Ever feel like you’re juggling a dozen balls in the air as a real estate agent? Between showings, client calls, marketing, and keeping up with market trends, managing your finances often takes a backseat. But here’s the truth: mastering your money isn’t just about knowing what you earn; it’s about understanding where every dollar goes, so you can reinvest in your business and yourself. It’s the secret sauce to sustained success.

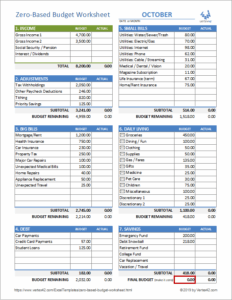

That’s why having a solid financial roadmap is crucial. Imagine having a clear picture of your income and expenses, allowing you to make smarter decisions, plan for future growth, and reduce financial stress. This isn’t just wishful thinking; it’s entirely achievable with the right tools. A well-designed real estate agent budget template can be your guiding star in this often unpredictable industry.

Think of it as your personal GPS for financial prosperity. It helps you track commissions, identify areas where you might be overspending, and most importantly, allocate funds strategically to marketing, professional development, and even personal savings. Let’s dive into how you can set up a budget that truly works for you, transforming your financial outlook and supercharging your career.

Why Every Real Estate Agent Needs a Robust Budget and How to Build One

Running a real estate business, even as a solo agent, is a significant undertaking. It’s not just about closing deals; it’s about managing an enterprise. Without a clear financial blueprint, you’re essentially flying blind. A robust budget isn’t just about cutting costs; it’s about optimizing your resources to maximize your potential. It helps you understand your profit margins, identify your most effective marketing channels, and even forecast your income more accurately. This proactive approach allows you to anticipate lean months and plan for growth opportunities, rather than reacting to financial surprises.

One of the biggest benefits of a detailed budget is gaining complete clarity on your cash flow. Many agents might have a general idea of their income, but struggle to pinpoint exactly where their money is being spent. Are your marketing efforts yielding a good return on investment? Are your technology subscriptions truly essential? A budget forces you to ask these tough questions and provides the data to answer them objectively. It transforms guesswork into informed decision-making, which is invaluable in a commission-based profession.

Key Income Streams to Track

When you’re building your budget, start with the income side. For most real estate agents, this primarily revolves around commissions from sales, but it can also include other sources. It’s important to differentiate between gross commission income and your net income after broker splits and other transaction fees.

- Commission from Sales: Your primary income, based on a percentage of the property sale price.

- Referral Fees: Income received for referring clients to other agents, perhaps in different geographical areas.

- Rental Commissions: If you also handle property rentals, these fees should be accounted for.

- Consulting Fees: For specific real estate advice or services beyond a typical transaction.

Essential Expense Categories for Agents

Expenses are where many agents can get tripped up. It’s easy for small, recurring costs to add up without you even realizing it. Categorizing your expenses helps you see the bigger picture and identify areas for potential savings or strategic investment. Think of both fixed costs (they stay relatively the same each month) and variable costs (they fluctuate based on your activity).

- Brokerage Fees and Splits: The percentage of your commission paid to your brokerage. This is often your largest single expense.

- Marketing and Advertising: Online ads, print materials, open house signage, professional photography, virtual tours, website hosting.

- Technology and Software: CRM systems, e-signature tools, property listing services, video editing software, productivity apps.

- Professional Development: Coaching, courses, seminars, licensing renewal fees, association dues (NAR, state and local associations).

- Office Expenses: Desk fees, utilities (if you have your own office), supplies, internet.

- Transportation: Fuel, car maintenance, mileage tracking for tax deductions.

- Insurance: Errors and omissions (E&O) insurance, health insurance, car insurance.

- Miscellaneous: Client appreciation gifts, networking events, lead generation tools.

Once you have a clear picture of both your income and expenses, you can start to allocate funds more intentionally. This might mean setting aside a specific percentage of each commission for marketing, another for professional development, and a portion for taxes and savings. The goal is to create a dynamic plan that helps you grow while maintaining financial stability, allowing you to thrive even when the market shifts.

Making Your Budget Work for You: Tips for Long-Term Success

Creating a budget is just the first step; consistently sticking to it and making it a living document is where the real magic happens. A budget isn’t a rigid, one-time creation; it’s a dynamic tool that should evolve with your business. Life as a real estate agent is rarely linear, so your financial plan needs to be flexible enough to accommodate market fluctuations, unexpected opportunities, and personal goals. Regularly reviewing your budget, ideally monthly or quarterly, allows you to adjust your spending and saving habits to align with your current reality and future aspirations.

One powerful strategy is to implement a “profit-first” approach. Before you even think about expenses, earmark a portion of every commission for profit, savings, and taxes. This ensures that you’re always paying yourself and planning for your financial future, rather than just covering costs. It flips the traditional budgeting model on its head, prioritizing your financial health. Then, allocate the remaining funds to your operational expenses, forcing you to be more judicious with your spending and find efficiencies where possible.

Leveraging tools to track your finances can also make a significant difference. While a basic real estate agent budget template in a spreadsheet is a great starting point, consider exploring dedicated budgeting software or apps that can automate expense tracking, categorize transactions, and provide visual reports. These tools can save you valuable time and offer deeper insights into your financial patterns, making it easier to identify trends and make informed decisions. Remember, your budget is a tool for empowerment, not restriction. Use it to build the sustainable, successful real estate career you envision.

Taking control of your finances is one of the most impactful steps you can take to elevate your real estate career. It moves you from a reactive financial posture to a proactive one, equipping you with the data and foresight to navigate the ups and downs of the market with confidence. By diligently tracking your income and expenses, you gain unparalleled clarity, allowing you to strategically invest in your growth, streamline operations, and ultimately, increase your profitability.

Embrace the power of a well-structured financial plan. It’s not just about numbers; it’s about building a solid foundation for your future, freeing up mental space, and empowering you to focus on what you do best: connecting people with their dream homes. Start today, and watch as a clear financial picture transforms not just your business, but your peace of mind.