Navigating the financial landscape with just one income stream can feel like a constant juggle, but it is absolutely achievable to not only manage but thrive. Many families across the globe rely on a single income, and the key to their success often lies in meticulous planning and a clear understanding of where every dollar goes. This is precisely where a well-structured single income family budget template becomes an invaluable tool, transforming potential stress into empowering clarity and control.

It is completely understandable to feel overwhelmed when you are the sole earner or managing household finances on a single paycheck. Concerns about unexpected expenses, saving for the future, or simply covering daily needs can loom large. Without a clear roadmap, it is easy for money to slip through the cracks, leaving you wondering why your hard-earned cash seems to disappear faster than you can earn it.

But imagine having a clear picture of your financial situation, knowing exactly how much you have coming in and where it needs to go. A budget is not about deprivation; it is about intentionality. It is about making your money work smarter for your family’s unique needs and aspirations, ensuring peace of mind and building a secure foundation for tomorrow.

Crafting Your Single Income Family Budget Template: A Step-by-Step Guide

Building a budget when you are a single-income family is a powerful act of financial empowerment. It is your personal financial GPS, guiding you toward your goals and helping you avoid common pitfalls. The process might seem daunting at first, but by breaking it down into manageable steps, you will quickly gain confidence and control. The first step is always to gather your financial statements, bank records, and any bills from the last few months. This raw data will be the foundation of your family’s financial blueprint.

Step 1: Track Your Income The Solo Stream

Your income is the lifeblood of your budget, and when you are operating on a single income, it is even more crucial to have a precise figure. This might seem obvious, but be sure to account for your net income, which is the amount you actually receive after taxes, deductions, and benefits are taken out. If there are any irregular income sources, like a quarterly bonus or a side hustle that sometimes brings in extra cash, it is often best to budget based on your consistent, lowest monthly net income and treat any additional funds as a bonus for savings or specific goals.

Step 2: Uncover Your Expenses Where Does It All Go

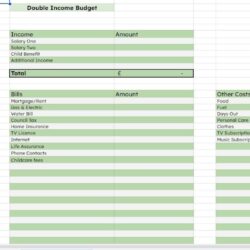

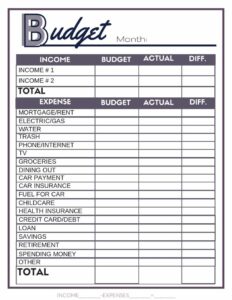

This is often the most revealing part of the budgeting process. Start by listing every single expense your family incurs over a month. These expenses generally fall into two categories: fixed and variable. Fixed expenses are those that stay roughly the same each month, such as rent or mortgage payments, loan repayments, insurance premiums, and subscription services. Variable expenses fluctuate, including groceries, utilities, transportation costs, dining out, and entertainment. Be honest and thorough; no expense is too small to record.

Step 3: Categorize and Conquer

Once you have your list of expenses, group them into logical categories. Common categories include housing, transportation, food, utilities, debt payments, personal care, childcare, medical expenses, savings, and discretionary spending. Having clear categories makes it easier to see where your money is truly going and identify areas where you might be able to make adjustments. This categorization is a critical component of any effective single income family budget template.

Step 4: Allocate and Adjust

Now that you know your income and your expenses, it is time to assign a portion of your income to each category. A popular method is the 50/30/20 rule, where 50 percent of your income goes to needs, 30 percent to wants, and 20 percent to savings and debt repayment. However, feel free to adapt this to fit your family’s unique situation. The goal is for your total allocated expenses plus savings to not exceed your net income. If it does, this is where the tough but necessary decisions come into play. Look for areas to cut back on wants first, then review needs for potential savings, like refinancing or negotiating bills.

Step 5: Regular Review and Refine

A budget is not a set-it-and-forget-it document; it is a living tool that needs regular attention. Life happens, and your financial situation will evolve. Make it a habit to review your budget at least once a month, comparing your actual spending to your budgeted amounts. Are you overspending in certain categories? Can you reallocate funds to better serve your goals? This continuous review cycle ensures your budget remains relevant and effective, adapting as your family’s needs and circumstances change.

Beyond the Numbers: Making Your Single Income Budget Work for You

Once you have your budget template set up, the real magic begins with how you actively use and optimize it. A single income budget is not just about tracking; it is about strategic decision-making that supports your family’s security and future aspirations. It is about transforming data into actionable plans that ease financial pressure and create opportunities for growth.

One of the most crucial elements to prioritize within a single-income framework is building a robust emergency fund. When there is only one income stream, an unexpected job loss, illness, or major household repair can have a more significant impact. Aim to save at least three to six months’ worth of essential living expenses in an easily accessible, separate savings account. This fund acts as a crucial safety net, providing peace of mind and stability during uncertain times.

Another powerful strategy is to focus on debt reduction, especially high-interest debt. Interest payments can quickly eat into a single income, diverting funds that could otherwise go towards savings or immediate needs. Prioritize paying down credit cards or personal loans using methods like the debt snowball or avalanche. As debt decreases, more of your income becomes available, giving your budget more breathing room and accelerating your journey toward financial freedom.

To truly make your single income budget work wonders, look for creative ways to maximize your resources without feeling deprived. Small adjustments can add up significantly.

- Automate Savings: Set up automatic transfers from your checking to your savings account each payday.

- Meal Plan: Plan your meals for the week to reduce food waste and impulsive takeout orders.

- Negotiate Bills: Regularly call providers for internet, cable, or insurance to see if you can get a better rate.

- Seek Free Entertainment: Explore local parks, libraries, and free community events for family fun.

- Review Subscriptions: Cancel any unused streaming services, gym memberships, or apps.

Embracing the structure of a single income family budget template is a proactive step towards greater financial stability and peace of mind. It empowers you to make informed decisions, prioritize what truly matters, and allocate your precious resources thoughtfully. By consistently tracking your income and expenses, setting clear goals, and making regular adjustments, you are not just managing money; you are actively building a more secure and prosperous future for your entire family. Keep refining your approach, celebrating small victories, and stay committed to your financial well-being. The effort you put in today will undoubtedly pave the way for a more confident and resilient tomorrow.