Utilizing such a form offers several advantages. It streamlines the approval workflow, minimizing delays and ensuring that acquisitions align with budgetary constraints and strategic objectives. Furthermore, a standardized approach promotes thorough consideration of all relevant factors, leading to more informed purchasing decisions and better resource allocation. A clear audit trail is also established, simplifying tracking and reporting.

capital

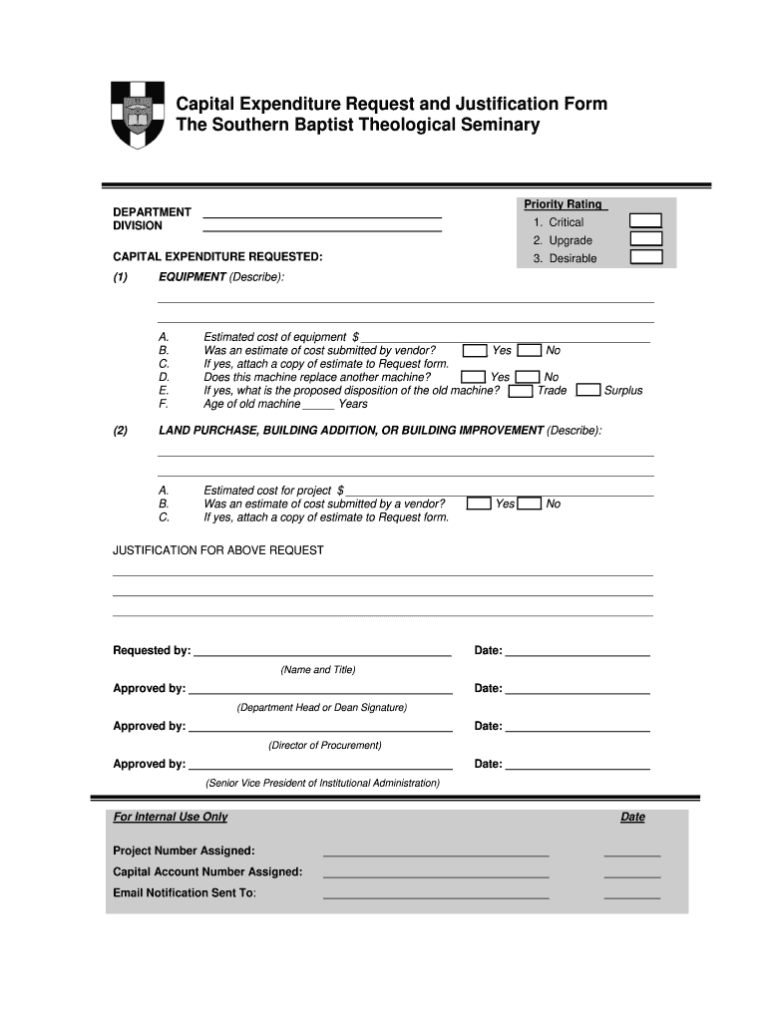

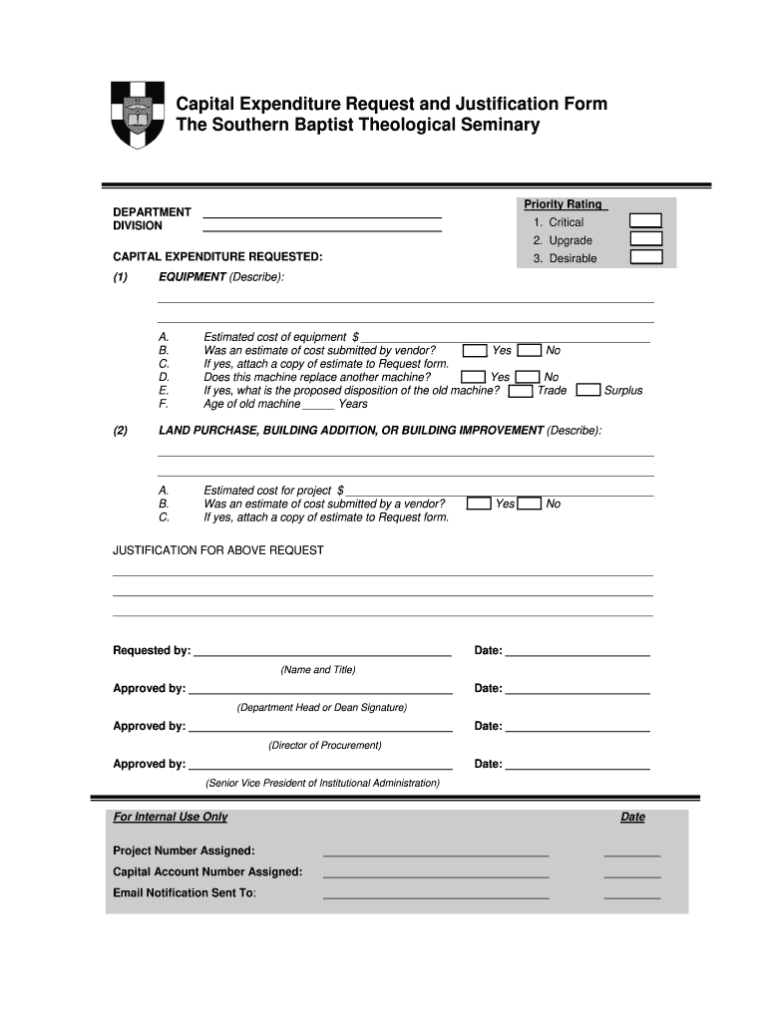

Capital Expense Request Template

Utilizing a formal, consistent structure streamlines the approval process for substantial purchases. It promotes transparency and accountability by providing decision-makers with the necessary information to evaluate the request effectively. This standardized approach can also simplify budgeting and forecasting by providing a clear record of anticipated capital expenditures. Ultimately, it contributes to more informed and strategic resource allocation.

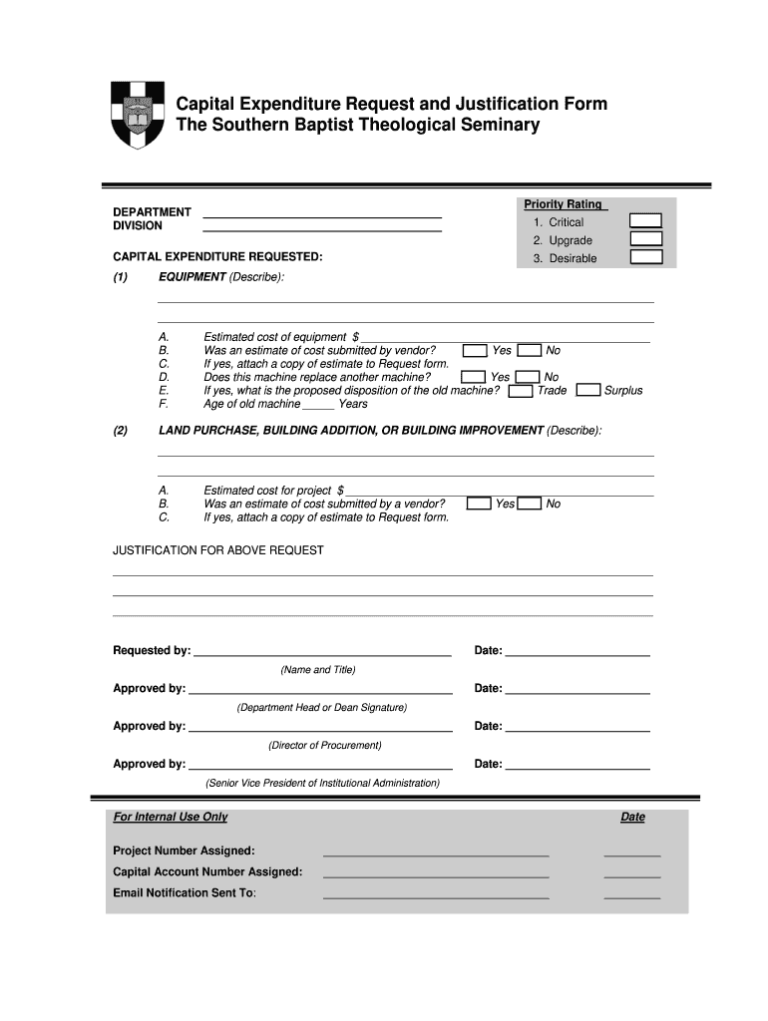

Capital Expenditure Request Template

Structured requests offer numerous advantages. They streamline the approval process, promote transparency, and encourage thoughtful planning of resource allocation. By standardizing the information gathered, these forms improve decision-making and reduce the likelihood of costly oversights. They contribute to better budget control and facilitate more effective tracking of investment performance over time.

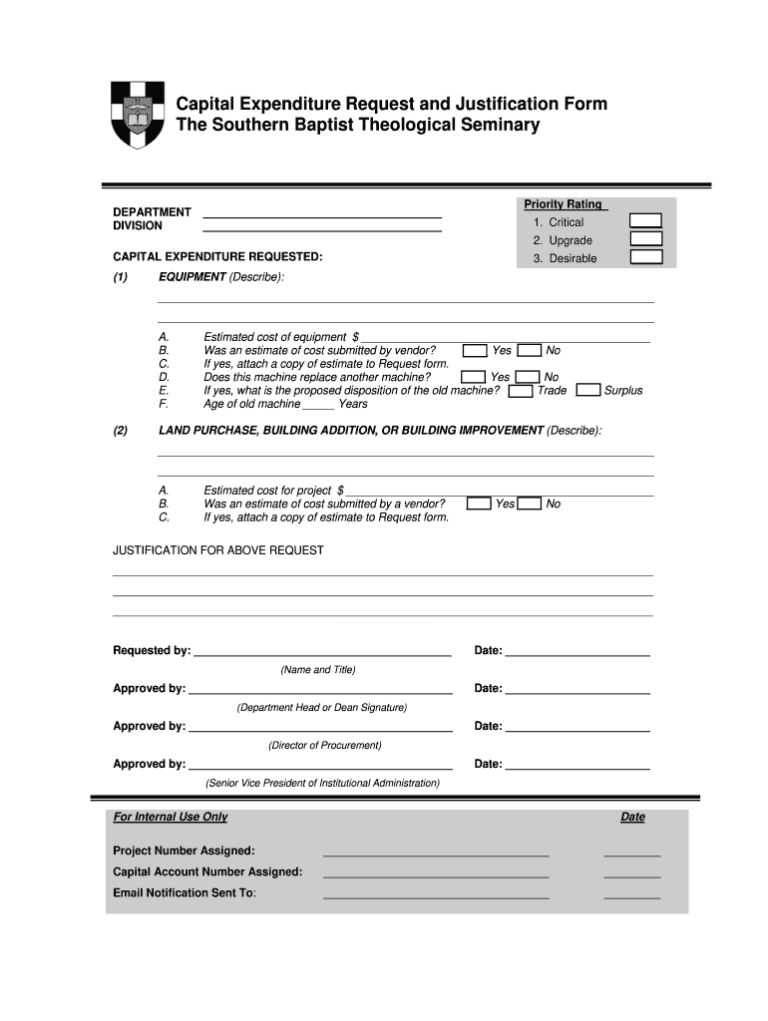

Capital Budget Request Template

Utilizing a standardized form offers several advantages. It ensures consistency and completeness in proposals, facilitating efficient review and comparison across competing requests. A well-designed form also promotes transparency by clearly outlining the financial implications of each proposed investment. This contributes to informed decision-making and better allocation of resources. Finally, it streamlines the approval process, reducing delays and ensuring timely acquisition of necessary assets.

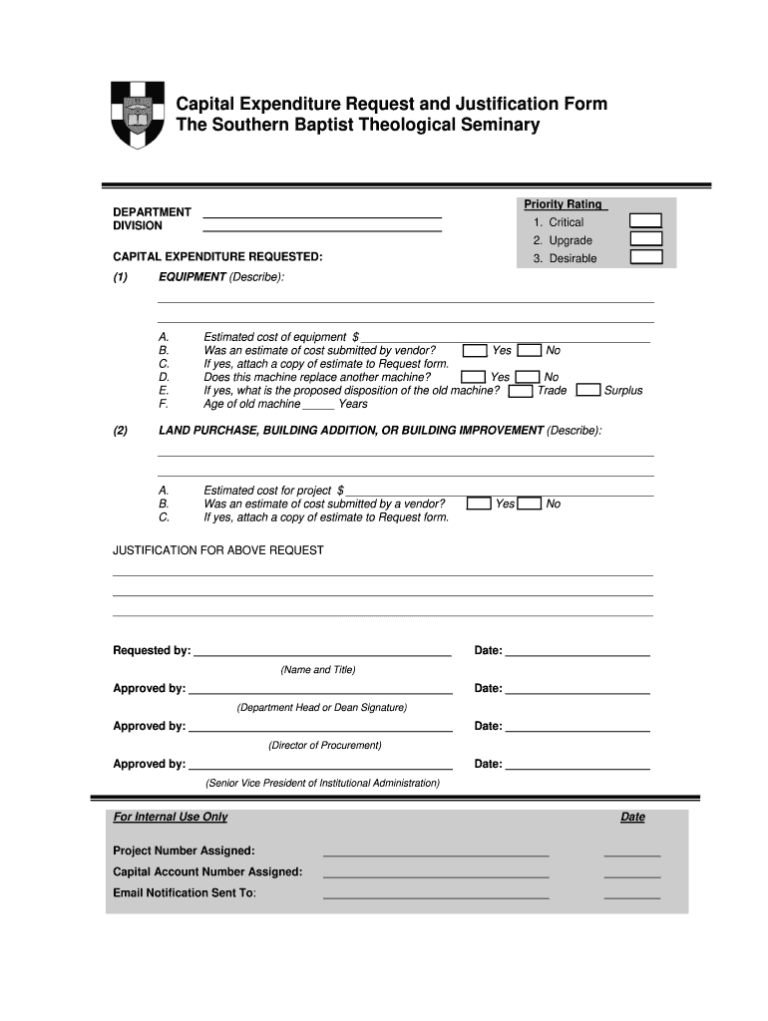

Capital Appropriation Request Template

Utilizing such a framework offers several key advantages. It promotes transparency and accountability by documenting the rationale, costs, and expected benefits of major investments. This structured approach streamlines the approval process, reducing delays and ensuring efficient allocation of resources. Furthermore, it allows for standardized reporting and analysis of capital expenditures, enabling organizations to track performance and optimize investment strategies. A well-defined process also helps mitigate risks by requiring thorough evaluation and justification before committing substantial funds.