Are you constantly wondering where your money goes each week? Do payday highs quickly turn into mid-week lows, leaving you scratching your head about your bank balance? You’re certainly not alone. Many of us grapple with the ebb and flow of our finances, feeling like we’re always just a step behind our spending. It’s a common challenge in our fast-paced lives, where expenses seem to pop up from every corner.

Managing your money effectively doesn’t have to be a monumental task that requires a degree in finance. In fact, one of the most powerful tools you can adopt is surprisingly simple: a clear, organized way to track your income and outgoings on a more frequent basis. Shifting from a vague idea of your finances to a concrete plan can bring immense peace of mind and control.

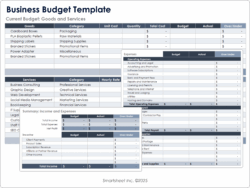

That’s where a well-designed weekly cash flow budget template comes in handy. It’s not just about restricting yourself; it’s about gaining clarity, making informed decisions, and ultimately, building a healthier financial future. Imagine knowing exactly what you can spend, save, or invest each week without any guesswork. It transforms financial management from a chore into an empowering habit.

Unlock Financial Clarity with a Weekly Focus

Diving into a weekly budget might seem like a lot of effort, especially if you’re used to a monthly approach or no budget at all. However, there’s a unique power in looking at your cash flow on a weekly basis. Our lives often operate week-to-week; paychecks arrive weekly or bi-weekly, groceries are bought weekly, and many social plans unfold over a seven-day cycle. A weekly budget naturally aligns with this rhythm, making it far more intuitive and actionable than trying to stretch a monthly plan over four or five unpredictable weeks.

This granular view allows for quick adjustments. If an unexpected expense pops up one week, you can immediately see its impact and make small tweaks for the following week, rather than waiting until the end of the month to discover a big deficit. It gives you a real-time snapshot, empowering you to course-correct before small issues snowball into larger financial woes. Think of it as navigating a car by looking closely at the road ahead, rather than just glancing at a map once a month.

Setting Up Your Weekly Cash Flow Template

To truly make your weekly budget work, you need a clear template that captures all the essential information. Starting with a blank page can feel daunting, but breaking it down into simple categories makes it manageable.

Gathering Your Financial Information

Before you even touch the template, spend a little time collecting your financial data. This means recent bank statements, credit card statements, pay stubs, and any recurring bill notifications. Don’t skip this step; accuracy is the foundation of an effective budget.

Key Sections of Your Template

A robust template will typically include these core sections:

- Starting Balance: What you have in your checking account at the beginning of the week.

- Weekly Income: All money you expect to receive that week, including your paycheck, side hustle income, or any reimbursements.

- Fixed Expenses: Bills that are the same every week or that you can easily prorate to a weekly amount (e.g., rent, loan payments, subscriptions if paid weekly).

- Variable Expenses: Money you spend that fluctuates weekly, like groceries, gas, dining out, entertainment, and personal care.

- Savings & Debt Repayment: Amounts you plan to put towards savings goals or extra debt payments each week.

- Ending Balance: What you expect to have left at the end of the week.

Putting It Into Practice

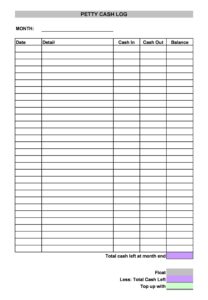

Once you have your template set up, the real work begins: tracking. Throughout the week, diligently record every dollar that comes in and goes out. Many people find it helpful to check in with their budget daily for a few minutes. This regular interaction builds awareness and helps you stick to your plan, transforming a daunting task into a simple, routine check-in.

Customizing Your Budget for Lasting Success

A budget isn’t a rigid set of rules designed to make life miserable; it’s a flexible tool that should adapt to your unique circumstances and financial goals. The real power of a weekly cash flow budget template lies in its ability to be personalized. What works for one person might not work for another, and that’s perfectly fine. The goal is to create a system that you can consistently use without feeling overwhelmed or deprived.

Don’t be afraid to experiment. Perhaps you find that tracking daily is too much, and reviewing mid-week and at week’s end works better. Or maybe you discover that certain expense categories need more generous allocations than you initially thought. The first few weeks of using your template are often a learning curve, revealing spending habits you never even realized you had. This insight is invaluable, as it allows you to make informed adjustments rather than just guessing.

The key to long-term success is consistency and flexibility. Life throws curveballs, and your budget should be able to bend without breaking. If one week doesn’t go exactly to plan, don’t abandon the entire effort. Instead, look at it as an opportunity to learn and refine your approach for the next week.

- Review Regularly: Set aside a consistent time each week (perhaps Sunday evening or Monday morning) to review the previous week’s spending and plan for the week ahead.

- Adjust Categories: As you track, you’ll see where your money truly goes. Adjust your spending categories and allocations based on real data, not just assumptions.

- Build an Emergency Buffer: Incorporate a small weekly contribution to an emergency fund. This will help you absorb unexpected costs without derailing your entire budget.

- Celebrate Wins: Acknowledge when you stick to your budget or achieve a small financial goal. Positive reinforcement encourages continued effort.

Embracing a weekly cash flow budget template offers a profound sense of control over your finances. It transforms abstract numbers into actionable insights, allowing you to proactively manage your money instead of passively reacting to it. This consistent, detailed oversight can pave the way for reaching your financial aspirations, whether it’s saving for a big purchase, paying off debt, or simply reducing financial stress.

Starting this journey of weekly financial tracking might just be the most impactful step you take towards a more secure and peaceful financial future. It’s an investment in yourself, providing the clarity and confidence to make your money work harder for you.