Utilizing a standardized form streamlines the audit process, reduces the risk of miscommunication, and improves the reliability of audit evidence. Direct communication with financial institutions provides independent verification, enhancing the auditor’s ability to detect fraud and misstatements. This process ultimately contributes to a higher quality audit and greater confidence in the financial information presented.

The following sections will explore the key components of these forms, best practices for their utilization, and considerations for various types of financial institutions.

Key Components of a Standard Bank Confirmation Request

Effective bank confirmation requests contain specific elements designed to elicit complete and accurate information from financial institutions. These components ensure the request is clear, unambiguous, and addresses the auditor’s specific needs.

1. Client Information: This section identifies the client being audited, including the legal name and address. Accurate client information ensures the financial institution can readily identify the relevant accounts.

2. Financial Institution Information: This section identifies the specific branch or department of the financial institution being contacted. Including contact names and direct contact information facilitates efficient communication.

3. Account Information: This section specifies the account numbers, types, and currencies being confirmed. Clear identification of accounts prevents ambiguity and ensures accurate responses.

4. Confirmation Date: This signifies the date as of which the information is requested. It establishes the relevant timeframe for the confirmation and ensures consistency with the audit period.

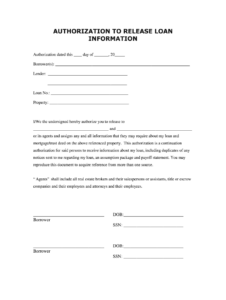

5. Authorization: Client authorization allows the financial institution to release confidential information to the auditor. This authorization is crucial for compliance with privacy regulations.

6. Specific Inquiries: These inquiries target specific information required by the auditor, such as account balances, loan details, or the existence of contingent liabilities. Clearly defined inquiries ensure the financial institution provides the necessary information.

7. Instructions for Response: Clear instructions to the financial institution on how and where to return the completed confirmation, including deadlines, facilitate timely and efficient processing.

Accurate and comprehensive responses from financial institutions depend on well-structured requests containing these essential elements. This ensures the auditor receives the necessary information to form a reliable opinion on the client’s financial statements.

How to Create a Bank Confirmation Request

Creating a comprehensive bank confirmation request requires careful attention to detail to ensure the retrieval of accurate and relevant information. The following steps outline the process:

1. Select a Standard Form: Begin by selecting a standard bank confirmation form. Professional accounting organizations often provide templates that can be adapted to specific audit requirements. Utilizing a standard format ensures consistency and clarity.

2. Populate Client Information: Accurately enter the client’s legal name, address, and any other identifying information required by the form. Accurate client identification is crucial for the financial institution to locate the correct accounts.

3. Identify the Financial Institution: Clearly specify the name and address of the financial institution, including the specific branch or department handling the accounts. Including contact names and direct contact information expedites the process.

4. Specify Account Details: Provide precise account numbers, account types (e.g., checking, savings, loan), and currencies. Clear account identification is essential to avoid ambiguity.

5. Establish the Confirmation Date: Indicate the specific date as of which the information is being requested. This date should align with the audit period.

6. Obtain Client Authorization: Secure written authorization from the client permitting the financial institution to release information to the auditor. This authorization is a critical compliance requirement.

7. Formulate Specific Inquiries: Clearly state the information required, including account balances, loan details, outstanding guarantees, and any other relevant financial data. Precise inquiries minimize the risk of misinterpretation.

8. Provide Clear Instructions for Response: Specify how the financial institution should return the completed confirmation, including preferred methods (e.g., mail, fax, secure online portal) and deadlines. Clear instructions facilitate timely processing.

Careful completion of these steps contributes significantly to the efficiency and effectiveness of the audit process by providing auditors with reliable and independently verified financial information.

Standardized forms for requesting bank confirmations serve as a critical component of a robust audit process. These forms facilitate the efficient gathering of essential financial information directly from financial institutions, ensuring the accuracy and completeness of audited financial statements. The key elements within these forms, such as precise client and account identification, clear authorization, and specific inquiries, contribute significantly to the reliability of the obtained information. Properly constructed and executed requests streamline the audit process and provide auditors with the necessary evidence to form a well-informed opinion.

Effective utilization of these standardized forms strengthens the integrity of financial reporting and contributes to greater transparency and trust in financial markets. Continued refinement of these processes and adaptation to evolving financial practices remains essential for maintaining the effectiveness of audits in a dynamic economic landscape.