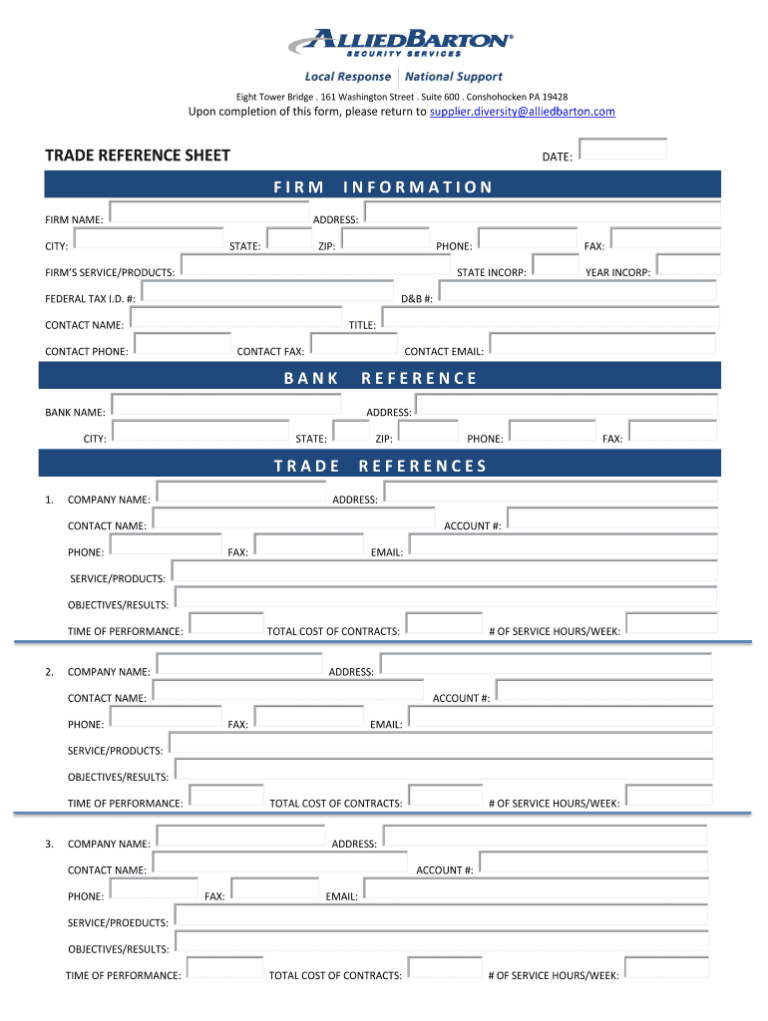

trade

Trade Reference Request Template

Utilizing such a form streamlines the credit evaluation process, reduces the risk of bad debt, and fosters stronger relationships with suppliers by demonstrating a professional and organized approach to credit management. This proactive approach to credit assessment contributes to a more stable and predictable financial environment for all parties involved.

Request For Trade Reference Template

Utilizing such a form streamlines the credit evaluation process, reducing time and resources spent on gathering essential information. It also promotes fairness and consistency in assessing potential trading partners, minimizing subjective biases. The structured format facilitates easy comparison and analysis of responses, leading to more accurate risk assessments and ultimately, better-informed business decisions. This proactive approach helps mitigate potential financial losses from late payments or defaults.