Starting a small horse farm is a beautiful dream for many, envisioning wide-open pastures, happy horses, and the peace of rural life. While the dream is often centered around the animals, the reality of farm ownership, no matter how small, always comes with financial considerations. To truly make this dream sustainable and enjoyable, having a solid financial plan is non-negotiable, and that’s where a small horse farm budget template becomes your best friend. It’s not just about knowing how much money you have, but about understanding where every dollar goes and where it needs to come from.

Budgeting might sound like a daunting task, filled with spreadsheets and complicated figures, but it’s actually a powerful tool for empowerment. It allows you to anticipate expenses, plan for the unexpected, and ultimately ensure the welfare of your beloved horses without constant financial stress. A well-structured budget provides clarity and confidence, transforming potential worries into manageable objectives.

This guide will walk you through the essential components of creating and managing your farm’s finances, helping you lay a strong foundation for your equestrian endeavors. We’ll explore both the income streams and the myriad of expenses that come with running even a modest horse operation, ensuring you’re prepared for the journey ahead.

Understanding Your Horse Farm’s Income and Expenses

Running a horse farm, whether it’s a sprawling estate or a few acres with a small barn, requires a careful balance of incoming funds and outgoing costs. Think of your budget as a comprehensive map of your farm’s financial landscape. It helps you visualize where money is generated and where it’s spent, allowing for informed decisions and preventing unwelcome surprises down the road. Without this clear picture, it’s easy to feel overwhelmed or even to let important financial details slip through the cracks.

Income Streams

Even a small horse farm can have several ways to generate income. Beyond the primary joy of owning horses, consider boarding a few horses for others, offering riding lessons, providing basic training services, or even breeding if you have suitable mares and stallions. Selling farm-produced items like hay, manure compost, or even handmade tack can also contribute. Sometimes, organizing small farm events or educational workshops can bring in a little extra. The key is to be realistic about what your farm can comfortably offer without overstretching your resources or sacrificing the well-being of your own animals.

Fixed Expenses

These are the costs that generally stay the same each month or year, regardless of how many horses you have or how much activity is happening on the farm. Common fixed expenses include mortgage or land rent payments, property taxes, various types of insurance (liability, property, equine mortality), and regular utility bills like electricity and water. If you have any staff, their salaries are also a fixed cost. Don’t forget loan payments for any equipment or vehicles you’ve financed. These are the bedrock expenses you absolutely must account for.

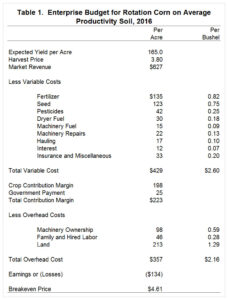

Variable Expenses

Variable expenses fluctuate based on factors like the number of horses, the season, and specific needs that arise. Feed is a major variable cost, encompassing hay, grain, and any supplements your horses require. Veterinary care ranges from routine vaccinations and dental checks to unexpected emergencies, making it crucial to have a buffer. Farrier services for regular hoof care are another ongoing variable. Bedding, stable supplies, and maintenance for fencing, pastures, and barn structures also fall into this category. Even fuel for tractors or vehicles used on the farm can add up significantly.

Unexpected and Capital Expenses

Beyond the routine, it’s vital to budget for the unforeseen. Horse ownership inevitably comes with potential emergencies, from colic surgeries to lameness issues, which can quickly become very expensive. An emergency fund is non-negotiable. Furthermore, consider capital expenses – larger, one-time investments that improve the farm, such as a new piece of equipment, repairing a roof, building an additional paddock, or upgrading a riding arena. While not monthly, these need to be planned for over time to avoid financial strain.

Managing all these moving parts requires diligent tracking and an honest assessment of your financial situation. A small horse farm budget template helps you categorize and monitor these expenditures, giving you clarity on where your money is going and enabling you to make smart choices for the health of your farm and horses.

Putting Your Budget Template to Work

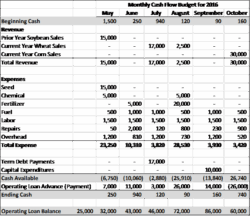

Having a comprehensive list of all potential income and expenses is a fantastic start, but the true power of a budget lies in its consistent application and review. A budget isn’t a static document; it’s a living, breathing financial roadmap that needs regular attention to be effective. Whether you choose a simple spreadsheet, a dedicated budgeting app, or even a good old-fashioned notebook, the key is to meticulously track every penny that comes in and goes out. This real-time data allows you to compare your actual spending against your planned budget, highlighting areas where you might be overspending or where you have room to adjust.

To make your budget a valuable tool rather than just a chore, here are a few practical tips:

- Review your budget regularly: At least once a month, sit down and compare your actual income and expenses to your projections. This helps catch issues early.

- Track everything: Even small purchases add up. Make a habit of recording every transaction.

- Be realistic: Don’t underestimate expenses or overestimate income. It’s better to be conservative.

- Build an emergency fund: Set aside money specifically for unexpected vet bills, equipment breakdowns, or other unforeseen farm crises.

- Seek professional advice: Consider consulting with an accountant or a financial advisor familiar with agricultural businesses. They can offer valuable insights and tax planning strategies.

By actively engaging with your budget, you empower yourself to make informed decisions for your small horse farm. A clear budget allows you to identify areas where you can cut costs without compromising care, plan for future investments, and confidently navigate the inevitable ups and downs of farm life. It transforms abstract financial goals into concrete steps, giving you the control needed to cultivate a thriving and sustainable equine haven.

Ultimately, the effort you put into developing and maintaining your small horse farm budget template will pay dividends in peace of mind and the continued well-being of your cherished horses. It’s an ongoing process, but one that provides the stability necessary for your farm to flourish. Embracing this financial discipline ensures that your dream of a horse farm remains a joyful and achievable reality for years to come.