Utilizing such a pre-designed structure streamlines the billing process, reducing potential misunderstandings and disputes. Clear documentation facilitates prompt payment, improving cash flow and reducing the administrative burden associated with collections. Standardized formats also contribute to professional record-keeping, simplifying accounting procedures and aiding in financial reporting. This improved efficiency saves time and resources for both the business and the client.

payment

Request For Advance Payment Template

Utilizing such a formalized structure offers numerous advantages. It facilitates better budget management for the requester, allowing projects to commence or continue without financial hindrance. Simultaneously, it provides the payer with a clear understanding of the financial commitment and allows for better control over cash flow. This transparency fosters trust and strengthens professional relationships.

Invoice Payment Request Template

Utilizing such a form promotes efficiency in payment processing by minimizing confusion and potential disputes. Consistent presentation of billing information streamlines record-keeping for both businesses and their clients, simplifies reconciliation, and can contribute to improved cash flow management. Clear communication of payment terms and methods also helps build trust and professionalism in business relationships.

Advance Payment Request Template

Utilizing such a structured approach offers numerous advantages. It facilitates clear communication, reduces the likelihood of misunderstandings, and establishes a professional tone in financial dealings. The formalization of the request also provides a valuable record for both payer and payee, simplifying accounting and tracking. Furthermore, securing upfront capital can be essential for covering initial project expenses, enabling timely project commencement and completion.

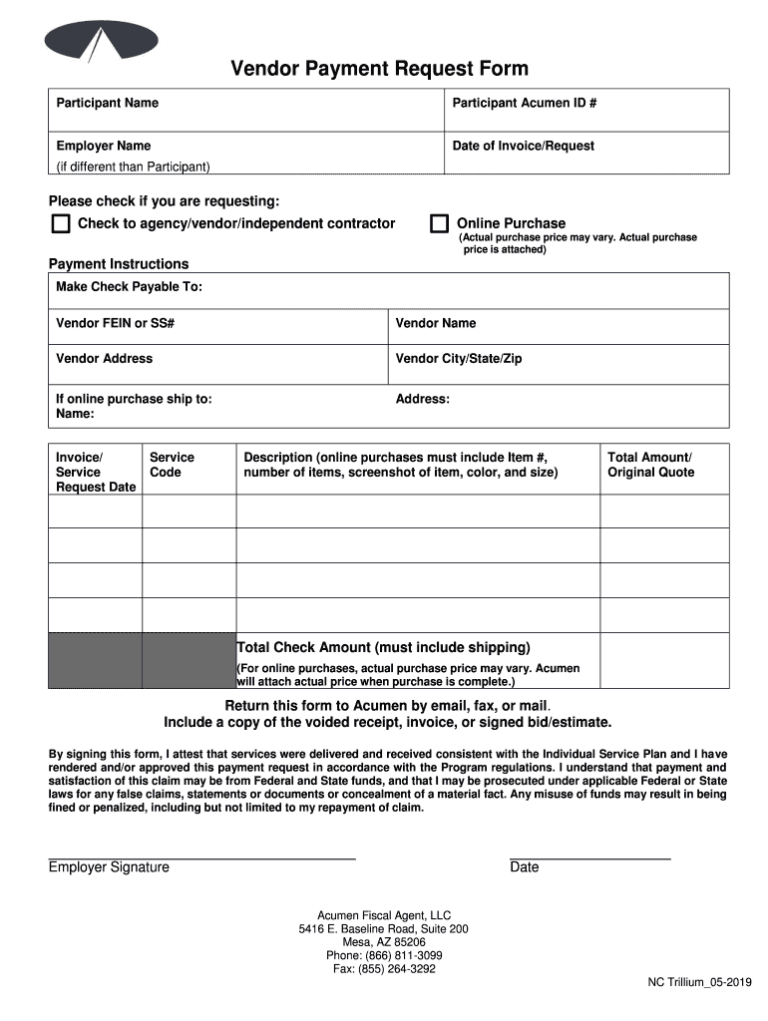

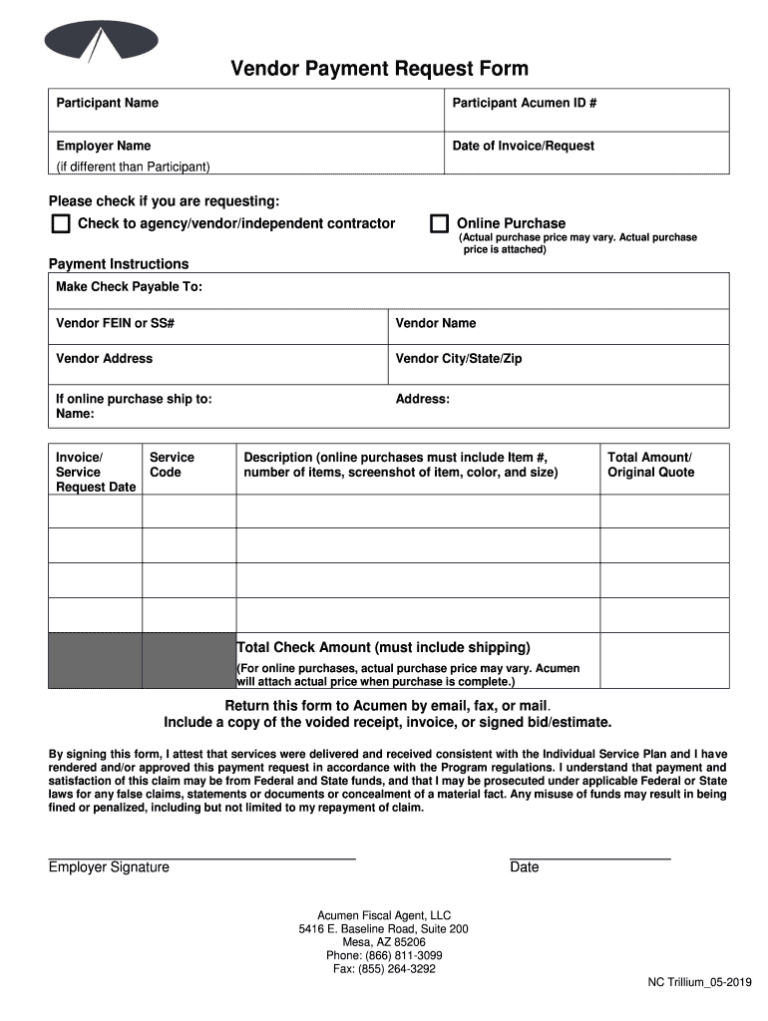

Request For Payment Template

Utilizing a pre-designed structure streamlines the billing process, reducing the time and effort required to create individual payment requests. This efficiency improves cash flow management and minimizes the likelihood of errors or omissions in critical billing information. Furthermore, consistent documentation strengthens professionalism and builds trust with clients, contributing to positive business relationships. The clarity provided by standardized formats also helps prevent misunderstandings and disputes regarding payment terms.

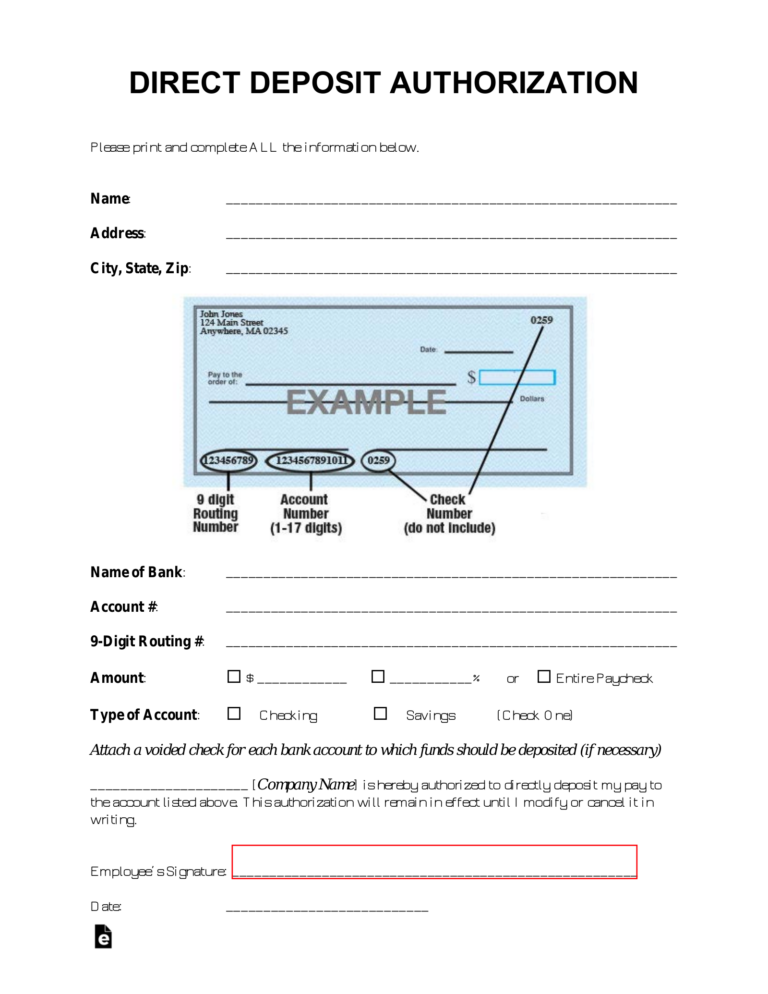

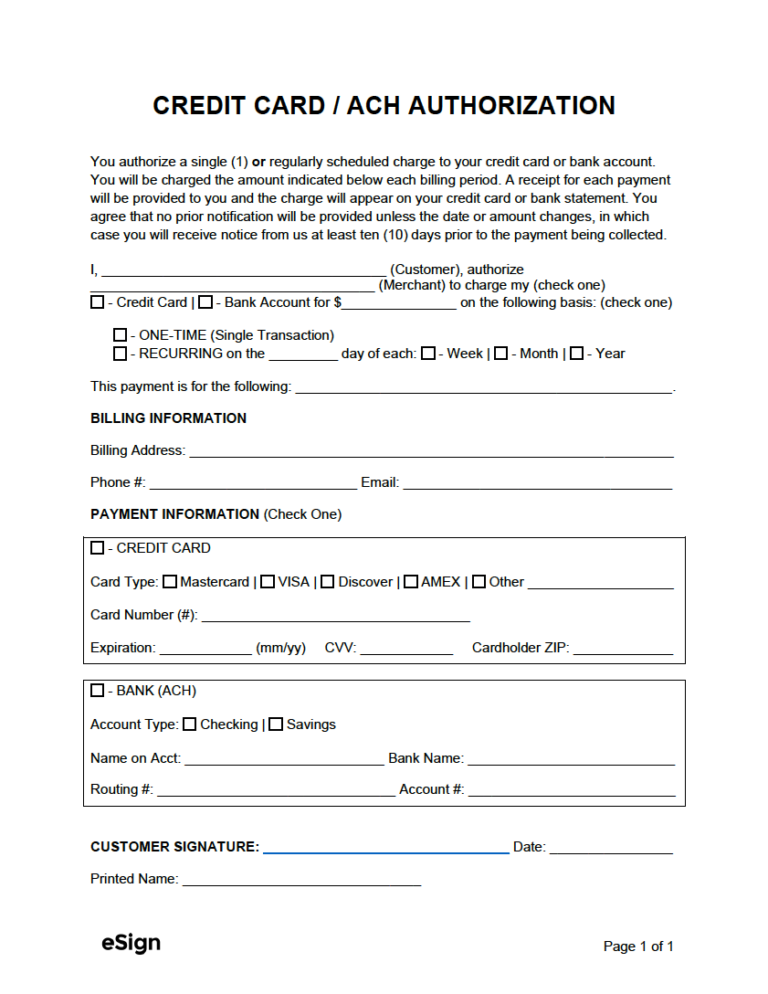

Direct Payment Authorization Form Template

There are many benefits to using a direct payment authorization form template. For businesses, it can help to streamline the payment process and reduce the risk of late payments. For customers, it can provide peace of mind knowing that their bills will be paid on time, even if they forget to send a payment.

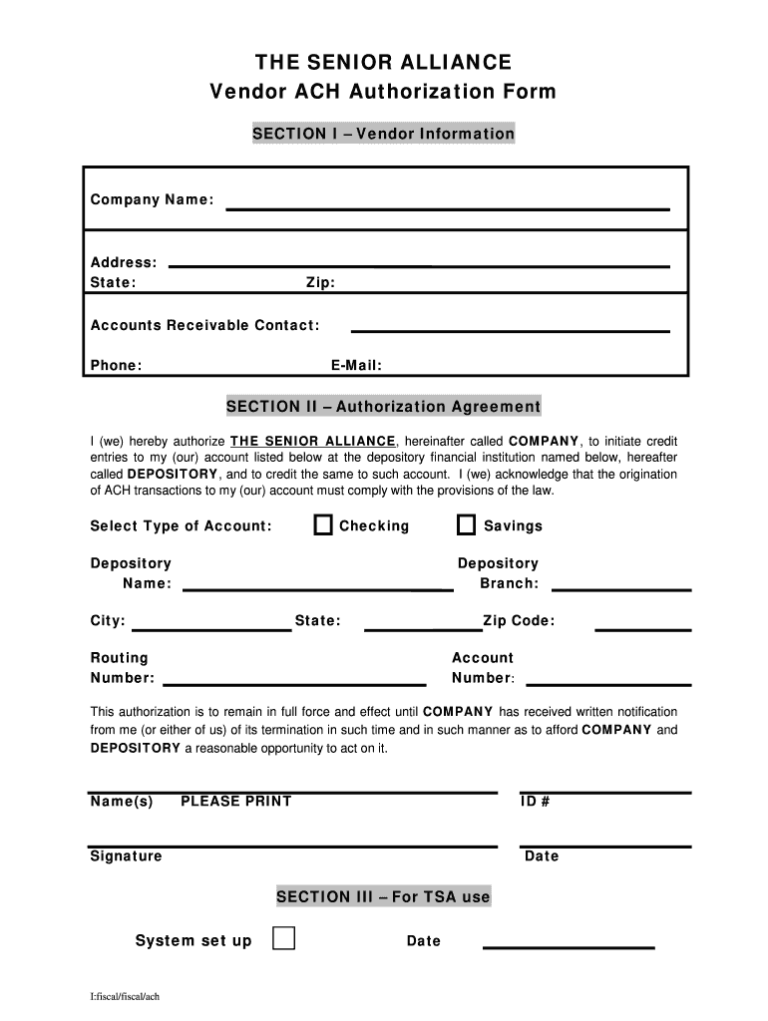

Vendor Ach Payment Authorization Form Template

Vendor ACH payment authorization forms typically include the following information:

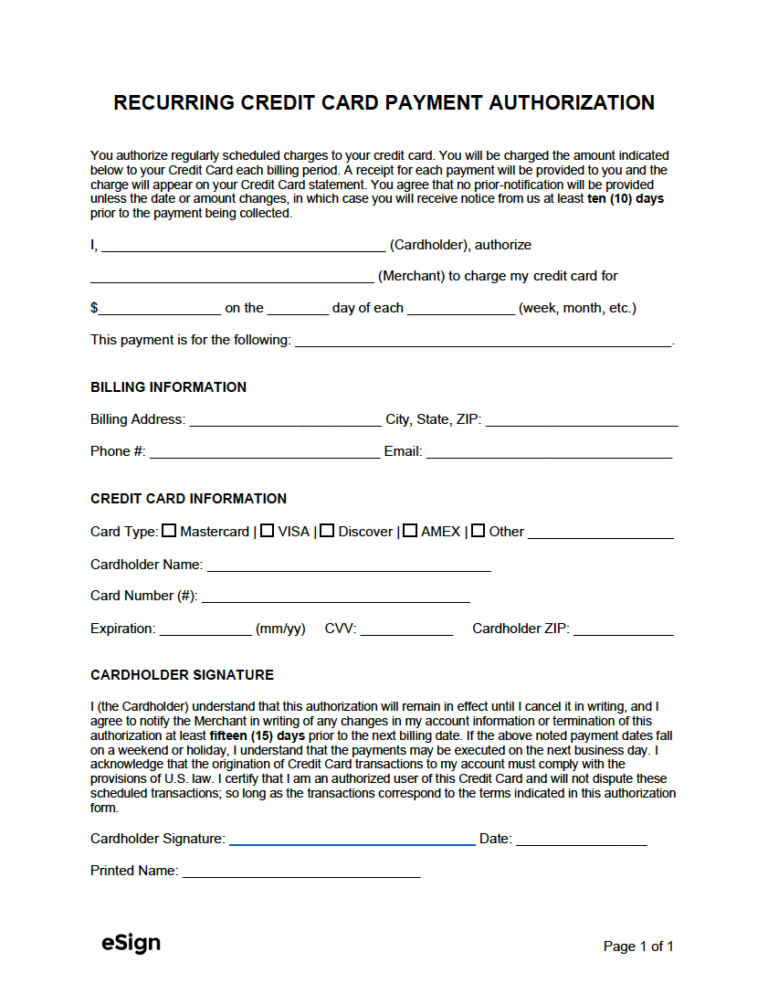

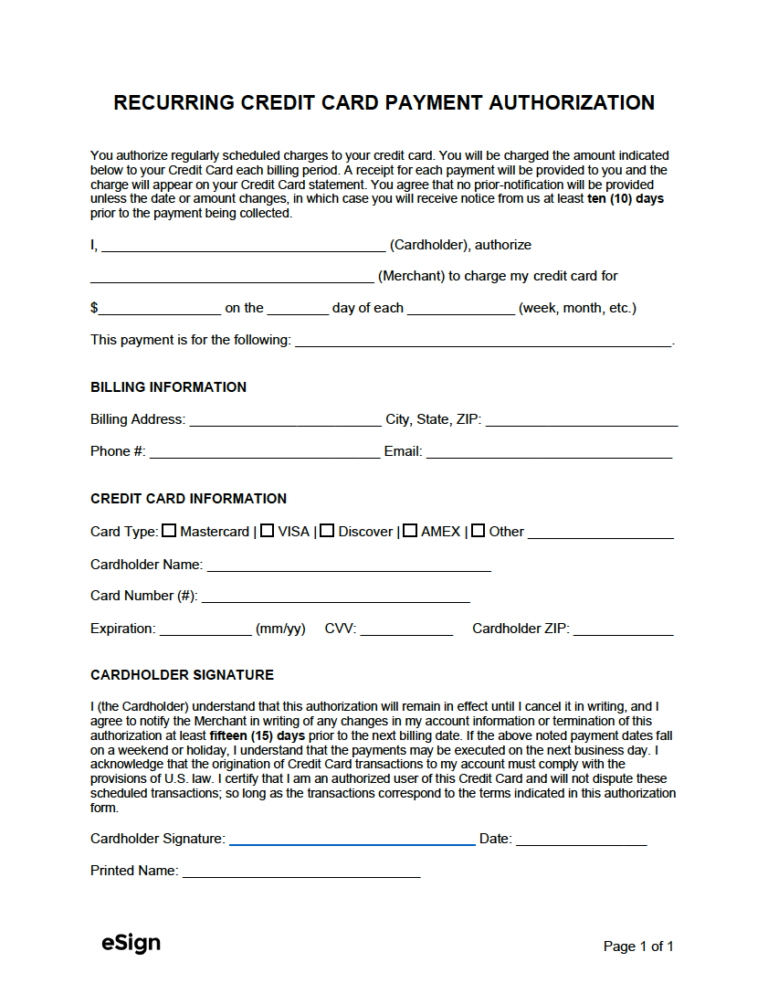

Recurring Payment Authorization Form Template

There are many benefits to using a recurring payment authorization form template. First, it helps businesses to streamline the payment process and reduce the risk of errors. Second, it provides customers with a clear and concise overview of the terms and conditions of the recurring payment agreement. Third, it helps businesses to comply with regulations and protect themselves from fraud.

Electronic Payment Authorization Form Template

Using electronic payment authorization form templates offers several benefits for businesses. These include:

Automatic Payment Authorization Form Template

There are many benefits to using an automatic payment authorization form template. For customers, it can save time and hassle by eliminating the need to manually make payments each month. It can also help to ensure that payments are made on time, avoiding late fees and other penalties. For merchants, automatic payment authorization forms can help to reduce the risk of late payments and improve cash flow. They can also help to save time and money by reducing the need for manual processing.