Navigating the complexities of personal finance can often feel like a daunting task. Between managing incoming funds, tracking numerous expenses, and trying to save for future goals, it is easy to get overwhelmed. Many people shy away from budgeting altogether because they envision complicated spreadsheets filled with formulas they do not understand, or restrictive plans that suck all the joy out of spending.

But what if there was a way to gain crystal-clear insight into your money without all the fuss? Imagine a system that empowers you to make informed financial decisions with ease, helping you reach your goals faster. That is precisely where a simple line item budget template comes into play, offering a straightforward path to financial clarity.

This approach simplifies the entire process by breaking down your finances into manageable, understandable categories. It allows you to see exactly where your money is coming from and where it is going, transforming what once felt like a mystery into a transparent, actionable plan. Let us explore how this tool can become an indispensable part of your financial toolkit.

Why a Simple Line Item Budget Template is Your Financial Navigator

A simple line item budget template acts as your personal financial navigator, guiding you through the often-choppy waters of income and expenditure. It strips away the intimidating layers of traditional budgeting, presenting your financial landscape in an intuitive format. The beauty of this method lies in its ability to provide granular detail without sacrificing simplicity, making it accessible to anyone, regardless of their financial literacy level.

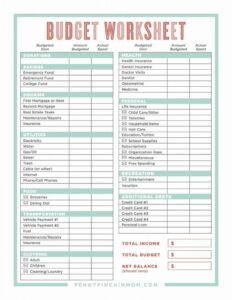

The core principle involves listing out specific categories for both your income and your expenses. Each category is a "line item," giving you a clear picture of every dollar. This detailed yet uncomplicated structure means you are not just seeing a lump sum for "spending" but rather understanding precisely how much went to groceries, utilities, entertainment, and savings, for example. This level of transparency is crucial for identifying areas where you can adjust your spending and allocate funds more effectively towards your aspirations.

One of the biggest advantages is the ease with which you can track your progress. When everything is laid out in distinct lines, you can easily compare your actual spending against your planned budget. This immediate feedback loop is incredibly powerful, allowing you to catch potential overspending early and make timely adjustments before small issues become big problems. It transforms budgeting from a punitive exercise into an empowering one, giving you control rather than feeling controlled by your money.

Understanding the Components of Line Items

To truly harness the power of this template, it helps to understand what kind of information populates each line. Generally, you will have two main sections: income and expenses. Within expenses, it is often helpful to further categorize them into fixed (consistent costs) and variable (fluctuating costs).

- Income Sources:

- Salary or wages from your primary job

- Freelance income or side hustle earnings

- Investment dividends or interest

- Rental income

- Fixed Expenses:

- Rent or mortgage payments

- Loan repayments (car, student, personal)

- Insurance premiums (health, auto, home)

- Subscription services (streaming, gym memberships)

- Variable Expenses:

- Groceries and dining out

- Utilities (electricity, gas, water)

- Transportation (fuel, public transport)

- Personal care and entertainment

- Clothing and household items

This breakdown enables you to spot trends, understand your spending habits, and make conscious decisions about where you want your money to go. It is not about deprivation, but about intentional allocation.

Moreover, by having this clear overview, you can more easily set realistic financial goals, whether that is saving for a down payment, paying off debt, or simply building an emergency fund. The clarity a simple line item budget template provides reduces financial anxiety and replaces it with a sense of calm and competence, knowing you have a firm grasp on your economic reality.

Embarking on Your Budgeting Journey

Getting started with your own simple line item budget template is much simpler than you might think. You do not need fancy software or a finance degree; a basic spreadsheet application, a free online template, or even just a pen and paper can serve as your starting point. The most important step is simply to begin, gathering your financial information and populating your chosen template with your real numbers.

Start by listing all your sources of income for a given month. Be thorough, accounting for every dollar that comes in. Then, move on to your expenses. It is often easiest to tackle the fixed expenses first, as these are typically the same amount each month and are easily identifiable from your bills and statements. Once those are recorded, you can then focus on the variable expenses, which might require a bit more tracking initially to get an accurate average.

The true power of this template comes from its regular use and review. Your financial life is not static, and neither should your budget be. Make it a habit to review your budget at least once a month, comparing your actual spending to your planned spending. This review process allows you to celebrate successes, identify areas for improvement, and adjust your budget to reflect changes in your income, expenses, or financial goals.

- Gather all income statements and bank statements for the past month or two.

- Create clear categories for all your income and expenses.

- Populate your template with realistic figures, aiming for accuracy over perfection.

- Track your spending diligently throughout the month.

- Set a specific time each month to review and adjust your budget.

- Do not be afraid to make changes as your financial situation evolves.

Taking control of your finances does not have to be an intimidating ordeal. By embracing a simple line item budget template, you unlock the clarity needed to make smarter money choices every day. This straightforward yet powerful tool puts you firmly in the driver’s seat, allowing you to steer towards a future of financial stability and prosperity.

Embracing this methodical approach empowers you to allocate your resources with intention, ensuring that your hard-earned money aligns with your deepest values and most ambitious goals. It transforms abstract financial dreams into concrete, achievable steps, bringing you closer to the peace of mind that comes with true financial understanding.