Navigating the financial landscape of any business, big or small, can feel like steering a ship through unpredictable waters. One moment you’re cruising along, the next you hit an unexpected wave of expenses or a sudden dip in sales. It’s a common challenge, and for many entrepreneurs, the biggest hurdle isn’t profitability itself, but rather the constant dance of cash coming in and going out. Without a clear picture of this ebb and flow, even a profitable business can find itself in a bind.

This is precisely where a robust business cash flow budget template becomes an invaluable tool. It’s not just about tracking past transactions; it’s about looking forward, anticipating your financial needs, and making informed decisions. By projecting your inflows and outflows over a specific period, you gain foresight that allows you to prepare for lean times, seize opportunities for growth, and ensure your operational engine never sputters out.

Think of it as your financial GPS, guiding you toward stability and growth rather than leaving you to drift. Understanding and utilizing a cash flow budget empowers you to maintain liquidity, manage debt effectively, and ultimately achieve your business goals with greater confidence and less stress.

Why a Cash Flow Budget Is Your Business’s Best Friend

A cash flow budget is essentially a detailed forecast of all the money you expect to receive and all the money you anticipate spending over a given period, usually monthly or quarterly. It differs from a profit and loss statement, which focuses on revenue and expenses when they are earned or incurred, regardless of when cash actually changes hands. A cash flow budget, on the other hand, is purely about the movement of cash, making it a critical tool for day-to-day operational management.

The primary benefit of having such a forecast is the ability to avoid nasty surprises. Imagine knowing weeks or even months in advance that you might have a cash deficit. With this information, you can proactively explore options like delaying non-essential purchases, accelerating collections, or arranging for a short-term line of credit. Conversely, if you foresee a surplus, you can plan to invest that extra cash wisely, perhaps paying down debt, expanding operations, or building a contingency fund.

Beyond just avoiding pitfalls, a cash flow budget enables strategic decision-making. Should you hire new staff? Can you afford that new piece of equipment? Is it the right time to launch a new product line? These are all questions that can be answered with more certainty when you have a clear understanding of your future cash position. It provides the data you need to make calculated risks and smart investments.

Key Components of an Effective Cash Flow Budget

To be truly effective, a cash flow budget needs to include several critical elements that paint a complete picture of your financial health. These components work together to provide a comprehensive outlook on your liquidity.

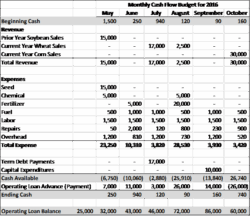

Typically, an effective cash flow budget includes:

* Opening Cash Balance: The amount of cash your business has at the beginning of the period.

* Cash Inflows: All sources of cash coming into the business, such as sales revenue, loan proceeds, equity investments, and asset sales.

* Cash Outflows: All cash going out of the business, including operating expenses (rent, utilities, salaries), inventory purchases, loan repayments, and capital expenditures.

* Net Cash Flow: The difference between your total cash inflows and total cash outflows for the period.

* Closing Cash Balance: The sum of your opening cash balance and net cash flow, showing how much cash you expect to have at the end of the period.

By meticulously tracking these items, you gain unparalleled insight into where your money is coming from and where it’s going. This granular view allows you to identify trends, pinpoint areas for improvement, and optimize your financial processes. It helps you manage relationships with suppliers, ensuring you can pay them on time, and with customers, as you understand the impact of payment terms on your liquidity.

Getting Started with Your Business Cash Flow Budget Template

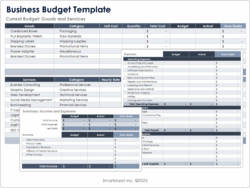

Adopting a systematic approach to your cash flow doesn’t have to be daunting. The first step is to commit to the process. Many businesses find that starting with a readily available business cash flow budget template simplifies the initial setup. These templates, often found in spreadsheet software or as part of accounting platforms, provide a structured framework, guiding you on what information to include and how to organize it.

Once you have your chosen template, the real work begins: gathering your financial data. This involves looking at historical records to understand past patterns of income and expenditure. While the past doesn’t perfectly predict the future, it offers valuable insights into seasonality, typical operational costs, and customer payment behaviors. Projecting future income and expenses requires a realistic assessment of your sales forecasts, upcoming bills, and planned investments. Be conservative with income projections and generous with expense estimates to build a robust safety margin.

The key to a successful cash flow budget is not just creating it, but consistently reviewing and updating it. Financial landscapes are dynamic, and your projections will need to evolve with your business and market conditions. Make it a regular habit to compare your actual cash flow against your budgeted figures. This comparison helps you identify discrepancies, understand why they occurred, and refine your forecasting accuracy for future periods. It’s an iterative process that gets better with practice.

Embracing the discipline of a business cash flow budget template is one of the most proactive steps you can take for your company’s financial health. It transforms guesswork into informed decision-making, providing a clear roadmap for managing your most vital asset: cash. By regularly monitoring your inflows and outflows, you pave the way for sustainable growth and a stronger, more resilient enterprise.