Managing properties can feel like navigating a complex financial maze. You are constantly balancing incoming rent with outgoing expenses, all while trying to keep property owners happy and tenants satisfied. It is a demanding role that requires sharp financial foresight and meticulous organization, where every dollar needs to be accounted for and every repair budgeted for. Without a clear financial roadmap, it is easy to feel overwhelmed, leading to unexpected costs and missed opportunities for growth.

That is where a well-designed operating budget template for property managers becomes an invaluable asset. This tool is not just about tracking money; it is about gaining clarity, exerting control, and making informed decisions that benefit everyone involved. It helps you move from reactive problem-solving to proactive financial planning, ensuring the long-term health and profitability of the properties under your care.

By outlining all expected revenues and expenditures over a set period, usually a year, an operating budget template empowers you to forecast financial performance, identify potential shortfalls, and allocate resources efficiently. It becomes the bedrock of your financial strategy, transforming abstract numbers into concrete action plans and allowing you to confidently manage your portfolio.

Why a Dedicated Operating Budget Template is Your Best Ally

Think about the sheer number of financial transactions involved in property management. From collecting rent to paying for utilities, maintenance, insurance, and taxes, the list goes on. Without a structured budget, it is like trying to catch water with a sieve; money flows in and out, but you lose track of where it is really going. A robust operating budget template provides that much-needed container, giving you a comprehensive overview of your financial landscape at any given moment.

It serves as a critical communication tool between you and property owners. When you can present a clear, detailed budget, it fosters trust and transparency. Owners can see exactly how their investments are performing, understand the rationale behind expenditures, and feel confident that their assets are being managed responsibly. This proactive approach helps to avoid uncomfortable conversations about unexpected costs later down the line.

Furthermore, a well-defined budget allows you to make strategic decisions rather than just reacting to emergencies. If you notice that maintenance costs are consistently higher than projected, the budget signals this trend, prompting you to investigate potential causes or seek more cost-effective solutions. It moves you from simply recording expenses to actively managing them for better outcomes. It is about understanding the financial heartbeat of each property and responding to its rhythms effectively.

An effective budget is also instrumental in setting realistic rental rates and identifying opportunities for cost savings or revenue enhancement. By meticulously tracking income and expenses, you can determine the true cost of operating a property, ensuring that your rental prices are competitive yet profitable. It highlights areas where you might be overspending or where there is potential to negotiate better deals with vendors and service providers. This financial discipline ultimately leads to improved net operating income for the properties you manage.

Key Components of an Effective Operating Budget

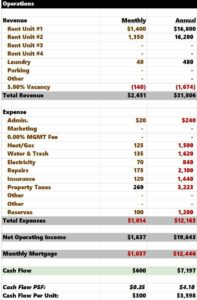

To be truly effective, an operating budget needs to capture all relevant financial data. It is typically divided into two main sections: revenue and expenses.

- Revenue Streams: This includes all the money coming into the property. The primary source is usually rent collection, but it also encompasses other income like late fees, application fees, laundry income, parking fees, and pet fees. Accurately projecting these figures is the first step in painting a realistic financial picture.

- Operating Expenses: These are the costs associated with running the property on a day-to-day basis. They can be broadly categorized as:

- Fixed Expenses: Costs that remain relatively constant regardless of occupancy or usage, such as property taxes, insurance premiums, management fees, and certain administrative costs.

- Variable Expenses: Costs that fluctuate based on property usage, tenant needs, or unforeseen events. This includes utilities (if paid by the property owner), cleaning services, landscaping, general repairs, routine maintenance, marketing and advertising for vacant units, and supplies.

- Capital Expenditures: While strictly separate from the operating budget, it is crucial to be aware of these. These are larger, infrequent investments in the property designed to improve its value or extend its lifespan, like a new roof, HVAC system replacement, or major renovations. A good operating budget helps you plan for the reserves needed to fund these in the future.

Understanding and accurately categorizing these components ensures that your budget provides a clear and honest reflection of the property’s financial health. It prevents surprise costs from derailing your financial plans and helps you maintain a stable and profitable operation.

Making the Most of Your Operating Budget Template for Property Managers

So, you have got your template, but how do you really bring it to life and make it work for you? The first step is diligent data collection. Gather all historical financial records for the property, usually from the past one to three years. This includes income statements, expense reports, utility bills, maintenance invoices, and any other relevant financial documentation. This historical data provides a solid foundation for making accurate projections for the upcoming budget period. Without this detailed look back, your future predictions will be mere guesses.

Once you have your historical data, begin populating your operating budget template for property managers with projected figures for the future. Be realistic and consider market trends, anticipated rent increases, potential vacancies, and any planned improvements or maintenance work. It is often wise to build in a small contingency fund for unexpected minor expenses. Remember, the goal is not just to track, but to predict and prepare.

Regular review and adjustment are paramount. A budget is not a static document; it is a living tool. Schedule monthly or quarterly reviews to compare actual income and expenses against your budgeted figures. This ongoing analysis allows you to quickly identify variances, understand why they occurred, and make necessary adjustments to your spending or revenue strategies. It ensures that your budget remains relevant and effective throughout the year, guiding your decisions rather than being a forgotten artifact.

Ultimately, a well-executed budget is a testament to effective property management. It provides a clear picture of financial performance, aids in proactive decision-making, and strengthens relationships with property owners. By consistently utilizing and refining your operating budget, you are not just managing money; you are cultivating financial stability and growth for your entire property portfolio. This meticulous approach to finances is what sets apart successful property managers, enabling them to navigate challenges with confidence and seize opportunities for expansion and enhanced profitability.