Navigating the world as a single individual offers immense freedom, but it also comes with the full weight of financial responsibility resting solely on your shoulders. Crafting a robust financial plan is not just smart, it’s essential for peace of mind and achieving your personal goals. This is where a well-designed single woman single person monthly budget template becomes an invaluable asset, providing a clear roadmap for managing your income and expenses. It’s about empowering yourself to make informed financial decisions, ensuring you’re in control of your money, not the other way around.

Without a partner to share expenses or pool resources, every financial decision, from groceries to rent, falls entirely to you. While this can feel daunting at times, it also presents a unique opportunity for complete financial autonomy. You get to decide exactly where your money goes, aligning your spending with your personal values and aspirations without compromise.

This article will guide you through the process of building a budget that truly serves you, a framework that is flexible, realistic, and ultimately liberating. By understanding your income and outflow, you can move from simply managing your money to actively directing it towards the life you want to build.

Crafting Your Personalized Single Budget

Creating a budget might sound like a restrictive chore, but think of it instead as designing your financial future. For single individuals, this process is particularly empowering because every dollar managed is a step towards greater independence. Your budget should be a reflection of your unique life, your goals, and your spending habits, not a one-size-fits-all solution. It begins with a clear understanding of your income and a frank assessment of your expenses.

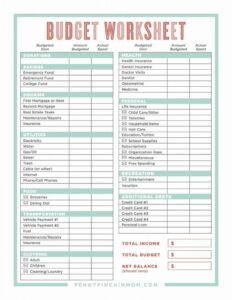

First, pin down your total monthly income. This includes your net pay after taxes, any freelance earnings, passive income, or other regular deposits. Be precise, as this figure forms the foundation of your entire budget. If your income varies month to month, consider using an average of the last few months or budgeting based on your lowest expected income to be safe.

Next, itemize your fixed expenses. These are the costs that generally remain the same each month and are often contractual. Think rent or mortgage payments, utility bills (though some fluctuate slightly, consider them mostly fixed), car loan payments, insurance premiums, student loan payments, and subscription services. These are the non-negotiables that need to be accounted for first and foremost.

Tracking Those Tricky Variable Costs

Then come the variable expenses, which are often the trickiest part of any budget, especially for a single person. These costs fluctuate monthly and can easily spiral if not monitored. Categories here include groceries, dining out, entertainment, transportation (gas, public transport), personal care items, clothing, and gifts. It’s easy to underestimate how much is spent in these areas, so diligent tracking is crucial. Many people find it helpful to assign an initial estimated amount to each variable category and then adjust it as they track their actual spending throughout the month. This iterative process helps refine your budget to be more accurate and sustainable.

Finally, and perhaps most importantly, allocate funds for savings and debt repayment beyond minimums. As a single person, building an emergency fund is paramount, as you are your only safety net. Whether you’re saving for a down payment, a vacation, retirement, or aggressively paying down high-interest debt, make these allocations non-negotiable parts of your budget. Think of savings as paying your future self first.

Beyond the Numbers: Making Your Budget Work for You

A budget isn’t a static document you create once and forget; it’s a living tool that needs regular attention to truly be effective. Life circumstances change, unexpected expenses arise, and your financial goals might evolve. It’s a good practice to review your budget at least once a month, perhaps at the end of each billing cycle, to see how well you adhered to your plan and where adjustments might be necessary. Don’t be afraid to tweak categories, reallocate funds, or even completely overhaul parts of your budget if it’s no longer serving you.

To ensure your budget isn’t just a list of numbers but a practical guide for your daily life, consider incorporating a few key strategies. These tips can help you stick to your plan without feeling overly restricted, allowing you to enjoy your single life while maintaining financial health.

- Automate your savings and bill payments: Set up automatic transfers to your savings accounts and for your recurring bills. This "set it and forget it" approach ensures you’re consistently saving and never miss a due date.

- Distinguish between needs and wants: Before every purchase, pause and ask yourself if it’s truly a necessity or a desire. This simple mental check can significantly curb impulse spending.

- Find affordable social activities: Being single often means a vibrant social life. Seek out free or low-cost activities like picnics in the park, hiking, library events, or potluck dinners with friends to keep entertainment costs down.

- Plan your meals: Meal planning and cooking at home can drastically reduce your grocery bill and the temptation to eat out frequently.

- Regularly track your spending: Whether you use a budgeting app, a spreadsheet, or a pen and paper, consistently tracking where your money goes is the most effective way to stay accountable and identify areas for improvement.

Ultimately, a single woman single person monthly budget template isn’t just about cutting costs; it’s about gaining clarity, confidence, and control over your financial destiny. It provides the structure you need to make intentional choices, enabling you to build a secure and fulfilling future on your own terms.

Taking charge of your finances as a single individual is one of the most empowering steps you can take. It instills a deep sense of security and opens up possibilities you might not have considered before, from pursuing passion projects to taking dream vacations. This journey of financial self-mastery is deeply rewarding, granting you the freedom to live life on your own terms.

Remember, building a strong financial foundation takes time and consistent effort. There will be months where you hit your budget perfectly, and others where you might go a little off track. The key is perseverance, learning from each experience, and continuously refining your approach. Embrace the process, celebrate your successes, and view any missteps as valuable learning opportunities on your path to financial well-being.