Utilizing such a form offers several advantages. It reduces the risk of overlooking critical information, ensures compliance with data privacy regulations, and expedites the processing time for these often time-sensitive requests. This efficiency benefits both the individual or business seeking financial verification and the financial institution providing it. Furthermore, standardized requests improve accuracy and clarity, minimizing potential misunderstandings and facilitating smoother transactions.

This article will further explore the specific elements typically included in these forms, best practices for their completion and submission, and the various contexts in which they are commonly utilized. It will also discuss the legal and ethical considerations surrounding the sharing of financial information.

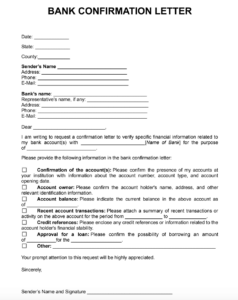

Key Components of a Bank Reference Request

Effective requests for banking references require specific information to ensure clarity and completeness. These components facilitate efficient processing and ensure the provision of relevant financial data.

1. Requester Information: This section identifies the individual or entity requesting the reference, including full legal name, contact information, and the purpose of the request.

2. Subject Information: This section identifies the individual or organization whose financial information is being requested, including their full legal name, account number(s), and any other relevant identifying information.

3. Bank Information: This section identifies the financial institution being contacted, including the full name, branch address, and contact person, if known.

4. Specific Information Requested: This outlines the specific financial data required, such as account duration, average balance, credit history, or transaction details. Clear articulation of the required information reduces ambiguity and processing time.

5. Authorization and Consent: This section typically includes a signature or other form of consent from the subject, granting permission for the bank to release the requested information. This crucial component ensures compliance with privacy regulations.

6. Declaration of Use: This section explains how the requested information will be used. This transparency further reinforces ethical handling of sensitive financial data.

Accurate and comprehensive requests benefit all parties involved. The inclusion of these key components ensures efficient processing, minimizes potential delays, and facilitates the secure and appropriate exchange of financial information.

How to Create a Bank Reference Request Template

Developing a standardized template for bank reference requests ensures consistency, efficiency, and compliance when seeking verification of financial standing. A well-structured template facilitates clear communication between the requesting party and the financial institution.

1. Header: Begin by clearly identifying the document as a “Bank Reference Request.” Include the date of the request and a unique reference number for tracking purposes.

2. Requester Information Section: Designate a section for the requesting party’s details, including the full legal name, address, contact information, and the purpose of the request.

3. Subject Information Section: Create a dedicated section for the individual or entity whose financial information is being requested. Include fields for their full legal name, any relevant account numbers, and other identifying information.

4. Bank Information Section: Provide a section for the recipient bank’s details, including the institution’s full name, branch address, and contact person, if known. This ensures the request reaches the appropriate department.

5. Information Requested Section: Clearly outline the specific financial data required. Provide checkboxes or a list of options to streamline the selection process for the bank. This may include account duration, average balance, credit history, and transaction details.

6. Authorization and Consent Section: Include a designated area for the subject’s signature or other form of consent, authorizing the release of their financial information. This crucial element ensures compliance with privacy regulations.

7. Declaration of Use Section: Incorporate a section explaining the intended use of the requested information. This transparency promotes ethical data handling practices.

8. Closing: Conclude with a professional closing and provide contact information for follow-up inquiries.

A comprehensive template incorporating these elements streamlines the request process, ensuring clarity and efficiency while protecting sensitive financial data. Standardization minimizes ambiguity and promotes consistent handling of requests, benefiting both requesters and financial institutions.

Standardized forms for requesting banking references serve as a critical tool in facilitating secure and efficient verification of financial information. These templates, comprising key elements such as requester and subject details, specific data requests, and authorization clauses, ensure clarity and minimize potential misunderstandings. The utilization of such templates promotes compliance with data privacy regulations and streamlines the processing time for both requesters and financial institutions. Accurate and comprehensive requests, guided by a well-structured template, contribute significantly to smoother financial transactions and informed decision-making.

As financial processes continue to evolve, the importance of standardized documentation for verifying financial standing remains paramount. Adopting structured request procedures strengthens transparency and trust within financial ecosystems, paving the way for more secure and efficient transactions in the future.