Navigating the world of grant applications can often feel like solving a complex puzzle, with numerous pieces needing to fit together perfectly to secure vital funding for your organization’s mission. Among these pieces, the budget stands out as one of the most critical, often determining whether your proposal moves forward or gets set aside.

A well-structured and transparent budget isn’t just a requirement; it’s a powerful tool that communicates your project’s feasibility, impact, and your organization’s fiscal responsibility. That’s why having a robust nonprofit grant proposal budget template isn’t just helpful, it’s practically indispensable for streamlining your efforts and presenting a compelling financial case to potential funders.

This article will guide you through the essential components of an effective grant budget, offering insights into what funders look for and how you can present your financial needs clearly and persuasively. Let’s make your next grant application process a little less daunting.

Deconstructing the Ideal Grant Budget Template

When a grant reviewer looks at your budget, they aren’t just scanning numbers; they’re trying to understand the story behind your project. They want to see how every dollar contributes directly to achieving your stated goals. An ideal grant budget template, therefore, isn’t just a spreadsheet; it’s a meticulously organized financial plan that aligns seamlessly with your program narrative.

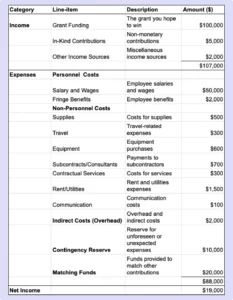

Your budget should be clear, comprehensive, and easy to understand at a glance. It should detail all anticipated income and expenses, ensuring that every cost is justifiable and directly related to the proposed activities. Funders appreciate transparency and evidence of careful financial planning, demonstrating that their investment will be managed wisely and effectively.

A strong budget template will typically differentiate between various types of costs, ensuring nothing is overlooked. This often involves categorizing expenses in a way that makes sense both to your internal team and to external reviewers. Getting this right from the start can save a lot of headaches later on.

Direct Costs: The Heart of Your Project Expenses

Direct costs are the expenses directly attributable to your proposed project. These are the tangible items and services without which your program simply couldn’t run. They need to be clearly itemized and explained in your nonprofit grant proposal budget template. Think of them as the building blocks of your project’s financial foundation.

- Staff Salaries and Benefits: This includes the salaries, wages, and associated benefits (health insurance, retirement contributions, payroll taxes) for any personnel directly involved in the grant-funded project. Clearly state their roles, percentage of time dedicated to the project, and corresponding costs.

- Program Supplies and Materials: All the consumables needed for your program, from educational materials and art supplies to office supplies used exclusively for the project. Be specific about quantities and unit costs where possible.

- Travel Expenses: Costs associated with project-related travel, such as mileage, airfare, lodging, and per diem for staff or beneficiaries. Detail the purpose and frequency of travel.

- Consultant and Professional Fees: Payments to external experts or organizations providing services essential to the project, such as evaluators, trainers, or specialized contractors.

- Equipment Purchases and Rentals: Any specific equipment that needs to be bought or rented for the duration of the project, like computers, specialized software, or scientific instruments. Clarify if the equipment will be retained by the organization after the grant period.

- Marketing and Outreach: Expenses for promoting your project, including website development specific to the program, brochure printing, or social media advertising.

- Facility Costs (Directly Attributable): If a specific space is rented or used solely for the project, a portion of rent, utilities, or maintenance might be a direct cost.

Beyond direct costs, many projects also incur indirect costs. These are the general operating expenses of your organization that support the project but aren’t directly tied to a specific activity. Things like general administrative salaries, utilities for the main office, or accounting services fall into this category. Funders often have specific policies on how indirect costs can be calculated and requested, so it’s crucial to understand these guidelines.

Finally, consider “in-kind” contributions. These are non-cash donations of goods or services that benefit your project. While they don’t involve money changing hands, they represent real value and demonstrate community support and resourcefulness. Listing them in a separate section of your budget can significantly strengthen your proposal by showing additional investment in the project.

Crafting a Persuasive Budget Narrative

A list of numbers alone, no matter how detailed, isn’t enough. Every robust grant proposal requires a compelling budget narrative. This narrative is your opportunity to explain and justify each line item, demonstrating why each expense is necessary, reasonable, and directly contributes to your project’s objectives. It bridges the gap between your financial figures and your program’s goals, making a coherent case for funding.

Think of the budget narrative as the translator for your numbers. It clarifies any assumptions made, explains how costs were estimated, and reinforces the direct link between spending and impact. Without a strong narrative, even a perfectly organized budget can leave reviewers with unanswered questions or doubts about your financial planning. This is where you connect the dots for the funder.

To write an effective budget narrative, aim for clarity, conciseness, and conviction. Avoid jargon and be as specific as possible. For instance, instead of just listing “travel,” explain *who* is traveling, *where*, *why*, and *how* the costs were calculated (e.g., “Mileage for program manager to conduct 10 site visits at $0.65/mile x 500 miles = $325”). This level of detail builds trust and shows thorough planning.

- Be Clear and Concise: Use plain language. Avoid vague terms or jargon that a reviewer might not understand.

- Justify Every Line Item: For each major expense, explain its purpose and necessity in relation to the project goals. Why do you need this particular item or service?

- Show Alignment with Program Goals: Explicitly link budget items back to your program objectives and activities described in your proposal narrative. Demonstrate how the funds will directly support the outcomes you promise.

- Highlight Sustainability: If applicable, explain how certain budget items contribute to the long-term sustainability of the project or organization beyond the grant period.

Mastering the art of budget preparation, especially with a solid template, significantly boosts your chances of securing grant funding. It’s more than just an administrative task; it’s an integral part of telling your project’s story and proving your organization’s capability to deliver meaningful results. By meticulously detailing your financial needs, you empower funders to confidently invest in your vision and the positive change you aim to create.

Remember, a well-prepared budget reflects well on your entire organization, showcasing your professionalism and commitment. It provides a clear roadmap for how funds will be utilized, assuring donors that their contributions will be maximized for impact. This careful planning not only secures current funding but also lays the groundwork for future philanthropic partnerships, fostering a legacy of trust and successful community engagement.