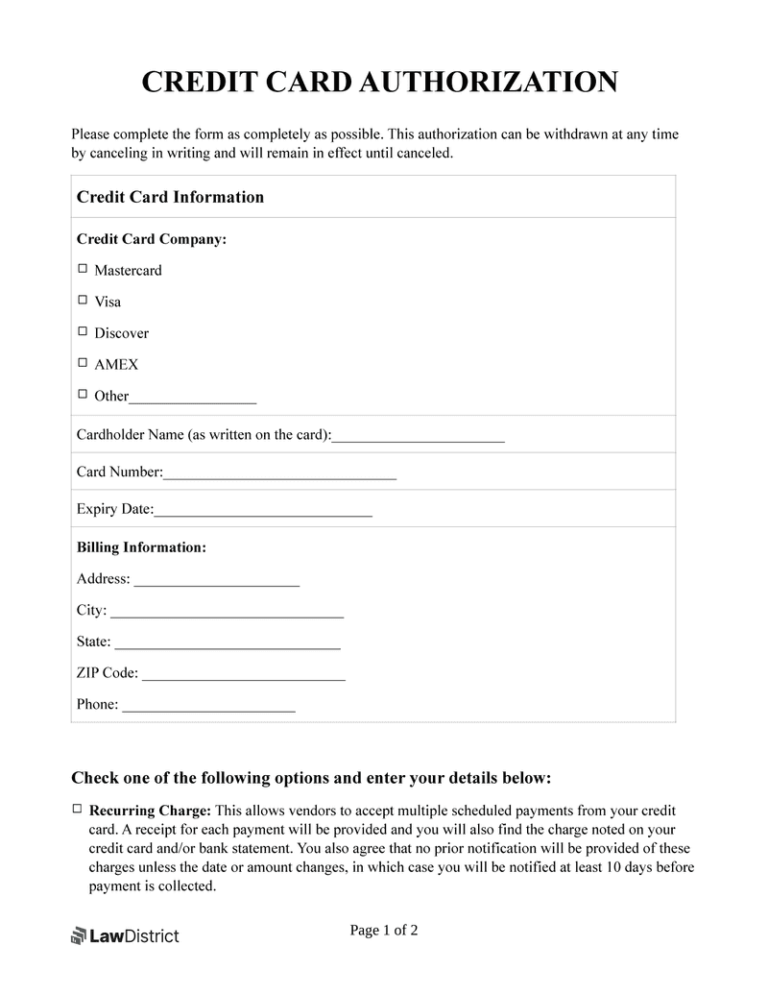

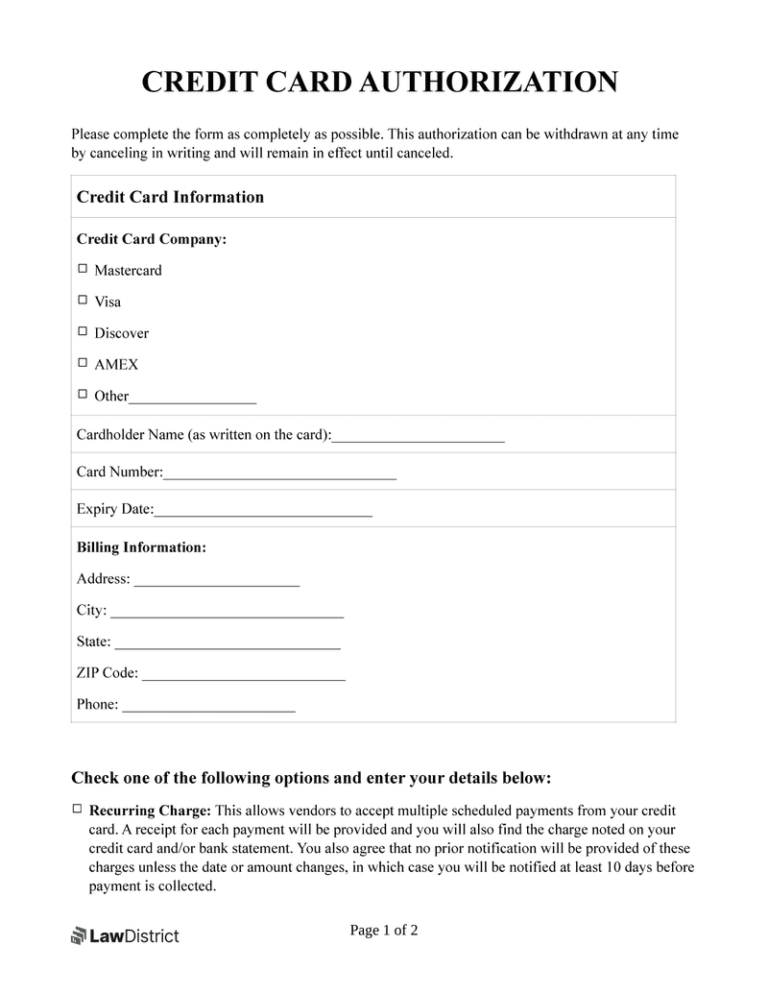

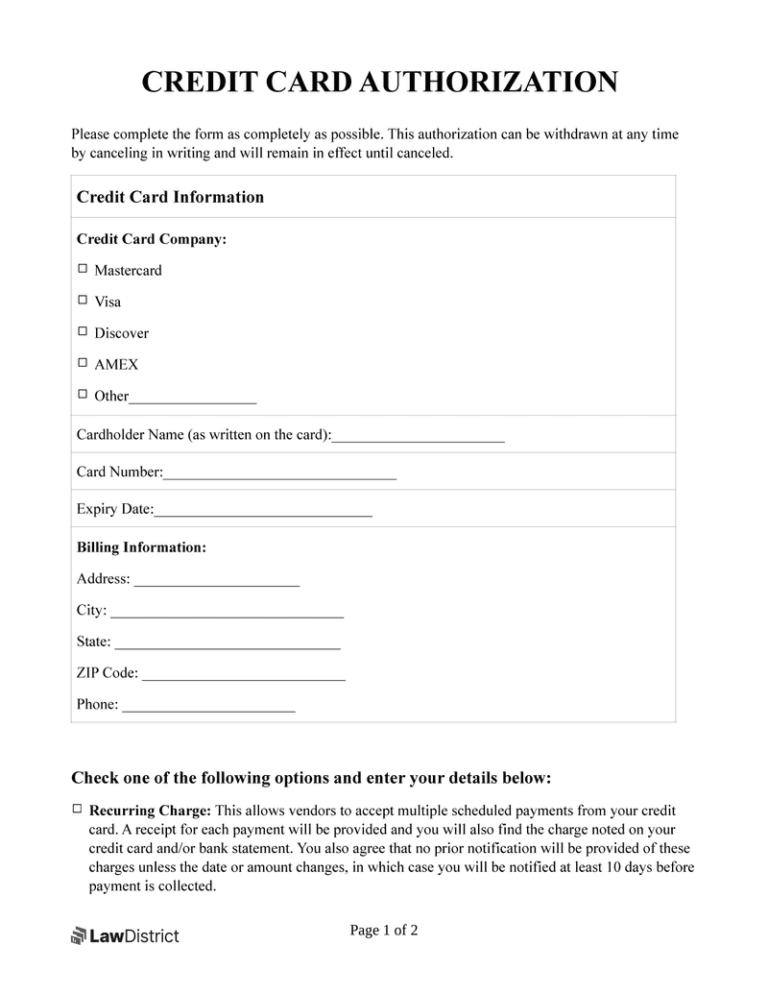

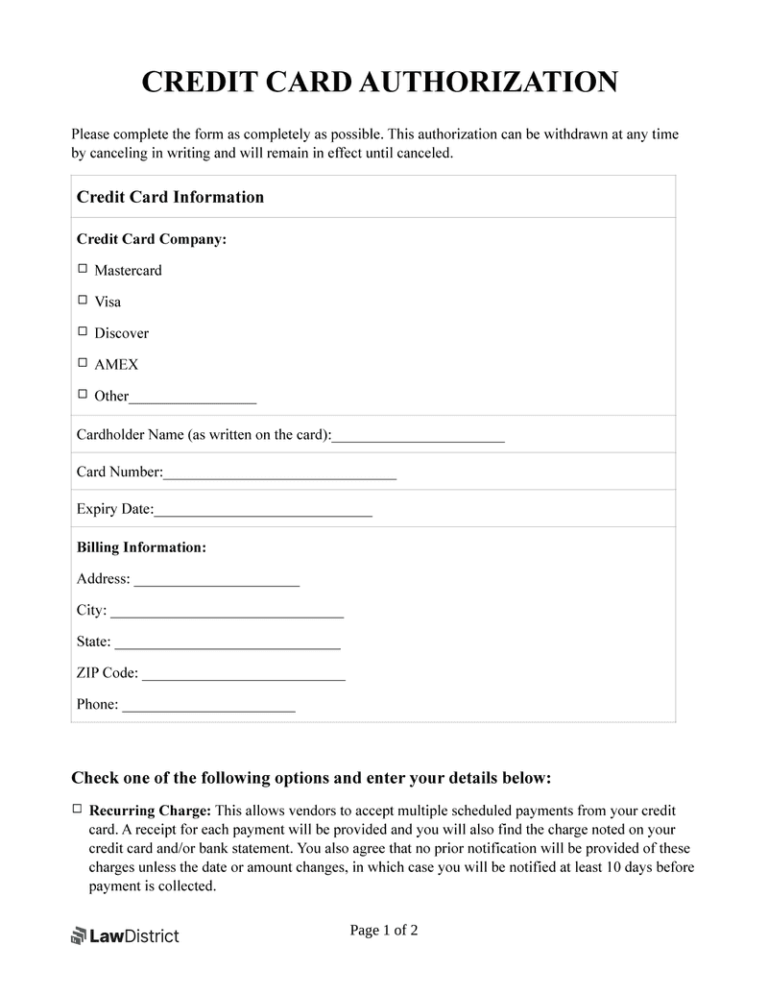

Using a free credit authorization form template can save businesses time and money. By providing a pre-formatted document, businesses can avoid the need to create their own forms from scratch. This can be especially helpful for small businesses that do not have the resources to invest in custom form design.

credit

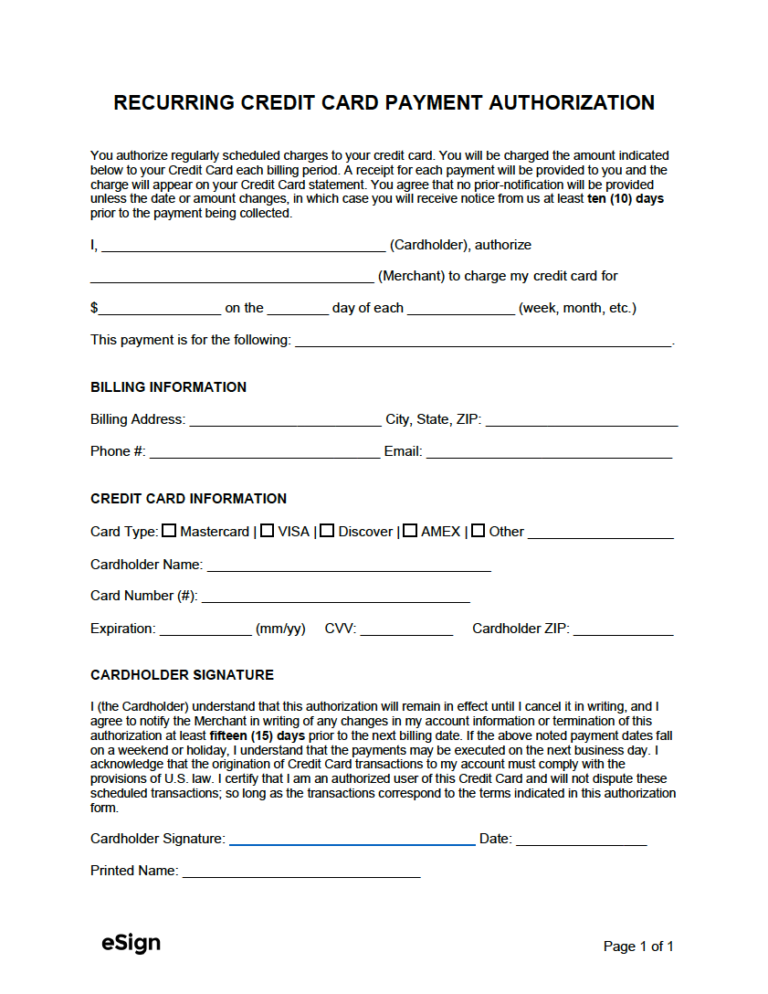

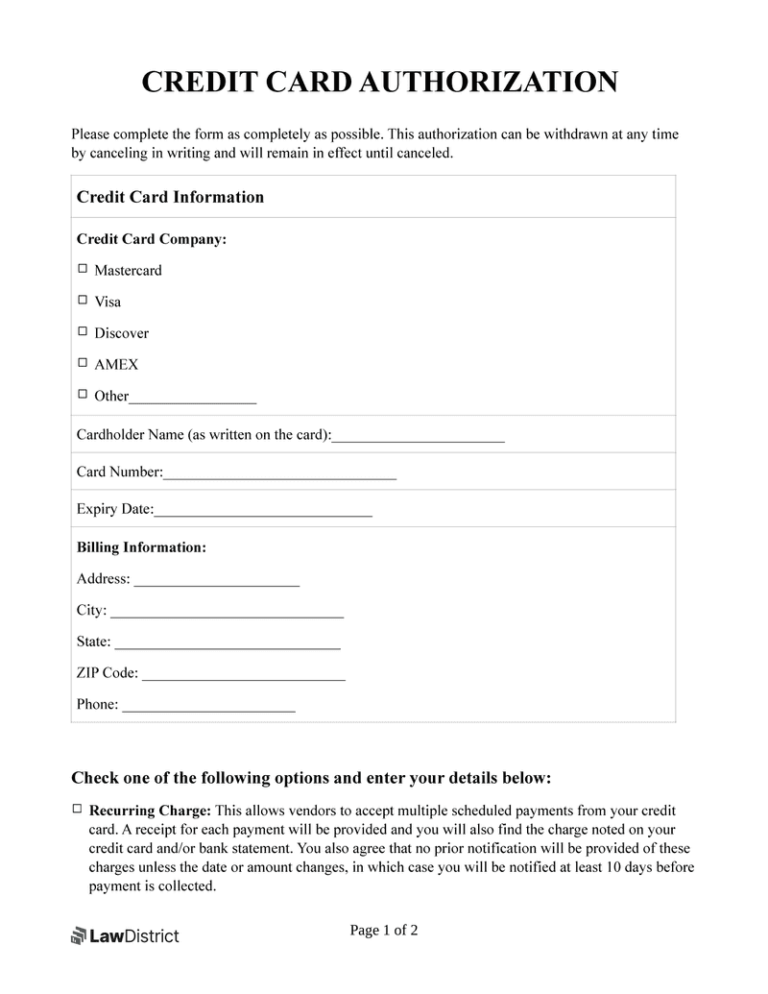

Credit Card Recurring Payment Authorization Form Template

There are many benefits to using a credit card recurring payment authorization form template. First, it can help businesses save time and money. By using a pre-formatted template, businesses can avoid the need to create their own form from scratch. This can save them time and effort, and it can also help to ensure that the form is compliant with all applicable laws and regulations.

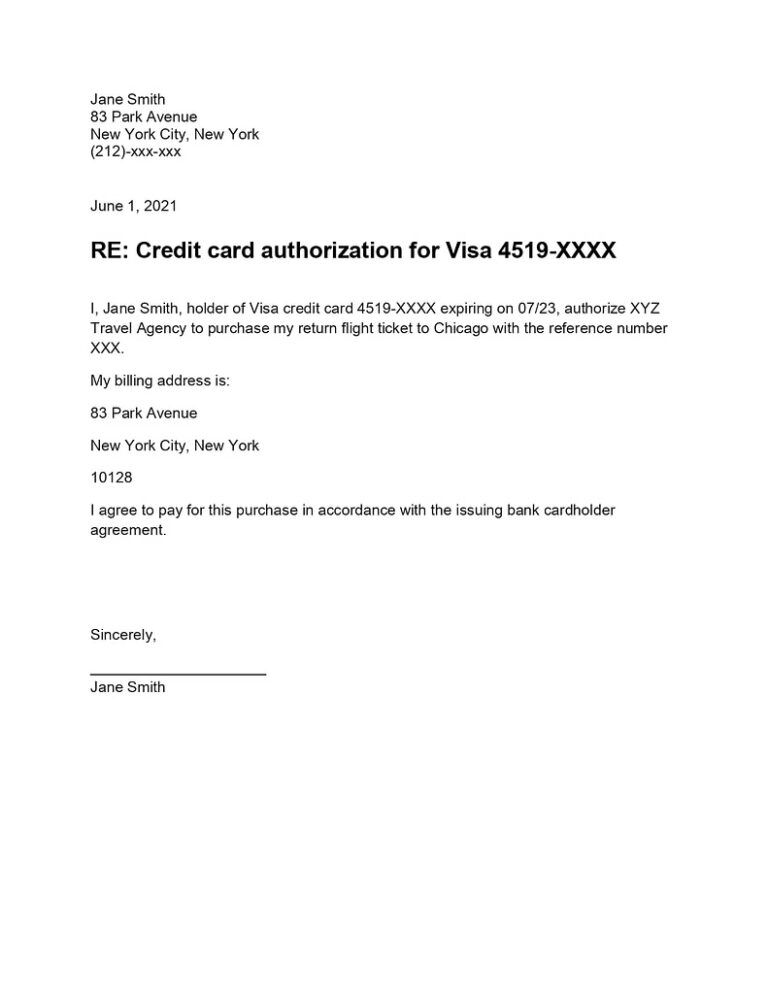

Credit Card Letter Of Authorization Template

There are many benefits to using a credit card letter of authorization template. First, it can help to protect the cardholder from fraud. By authorizing another person to make purchases on their behalf, the cardholder can limit their liability for any unauthorized purchases. Second, a credit card letter of authorization template can make it easier for the cardholder to manage their finances. By giving another person permission to make purchases on their behalf, the cardholder can free up their time and avoid having to worry about making purchases themselves.

Credit Card Debit Authorization Form Template

There are many benefits to using a credit card debit authorization form template. These benefits include:

Credit Card Charge Authorization Form Template

There are many benefits to using a credit card charge authorization form template. First, it can help businesses to reduce the risk of fraud. By collecting customer information, businesses can verify that the customer is who they say they are and that they are authorized to use the credit card. Second, it can help businesses to improve their customer service. By providing a clear and concise form, businesses can make it easy for customers to provide the necessary information and complete the transaction.

Credit Card Billing Authorization Form Template

Credit card billing authorization forms are important because they help businesses to protect themselves from fraud. By collecting customer information and obtaining the customer’s signature, businesses can verify that the customer is who they say they are and that they are authorized to use the credit card.

Blank Credit Card Authorization Template

Using a blank credit card authorization template can provide several benefits for businesses. First, it can help to streamline the payment process. By collecting all of the necessary customer information upfront, businesses can avoid having to request this information from the customer later on. This can save time and reduce the risk of errors.

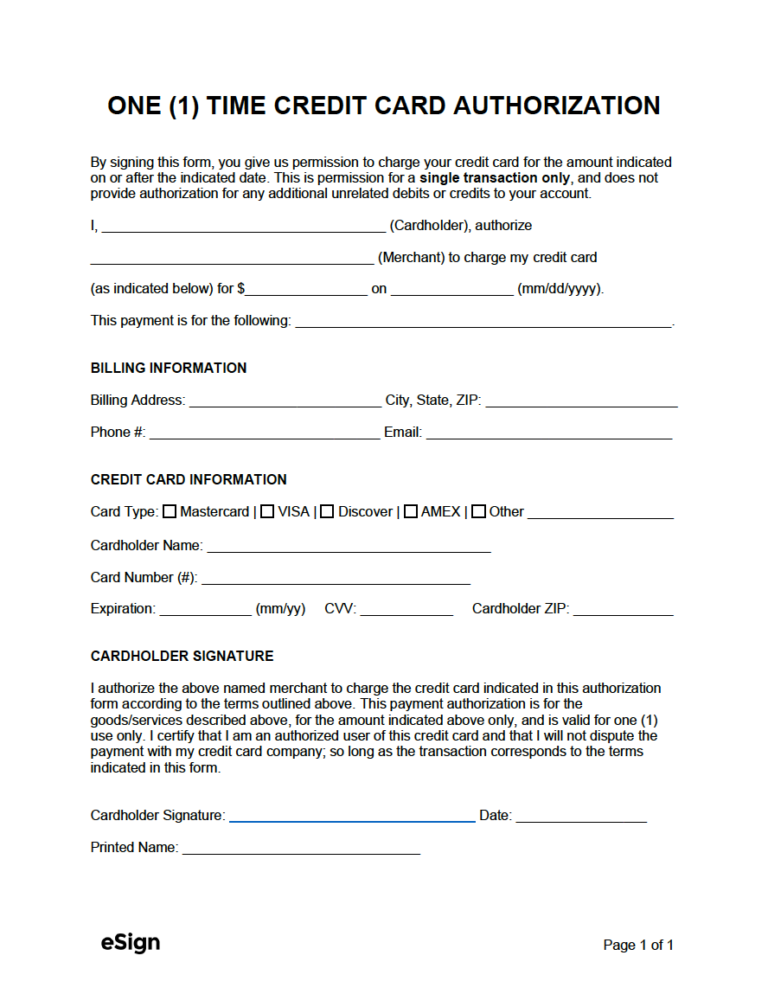

Authorization To Charge Credit Card Template

There are many benefits to using an authorization to charge credit card template. First, it helps to protect the merchant from fraud. By obtaining the customer’s signature, the merchant can verify that the customer is who they say they are and that they have authorized the purchase. Second, the template helps to streamline the checkout process. By having the customer fill out the template in advance, the merchant can quickly and easily process the transaction.

Simple Credit Card Authorization Form Template

Using a simple credit card authorization form template can provide several benefits for businesses. First, it can help to streamline the payment process by providing a consistent format for collecting customer information. This can help to reduce errors and make it easier to process payments quickly and efficiently.

Sample Credit Card Authorization Form Template

Using a sample credit card authorization form template has several benefits for businesses. First, it helps to ensure that the business has all of the necessary information to process the customer’s payment. Second, it helps to protect the business from fraud by providing a record of the customer’s authorization. Third, it can help to speed up the payment process by eliminating the need for the customer to provide their credit card information multiple times.