Navigating household finances can feel like a complex dance, especially when two incomes are involved. On one hand, having dual earnings offers fantastic opportunities for achieving financial goals, from homeownership to dream vacations or a comfortable retirement. On the other hand, managing these combined funds, making sure both partners feel heard, and ensuring everything is aligned can sometimes lead to confusion or even small disagreements if there isn’t a clear system in place.

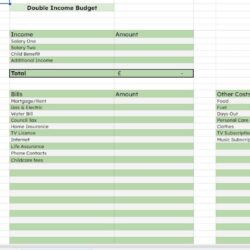

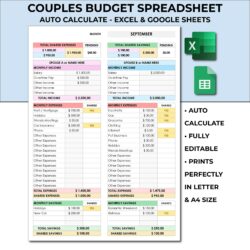

That’s where a well-crafted budgeting tool becomes invaluable. Instead of just winging it or using a generic approach, tailoring your financial strategy to your specific situation is key. Finding the perfect two income household budget template can be a game-changer, simplifying the process and bringing clarity to your shared financial picture.

With a dedicated template, you transform your finances from a source of potential stress into a powerful tool for teamwork and goal achievement. It helps you see exactly where your money is coming from and where it’s going, empowering you to make informed decisions that benefit both partners and move you closer to your collective dreams.

Why a Dedicated Budget Template is Essential for Dual-Income Homes

While the idea of budgeting isn’t new, the nuances of managing two incomes often require a more specific approach than a one-size-fits-all solution. Generic budget spreadsheets might track income and expenses, but they sometimes miss the critical elements of joint financial planning, such as how contributions are split, how shared goals are funded, or even just making sure both partners are on the same page regarding their spending habits. A template specifically designed for two incomes acknowledges these dynamics and provides a structured framework.

When both partners contribute to the household, it’s not just about adding two salaries together; it’s about integrating two sets of financial habits, goals, and sometimes even debts. A specialized two income household budget template helps bridge any gaps by offering a clear, unified view. It encourages transparency, whether you decide to pool all your finances, keep some separate, or use a hybrid approach. The template acts as a shared document, reflecting both incomes and all joint expenses.

This approach isn’t just about tracking; it’s about strategizing. It allows you to see the bigger picture, identifying areas where you might be overspending or places where you could reallocate funds to accelerate savings or debt repayment. Without this clear overview, it’s easy for expenses to creep up unnoticed, or for one partner to unknowingly carry a disproportionate financial burden.

Setting Financial Goals Together

One of the most powerful aspects of using a tailored budget is its ability to facilitate shared goal setting. Instead of individual dreams, you start to cultivate collective ambitions. Maybe you’re saving for a down payment on a house, planning for a child’s education, or building a robust retirement fund.

A comprehensive template helps you allocate funds towards these specific goals systematically. It allows you to visualize progress, celebrate milestones, and adjust your plan as life evolves. When both partners are actively contributing and seeing the impact of their efforts within the budget, it creates a powerful sense of shared purpose and accountability.

A good template should typically include sections for:

Making Your Budget Template Work for You

Having a fantastic two income household budget template is only the first step; the real magic happens when you actively use it and incorporate it into your financial routine. Consistency and open communication are the cornerstones of successful dual-income budgeting. Make it a habit to regularly review your budget together, perhaps once a week or bi-weekly, to ensure you’re both on track and to make any necessary adjustments. This isn’t about pointing fingers; it’s about working as a team to understand where your money is going and making conscious decisions about its future.

To get started, gather all your financial statements, including bank accounts, credit cards, loans, and pay stubs. Sit down with your partner and input all your income and expenses into the template. Be honest and thorough. It’s crucial that both partners are fully invested in this process, understanding not just the numbers, but also the ‘why’ behind them. This initial deep dive might take some time, but it lays a solid foundation for your financial future.

Remember that a budget is a living document, not a rigid set of rules cast in stone. Life throws curveballs, and your financial situation will undoubtedly change over time. Be prepared to revisit, adapt, and refine your budget as your income fluctuates, expenses change, or new financial goals emerge. The template is a tool to empower you, not to constrain you.

Taking control of your finances as a two-income household can significantly reduce stress and open up new possibilities for your future together. By consistently utilizing a dedicated budget template, you transform your financial management into a collaborative effort, fostering transparency and mutual understanding. This shared journey toward financial wellness strengthens your partnership and builds a solid foundation for achieving all your dreams.

Embracing this proactive approach means you’re not just managing money; you’re actively designing the life you want to live. The financial clarity and control gained from a well-maintained budget will empower you both to make confident decisions, secure your future, and enjoy the peace of mind that comes with shared financial harmony.