Navigating your finances can sometimes feel like trying to hit a moving target, especially when your income arrives in a semi-monthly fashion. You get paid twice a month, and while that sounds consistent, it brings its own unique budgeting challenges. That is precisely where a well-designed semi monthly paycheck budget template becomes an invaluable tool, transforming potential financial headaches into a clear, manageable plan. It helps you anticipate income flow, allocate funds, and ensure all your bills are covered without scrambling at the last minute.

Many people find themselves in a cycle where one paycheck barely covers immediate needs, and the next one feels like it vanishes just as quickly. This isn’t a sign of poor spending habits necessarily, but often a lack of a clear system to manage money that arrives on specific, but not always evenly spaced, dates. Without a robust framework, it’s easy for expenses to pile up unexpectedly, leading to stress and missed opportunities for saving or debt repayment.

This guide is designed to help you create that crucial framework. We’ll explore why a specific approach is needed for semi-monthly pay and walk you through the essential components of a template that works. By the end, you’ll have a clearer path to financial stability and peace of mind, allowing you to take control of your money rather than letting it control you.

Understanding Your Semi-Monthly Paycheck Cycle

When your employer pays you semi-monthly, it typically means you receive two paychecks each month, usually on fixed dates such as the 15th and the last day of the month. This differs from bi-weekly pay, which results in 26 paychecks a year (meaning two months out of the year will have three paychecks). With semi-monthly pay, you consistently receive 24 paychecks annually, or exactly two checks per month, every month. While this might seem more straightforward at first glance, it presents a subtle challenge: your income arrives consistently twice a month, but your bills often have varying due dates throughout the month.

The primary pitfall here is the temptation to treat each paycheck as a standalone event, covering whatever expenses are most pressing at that moment. This reactive approach can lead to a feast-or-famine situation, where one paycheck feels robust and the next is quickly depleted by accumulating bills. Without a strategic plan, it’s easy to overspend early in the month only to find yourself short just before the next payday.

To truly master your semi-monthly pay, you need to think beyond individual paychecks and consider the entire monthly cycle. This involves understanding which bills align with which paycheck, and more importantly, how to save for expenses that might fall unevenly between your two payment dates. It requires a proactive allocation strategy that ensures all financial obligations are met, regardless of their due date.

Your budget template needs to reflect this cyclical nature, assigning specific chunks of your income to specific categories of expenses or savings goals. Instead of just listing what you spend, it helps you intentionally decide where every dollar goes before it even hits your bank account. This mental and practical shift is vital for financial control.

It’s not just about covering bills; it’s about optimizing your cash flow. By planning which paycheck covers the rent and which covers the car payment, you eliminate guesswork and reduce financial anxiety. This detailed planning allows you to see the bigger picture, identify potential shortfalls early, and make adjustments before they become problems.

Breaking Down Each Paycheck

A key strategy for semi-monthly budgeting is to assign particular expenses to specific paychecks. For example, your first paycheck of the month might cover your rent or mortgage, utility bills, and a portion of your grocery budget. The second paycheck could then be designated for car payments, insurance, student loans, and the remaining grocery allocation. This method ensures that critical fixed expenses are always accounted for.

Furthermore, consider setting aside a small portion from each check for less frequent but significant expenses, like annual insurance premiums, holiday gifts, or car maintenance. This proactive saving prevents those larger costs from derailing your budget when they inevitably arise, turning potential financial surprises into manageable, planned expenditures.

Crafting Your Personalized Budget Template

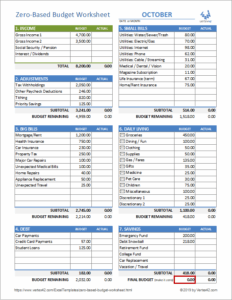

Creating your semi monthly paycheck budget template begins with a clear understanding of your income and all your expenses. Start by listing your net pay for both the first and second paychecks of the month. Be precise with these figures, as they form the foundation of your entire budget. Once you have a firm grasp on your total monthly income, you can move on to outlining your expenditures.

Next, categorize your expenses into fixed and variable costs. Fixed expenses are those that generally stay the same each month, such as your rent or mortgage, loan payments, and insurance premiums. Variable expenses, on the other hand, fluctuate and include categories like groceries, entertainment, dining out, and transportation. Being honest about your variable spending is crucial, as this is often where the most significant adjustments can be made.

Once you have your income and expenses laid out, the real work of allocation begins. Assign each fixed expense to the paycheck it will be paid from. For variable expenses, you might divide the monthly total in half, allocating one portion to the first paycheck and the other to the second. This structured approach ensures that you always have funds earmarked for every bill and spending category.

- Determine Your Income Sources: Accurately note your net pay for each of the two paychecks you receive monthly.

- List All Fixed Expenses: Identify and record all non-negotiable, consistent bills and their due dates.

- Track Variable Spending: Estimate and track your fluctuating expenses like groceries, fuel, and discretionary spending.

- Allocate Funds for Savings and Debt: Prioritize setting aside money for your financial goals, whether it is an emergency fund, a down payment, or paying down high-interest debt.

- Review and Adjust Regularly: Your budget is a living document. Life happens, so check in with your budget weekly or bi-weekly and make necessary tweaks.

Remember that your budget is a tool designed to serve you. It might take a few months of trial and error to get it just right. Don’t be discouraged if your initial attempts aren’t perfect. The key is consistent effort, regular review, and a willingness to adjust your template as your financial situation or spending habits evolve. This iterative process is what makes a budget truly effective and sustainable.

Adopting a detailed semi-monthly budgeting approach empowers you to see exactly where your money is going and to make conscious decisions about your spending. It removes the mystery from your finances, allowing you to save for important goals, pay down debt more efficiently, and navigate unexpected expenses with greater ease. This proactive stance cultivates a stronger sense of financial security and freedom.

By taking the time to set up and consistently use your budget template, you are building a robust foundation for your financial future. This organized approach to managing your semi-monthly paychecks will not only reduce stress but also open up possibilities for achieving your long-term financial aspirations. Start today and experience the positive transformation a well-crafted budget can bring.