Utilizing such a structured approach offers several advantages. It reduces the likelihood of errors or omissions that might otherwise hinder the request. Furthermore, it promotes efficiency by ensuring the financial institution receives a complete and unambiguous request. This can expedite processing time and facilitate a quicker response. Standardized formats also benefit financial institutions by simplifying their workflow and enabling them to handle requests more effectively.

bank

Bank Loan Request Template

Utilizing such a structure offers several advantages. It increases the likelihood of a successful application by ensuring all necessary information is included and presented clearly. It saves time and effort by eliminating the need to create a request from scratch. Furthermore, a standardized format helps borrowers articulate their financial needs effectively and professionally.

Bank Confirmation Audit Request Template

Utilizing a structured format provides several advantages. It streamlines the information-gathering process, reduces the potential for misunderstandings between the auditor and the financial institution, and facilitates efficient verification of key financial data. This, in turn, contributes to a more robust and reliable audit, enhancing the credibility of the financial statements.

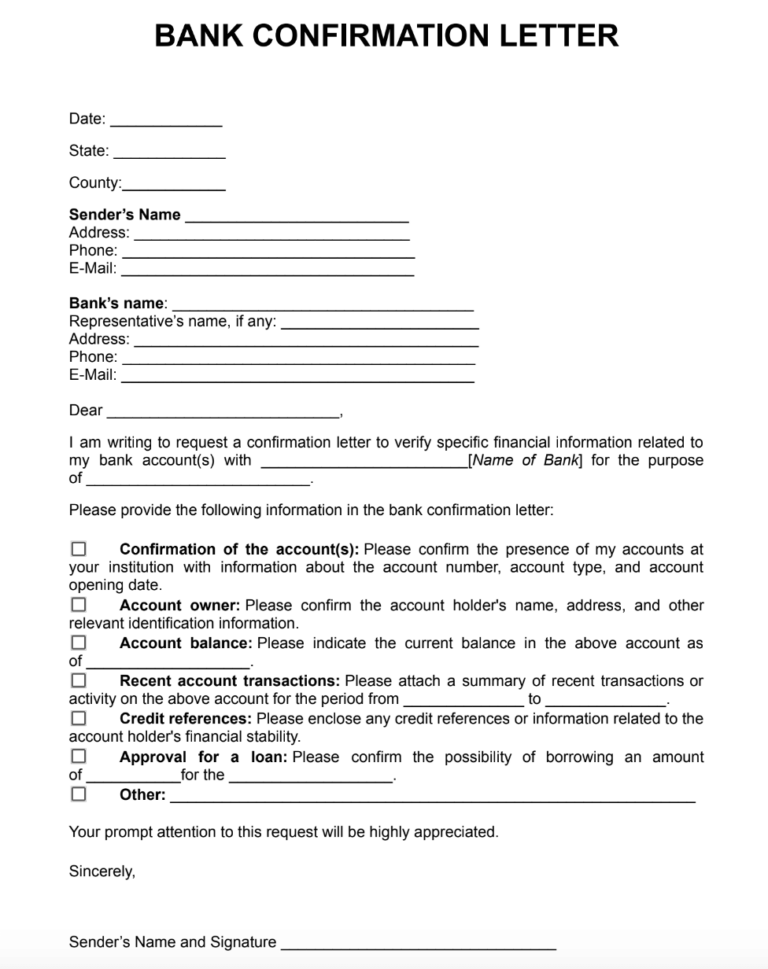

Bank Confirmation Audit Request General Template

Utilizing a standardized form streamlines the audit process, reduces the risk of miscommunication, and improves the reliability of audit evidence. Direct communication with financial institutions provides independent verification, enhancing the auditor’s ability to detect fraud and misstatements. This process ultimately contributes to a higher quality audit and greater confidence in the financial information presented.

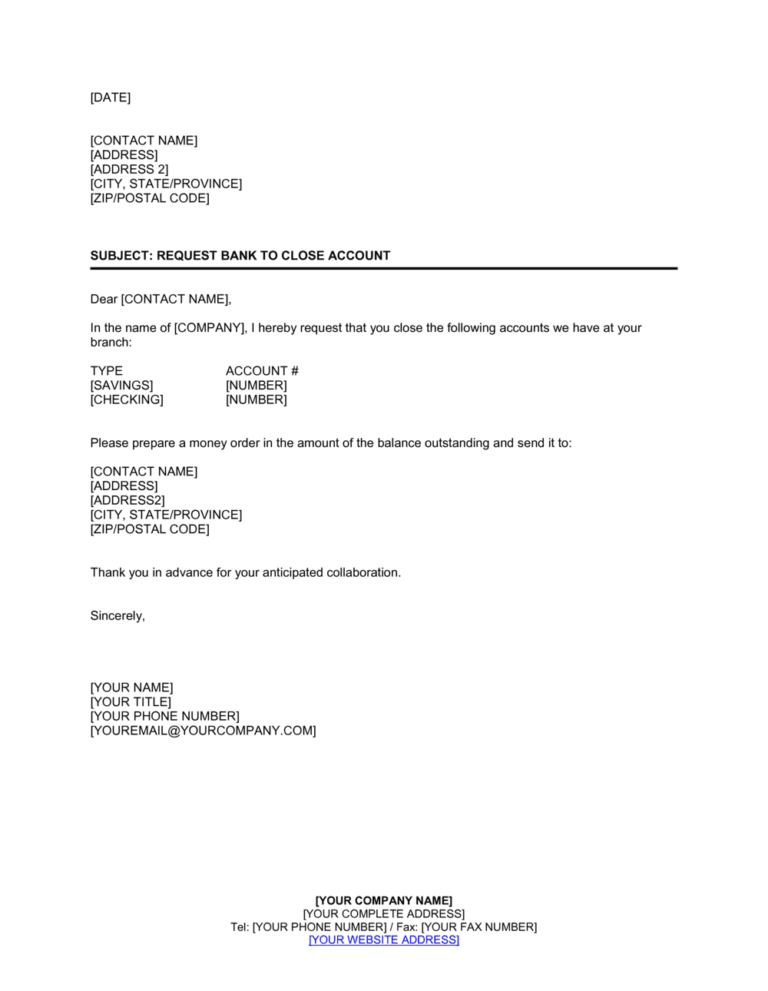

Request To Close Bank Account Template

Leveraging a standardized form offers several advantages. It ensures all necessary information is provided, reducing back-and-forth communication with the financial institution. This simplified process saves time for both the account holder and the bank. Furthermore, a formal request helps maintain a clear record of the closure, protecting both parties involved. It can also facilitate a smoother transition, especially when transferring remaining balances to other accounts.

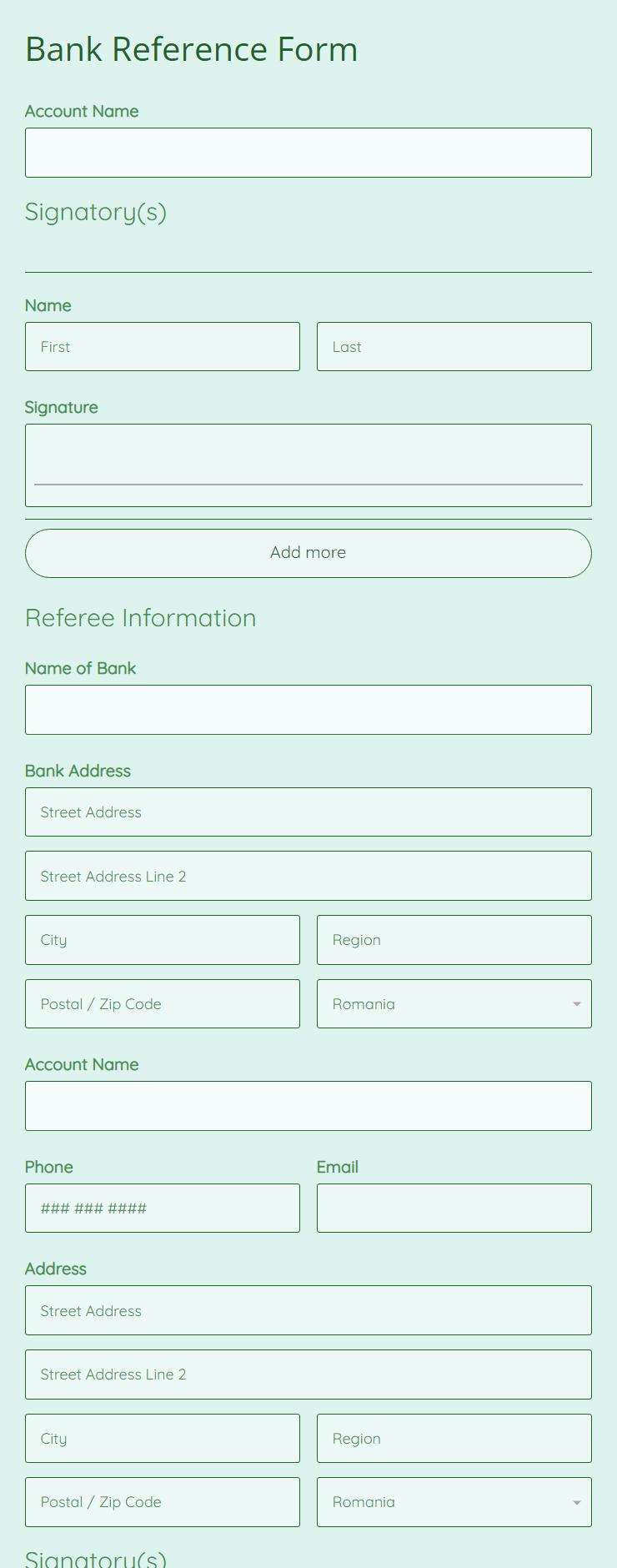

Bank Reference Request Template

Utilizing such a form offers several advantages. It reduces the risk of overlooking critical information, ensures compliance with data privacy regulations, and expedites the processing time for these often time-sensitive requests. This efficiency benefits both the individual or business seeking financial verification and the financial institution providing it. Furthermore, standardized requests improve accuracy and clarity, minimizing potential misunderstandings and facilitating smoother transactions.

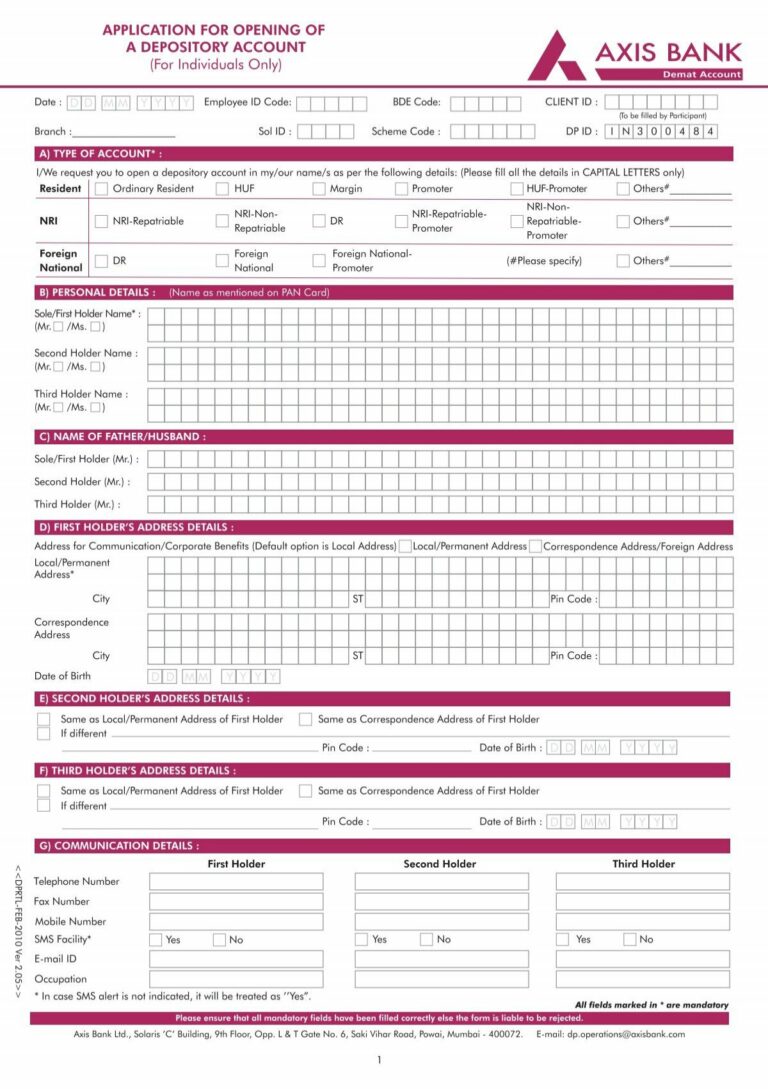

Closure Request For Demata Ccount Axis Bank Template

Accessing a pre-designed form simplifies the closure process, reducing the time and effort required. It ensures a clear and structured communication with the bank, minimizing the risk of errors or omissions that could delay the account closure. Furthermore, it provides individuals with a clear understanding of the necessary steps involved. This can be particularly helpful for those unfamiliar with the formalities associated with financial account closures.

Authorization Letter To Bank Template

There are many benefits to using an authorization letter to the bank. First, it can save you time and hassle. Rather than having to go to the bank in person to complete a transaction, you can simply give your authorized representative the letter and they can handle it for you. Second, it can give you peace of mind knowing that someone you trust is handling your financial affairs. Third, it can help to protect you from fraud and identity theft. By only authorizing trusted individuals to access your accounts, you can reduce the risk of someone unauthorized gaining access to your money.

Bank Letter Of Authorization Template

There are many benefits to using a bank letter of authorization template. First, it can save you time and hassle. Instead of having to go to the bank in person or call customer service, you can simply fill out a template and give it to the person you want to authorize. Second, it can help to protect your account from unauthorized access. By only authorizing specific individuals to access your account, you can reduce the risk of your money being stolen or misused.

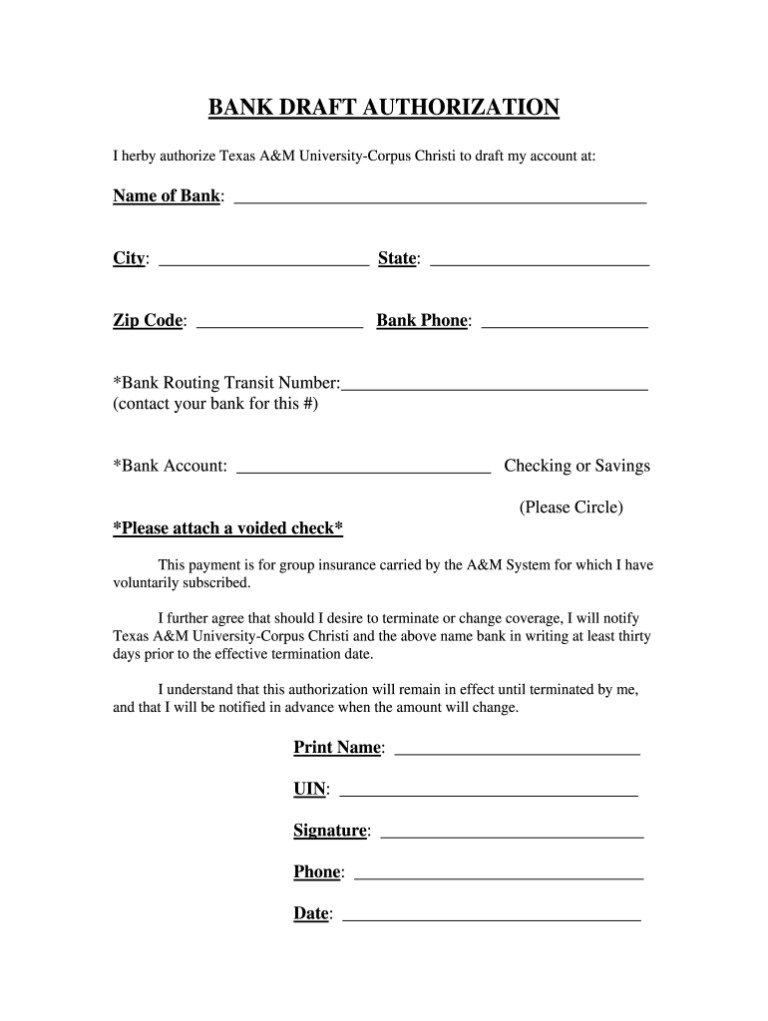

Bank Draft Authorization Form Template

Bank draft authorization forms help ensure that the transfer of funds is carried out securely and accurately. The form typically includes details such as the amount to be transferred, the recipient’s information, the sender’s information, and the sender’s authorization for the bank to proceed with the transfer. Bank draft authorization forms also serve as a record of the transaction, providing a clear and auditable trail of the transfer.