There are many benefits to using a client survey template web development. These benefits include:

Client Survey Template Questions Website Design

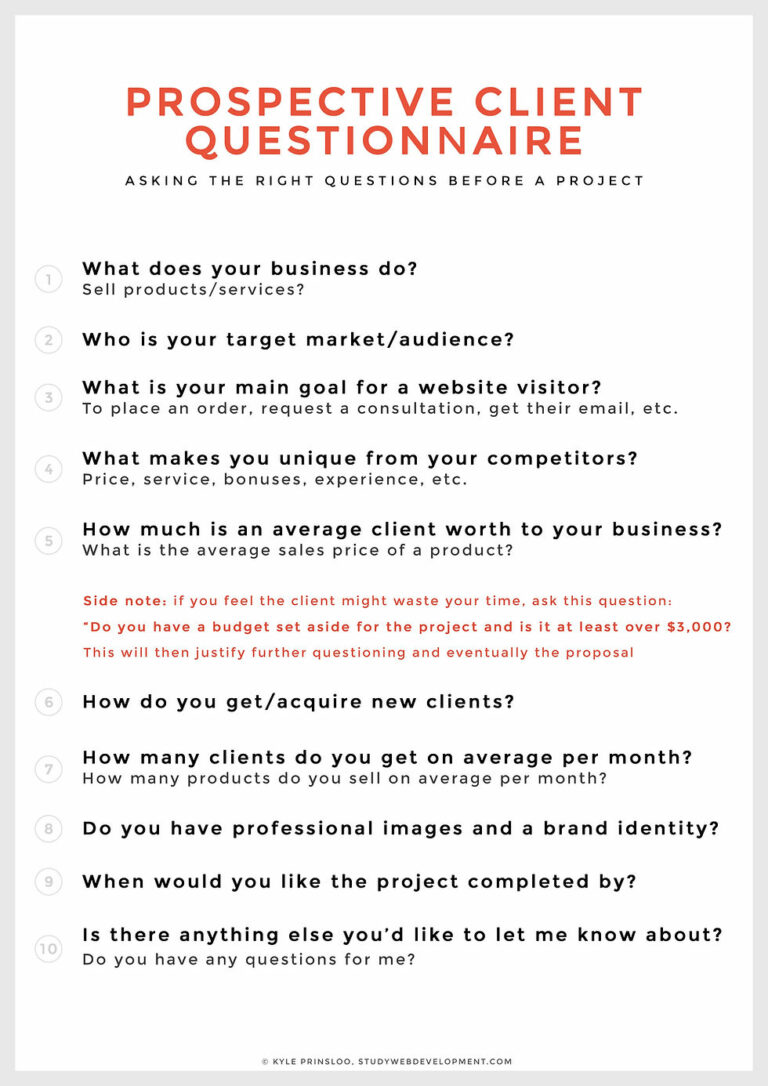

There are many different types of client survey template questions that you can ask, but some of the most common include:

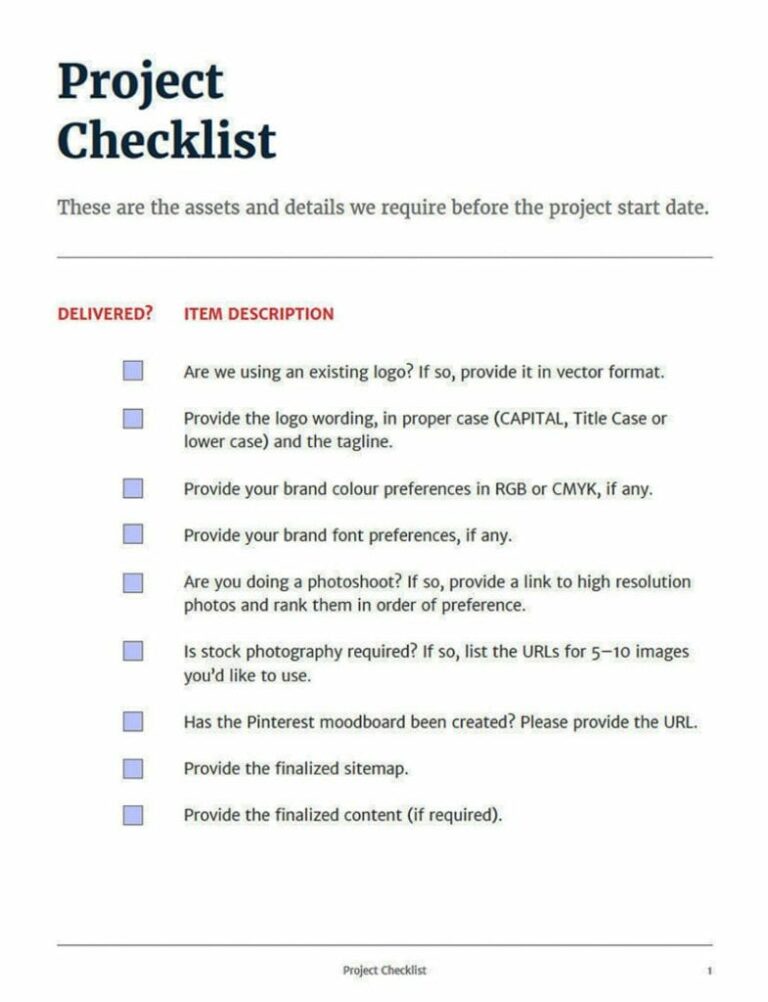

Client Survey Template Professional Services

What are the benefits of using a client survey template for professional services? Client survey templates for professional services can help firms:

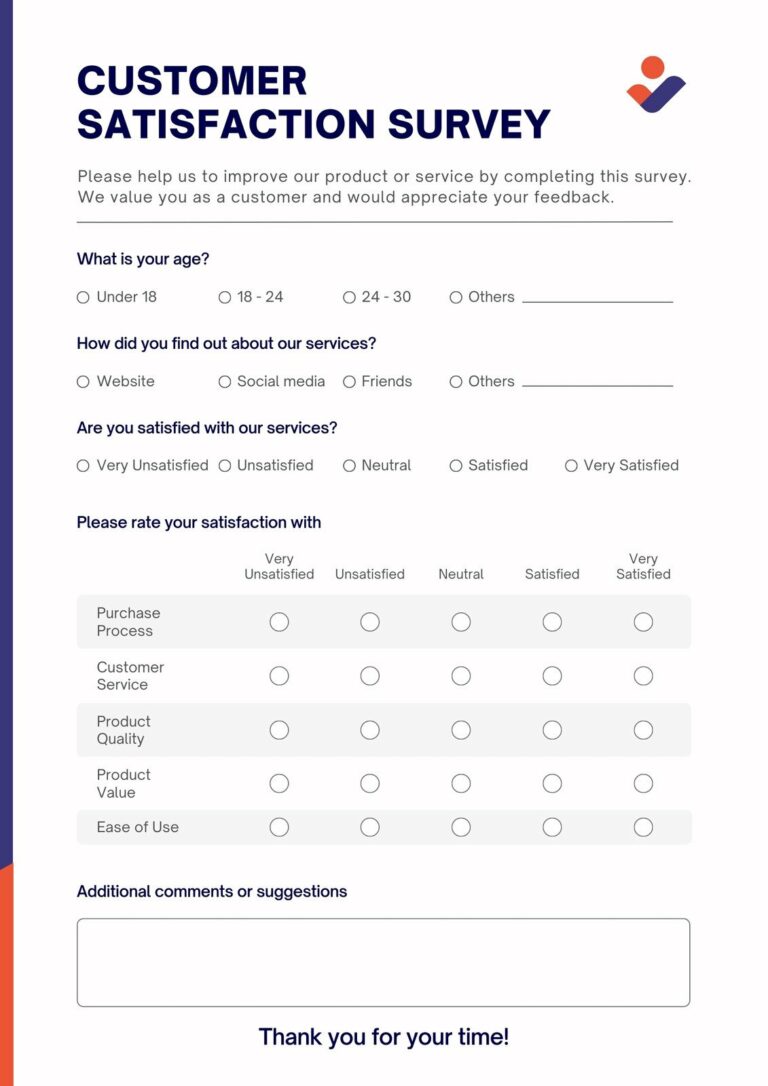

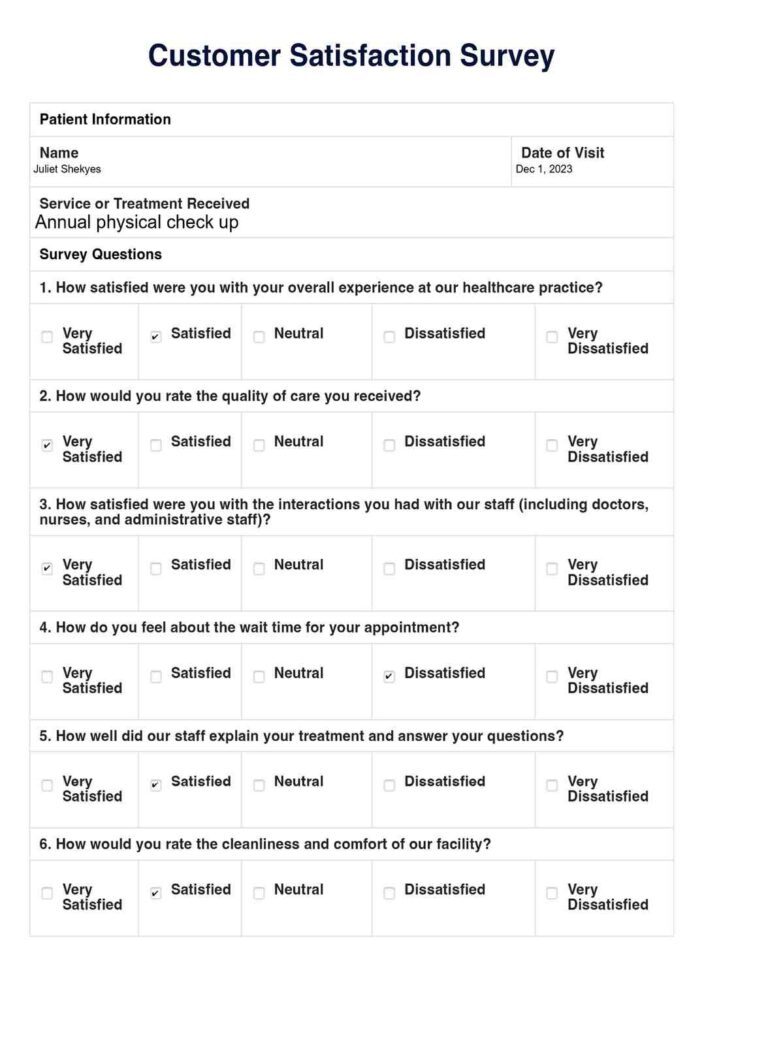

Client Service Satisfaction Survey Template

There are many benefits to using a client service satisfaction survey template. First, it can help companies identify areas where they are meeting or exceeding customer expectations. This information can be used to maintain or improve upon these areas. Second, a survey template can help companies identify areas where they are falling short of customer expectations. This information can be used to make improvements to the company’s products or services. Third, a survey template can help companies track customer satisfaction over time. This information can be used to measure the effectiveness of changes made to the company’s products or services.

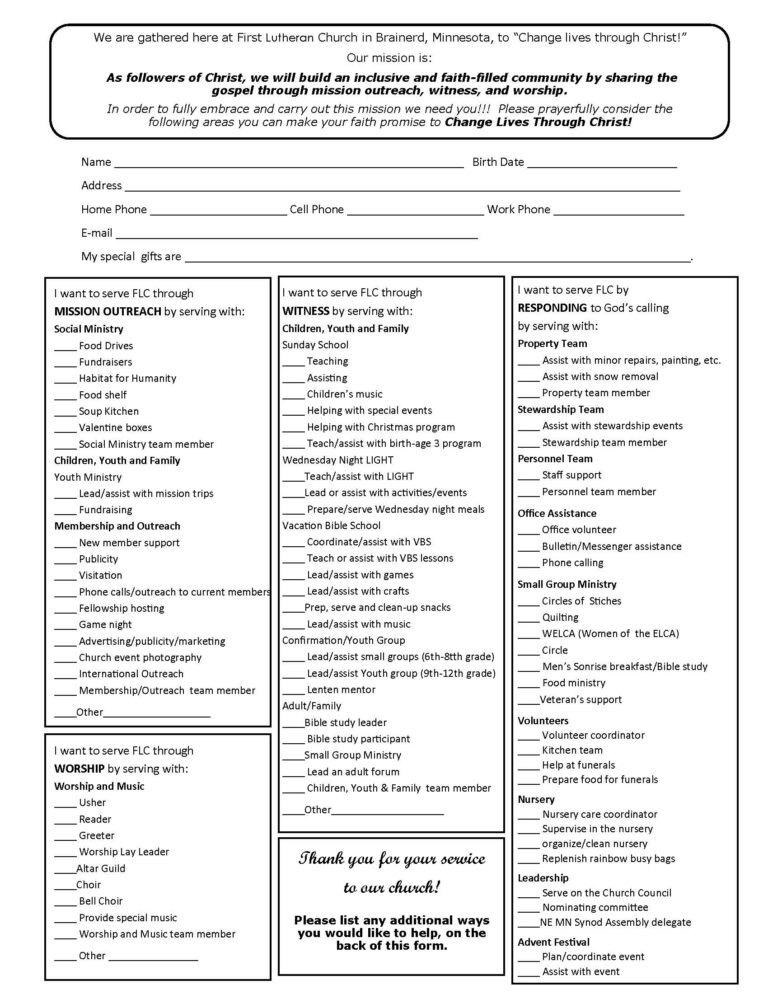

Church Time And Talent Survey Template

There are many benefits to using a church time and talent survey template. First, it can help churches to identify the strengths and weaknesses of their membership. This information can then be used to develop targeted programs and initiatives that will meet the needs of the congregation.

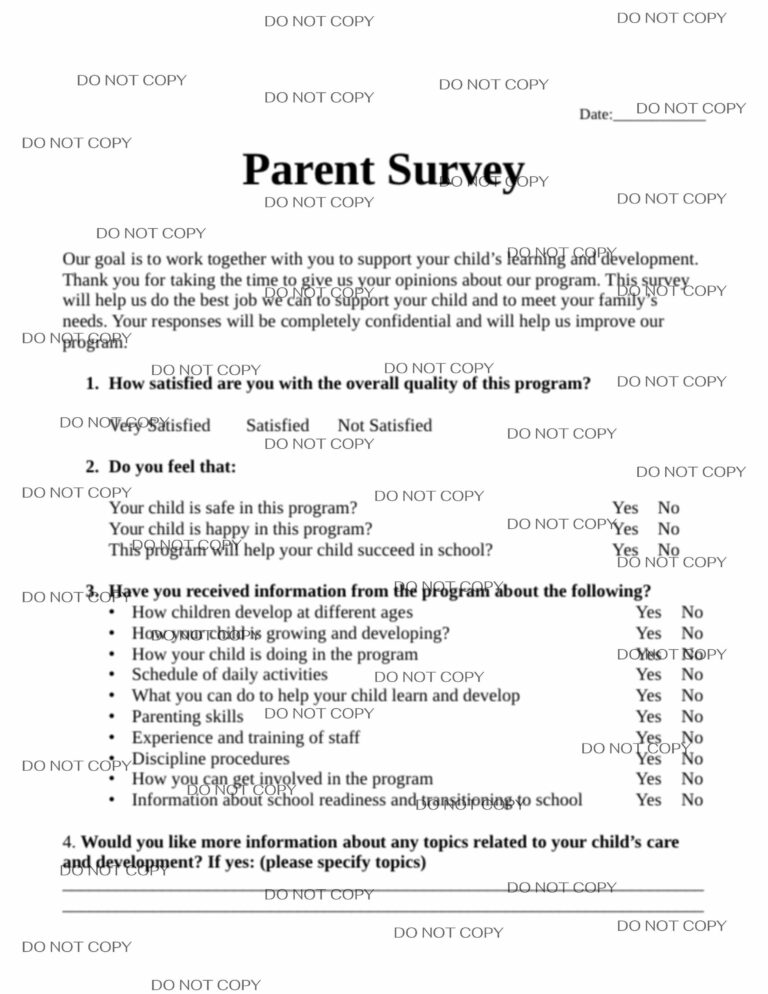

Child Care Parent Survey Template

Child care parent surveys are important because they provide valuable feedback that can help child care providers improve the quality of their services. They can also help parents make informed decisions about which child care program is best for their child.

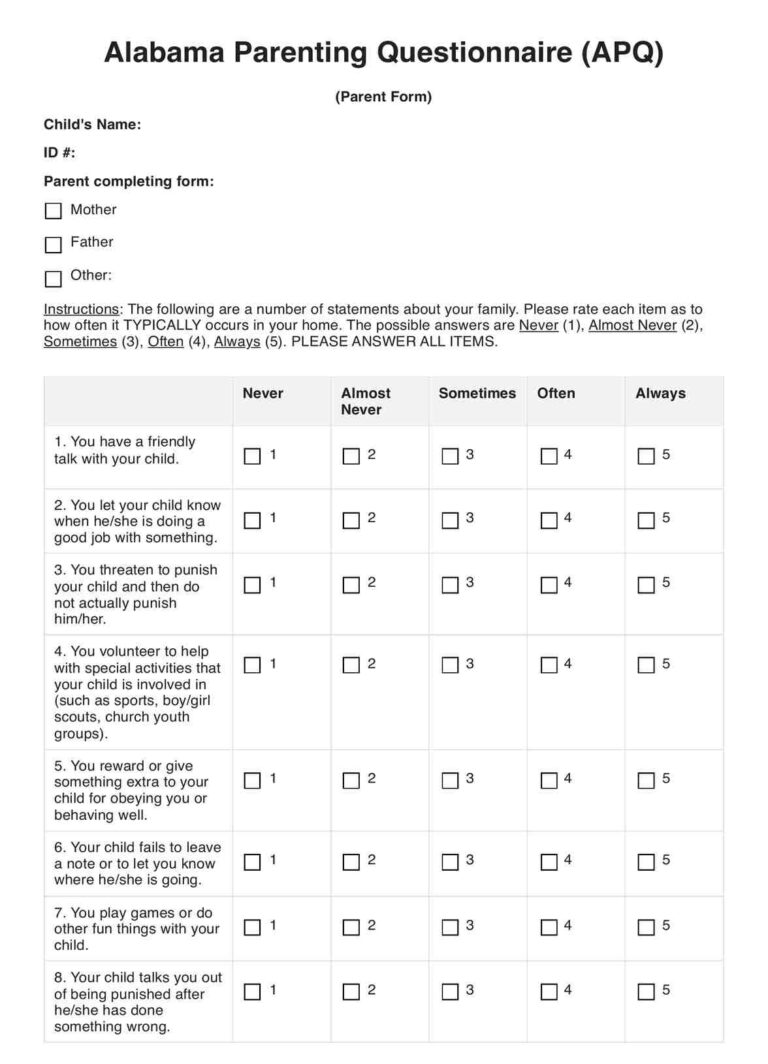

Child Care Needs Survey Questions Template

There are many different types of child care needs survey templates available, but they all typically include questions about the following topics:

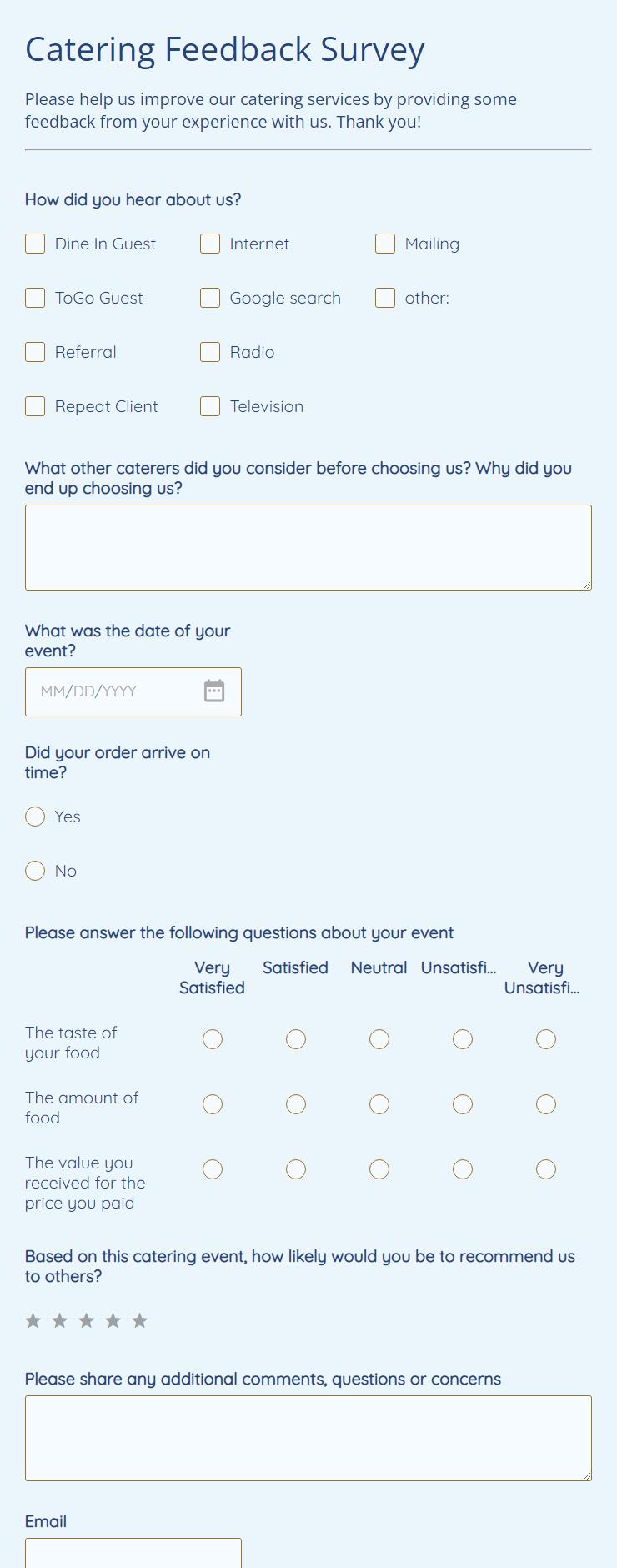

Catering Customer Satisfaction Survey Template

There are many benefits to using a catering customer satisfaction survey template. First, it can help to identify areas where the service can be improved. Second, it can help to build relationships with customers and show that the business values their feedback. Third, it can help to increase customer loyalty and repeat business.

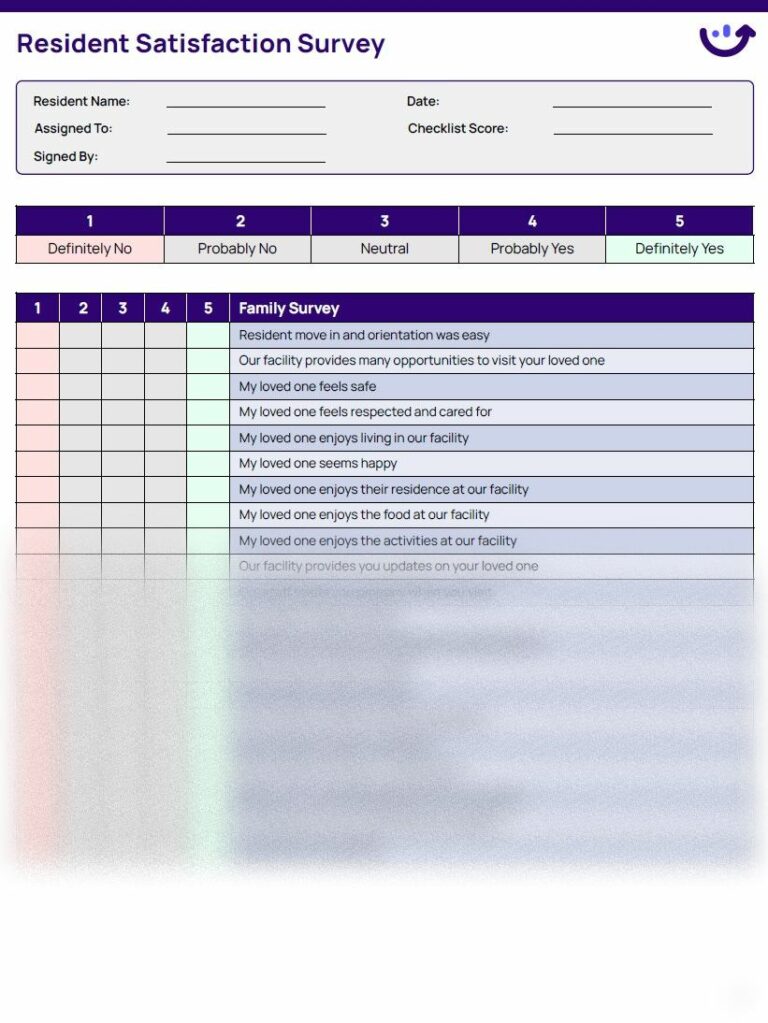

Care Home Resident Satisfaction Survey Template

There are many benefits to using a care home resident satisfaction survey template, including:

Cap Student Feedback Survey Googe Template

Google Forms is a free online tool that can be used to create and administer surveys. It is easy to use and can be customized to meet the specific needs of a class or course.