Feeling like your money slips through your fingers before you even know where it went It is a common struggle for many of us trying to get a grip on our finances. The idea of budgeting can sometimes feel overwhelming like a strict diet for your wallet but it does not have to be a source of stress.

Instead budgeting can be a powerful tool for achieving financial peace of mind. Especially for those who get paid bi weekly a traditional monthly budget might not always align perfectly with their income flow. That is where a thoughtful semi monthly personal budget template truly shines offering a more natural rhythm to manage your money.

By breaking down your financial planning into two manageable halves you can gain clearer insights into where your money is going and make more informed decisions about your spending. It is about creating a system that works with your life not against it helping you to cover your expenses comfortably and even build towards your savings goals.

Why a Semi Monthly Budget Works Wonders for Your Wallet

Many people receive their paychecks every two weeks which means they often get three paychecks in certain months of the year. While this can feel like a bonus a traditional monthly budget might struggle to accommodate these fluctuations seamlessly. A semi monthly budget however perfectly syncs with this common pay schedule providing a more realistic and actionable framework for your finances.

Imagine knowing exactly how much money you have coming in and what needs to go out during each half of the month. This clarity can prevent that end of the month crunch where you are scrambling to cover bills or wondering why your account balance is lower than expected. It allows for a more granular approach to spending and saving making it easier to stay on track.

The beauty of this method lies in its adaptability. You are not trying to stretch one month’s budget across an uneven income stream. Instead you are continually making smaller adjustments twice a month ensuring that your budget is always current and relevant to your immediate financial situation. This frequent check-in can also help you identify overspending sooner rather than later allowing you to course correct before things get out of hand.

Understanding Your Income and Expenses

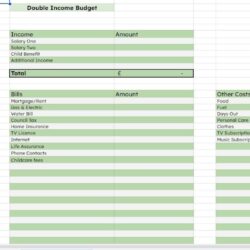

The first step in any effective budget is to have a clear picture of your money. For a semi monthly plan this means understanding your income that arrives in each half of the month. If you are paid bi weekly you will typically have two pay periods to consider for each semi monthly segment. Jot down the exact net amount you receive from each paycheck.

Next comes your expenses. These can be broadly categorized into fixed and variable. Fixed expenses are those that generally stay the same amount each month or semi monthly period while variable expenses fluctuate based on your usage or choices. Accurately listing these out is crucial for seeing where your money is truly allocated.

- Fixed Expenses: These are typically your non negotiable payments that have a set due date and amount. Think about your rent or mortgage car payment insurance premiums loan repayments and subscription services. Assign these to the half of the month when they are due.

- Variable Expenses: This category includes items like groceries dining out entertainment utilities such as electricity and water transportation costs including gas or public transit and personal care items. These are areas where you often have more control and can adjust your spending if needed.

Once you have a thorough list of both your income and expenses for each semi monthly period you can begin to see where your money is going. This visibility empowers you to make conscious decisions about your spending rather than letting your money dictate itself. It is about taking control and aligning your spending with your financial goals whether that is saving for a down payment or simply building an emergency fund.

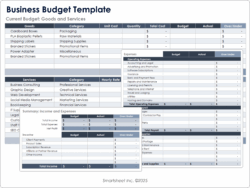

Crafting Your Own Semi Monthly Budget Template

Now that you understand the principles let us talk about putting it into practice. Creating your own semi monthly personal budget template does not require advanced financial degrees. You can use a simple spreadsheet program a dedicated budgeting app or even just a pen and paper. The key is consistency and a willingness to be honest about your spending habits.

The core idea is to allocate your income as it comes in to cover the expenses due in that specific half of the month. This prevents money from being spent on non essential items before crucial bills are paid. It also makes it easier to track your progress and adjust your spending habits in real time rather than waiting until the end of a whole month.

Here is a straightforward approach to setting up your template and making it work for you:

- Step 1 Divide your monthly income into two equal halves or align with your typical two paychecks. This forms the income side of your semi monthly budget.

- Step 2 List all your fixed expenses and assign them to the specific half of the month they are due. For example if your rent is due on the first of the month it goes into your first semi monthly budget.

- Step 3 Allocate funds for variable expenses for each half adjusting as needed. This might involve setting a specific amount for groceries or entertainment for each two week period.

- Step 4 Monitor your spending regularly preferably daily or every few days. Compare your actual spending against your budgeted amounts.

- Step 5 Review and refine your budget at the end of each semi monthly period. What went well Where can you improve Make adjustments for the next period.

Remember your budget is a living document. It is meant to evolve with your life and financial situation. Do not be afraid to make adjustments. The most effective semi monthly personal budget template is one that you actually use and that works for your unique circumstances.

Embracing a semi monthly budgeting approach offers a practical and effective way to gain control over your finances. By breaking your financial planning into smaller more frequent cycles you foster a greater awareness of your spending habits and cultivate a proactive mindset towards your money. This consistent engagement empowers you to not only meet your current obligations but also to build a strong foundation for future financial well being.

Taking the step to organize your budget this way can significantly reduce financial stress and open up possibilities for saving investing or simply enjoying life without the constant worry about money. Start today by creating your own template and discover the freedom that comes with truly understanding and managing your financial flow.