishing a clear financial framework from the outset, you can make informed decisions that align with both your product vision and your company’s broader financial goals.

Key Categories to Consider

To build a truly comprehensive budget, you’ll want to segment your expenses into logical categories. This makes tracking easier and helps you identify areas where you might need to adjust spending or reallocate resources.

- Product Development and Testing: This includes research, design, prototyping, manufacturing setup, quality assurance, and any necessary certifications or legal reviews.

- Marketing and Public Relations: Think about your go-to-market strategy. This encompasses everything from digital advertising (social media, search engines), content creation, influencer partnerships, press releases, media kits, launch events, and potentially agency fees.

- Sales and Distribution: Consider costs associated with sales team training, onboarding new distributors or retailers, initial inventory purchases, warehousing, shipping logistics, and potentially creating point-of-sale materials.

- Operational Costs: Don’t forget the underlying infrastructure. This could include new software licenses, additional staff or contractors, customer service setup, and any initial support materials.

- Contingency Fund: This is absolutely critical. Always allocate a percentage (typically 10-15%) of your total budget for unexpected issues, market shifts, or opportunities that arise.

Focusing on the marketing and PR side, it’s easy to get carried away. A detailed new product launch budget template allows you to itemize specific campaigns, channels, and assets. Are you planning a large-scale national ad campaign or a targeted digital push? Will you invest in professional video production, or rely more on organic content? Each decision has a direct budgetary implication, and seeing them laid out helps you make strategic choices about your reach and messaging. For instance, influencer marketing might require upfront payments or product samples, while a Google Ads campaign will incur ongoing costs per click or impression.

Sales and distribution also hold significant weight. If your product requires a new sales channel, there will be costs associated with establishing those relationships, training sales teams on the new product’s features and benefits, and potentially setting up initial inventory in various locations. Overlooking these logistical expenses can lead to delays in getting your product to customers, directly impacting initial sales performance. A well-planned budget anticipates these elements, smoothing the path from your warehouse to your customer’s doorstep.

Finally, the contingency fund isn’t just a nice-to-have; it’s a necessity. No launch goes exactly to plan. A supplier might increase prices, a marketing campaign might underperform and require a pivot, or you might identify an unexpected opportunity that requires additional investment. Having this buffer prevents you from dipping into other critical areas or, worse, running out of funds entirely. It provides peace of mind and the flexibility needed to navigate the inherent uncertainties of a product launch.

Maximizing Your Investment and Tracking Success

A budget isn’t a static document; it’s a living guide that should be revisited and updated regularly. Once your budget is set, the real work begins: ensuring that every dollar spent is working towards your launch objectives. This means more than just tracking expenses against your initial projections; it involves evaluating the effectiveness of each investment and being prepared to pivot if certain strategies aren’t yielding the desired results. Thinking strategically about ROI for each budgetary line item allows you to make data-driven decisions throughout the launch process and beyond.

To truly maximize your investment, you need to establish key performance indicators (KPIs) for each major spending category. For instance, if you’re investing heavily in social media ads, your KPIs might include click-through rates, conversion rates, and cost per acquisition. For PR efforts, you might track media mentions, sentiment, and website traffic originating from press coverage. Regularly reviewing these metrics against your budget helps you understand where your money is most effective and where adjustments might be needed to optimize performance.

Consider integrating your budget template with your project management tools or financial software. This creates a seamless flow of information, making it easier to track actual spending against planned figures. Regular financial reviews with your team aren’t about pointing fingers; they’re about learning, adapting, and ensuring that the entire team is aligned on financial goals and responsible resource utilization. This proactive financial management is a cornerstone of a successful product introduction and sustained growth.

Ultimately, a well-crafted and diligently managed budget is more than just a list of expenses; it’s a strategic asset that guides your product through its most critical phase. It empowers informed decision-making, fosters financial discipline, and provides the clarity needed to navigate the complexities of bringing something new to market. By understanding and allocating your resources thoughtfully, you lay a robust foundation for your product’s long-term success, transforming potential into tangible results and a thriving market presence.