Utilizing a structured format provides several advantages. It streamlines the information-gathering process, reduces the potential for misunderstandings between the auditor and the financial institution, and facilitates efficient verification of key financial data. This, in turn, contributes to a more robust and reliable audit, enhancing the credibility of the financial statements.

This article delves deeper into the specifics of using these forms, including best practices for preparation, common challenges, and key considerations for ensuring a smooth and effective audit process. Topics covered include the types of information typically requested, the importance of proper authorization, and strategies for managing communication with financial institutions.

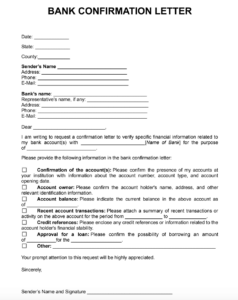

Key Components of a Bank Confirmation Request

Effective confirmation requests contain essential elements that ensure clarity and completeness. These components facilitate efficient communication with financial institutions and contribute to a more reliable audit.

1. Client Information: This section identifies the client being audited, including the legal name, address, and relevant account numbers. Accurate client information ensures the financial institution can readily identify the accounts subject to confirmation.

2. Auditor Information: This section provides the auditor’s name, address, and contact information. Clear auditor identification allows the financial institution to direct any inquiries or clarifications to the appropriate party.

3. Confirmation Date: The date of the request establishes the relevant point in time for the requested information. This ensures data accuracy and consistency with the audit period.

4. Specific Requests: This section details the specific information required from the financial institution. Typical requests include confirmation of account balances, loan details, and the existence of any liens or collateral agreements. Clearly defined requests minimize ambiguity and facilitate a prompt response.

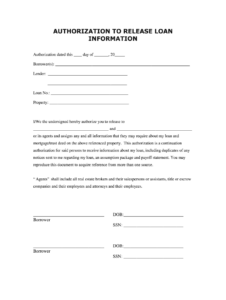

5. Authorization: Client authorization is essential for the release of confidential financial information to the auditor. This section typically includes a signature or other form of client approval, granting the financial institution permission to disclose the requested data.

6. Instructions to the Financial Institution: Clear instructions guide the financial institution on how to complete and return the confirmation request. This often includes specifying the preferred method of response (e.g., mail, fax, secure online portal) and deadlines for submission.

Accurate and comprehensive documentation facilitates a smooth and effective communication process between the auditor and the financial institution, ensuring reliable verification of financial data. These elements contribute to a higher quality audit and enhance the reliability of the financial reporting process.

How to Create a Bank Confirmation Audit Request Template

Creating a standardized template for bank confirmation requests promotes efficiency and consistency in the audit process. A well-designed template ensures all necessary information is requested and facilitates clear communication with financial institutions.

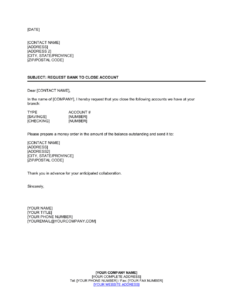

1. Establish Header Information: Begin by clearly identifying the document as a “Bank Confirmation Request.” Include the audit firm’s name and logo for professional presentation.

2. Designate Client Information Fields: Incorporate fields for essential client details: legal entity name, address, and tax identification number. Designated spaces for individual account numbers ensure requests are specific to the accounts under audit.

3. Include Auditor Identification: Dedicate a section for the audit firm’s contact information. This should include the firm’s name, address, telephone number, and the name of the individual auditor handling the request.

4. Specify Confirmation Date: A field for the confirmation date establishes the relevant reporting period for the requested financial information. This ensures data accuracy and consistency with the audit timeline.

5. Define Specific Request Sections: Create distinct sections for different types of requests. Common sections include account balances, loan details, and other relevant financial information such as liens or guarantees. Checkbox options within each section allow for efficient selection of the specific data points required.

6. Incorporate Client Authorization: Include a section for client authorization. This typically involves a designated space for the client’s signature and date, granting the financial institution permission to release the requested information to the auditor.

7. Provide Clear Instructions to the Financial Institution: Outline clear instructions on how to complete and return the confirmation. Specify acceptable response methods (e.g., mail, secure online portal, fax) and establish a reasonable deadline for submission.

8. Designate Space for Financial Institution Response: Provide ample space for the financial institution to complete its responses directly on the form. This streamlines the process and minimizes the risk of misinterpretation or data entry errors.

A well-structured template ensures comprehensive data collection, promotes clear communication, and contributes to a more efficient and reliable audit process. Standardization through templating reduces the potential for errors and facilitates consistent application of audit procedures.

Effective financial audits rely on accurate and independently verified information. Standardized forms for obtaining confirmations from financial institutions serve as a critical tool in this process, enabling auditors to corroborate client-provided data and assess the risk of material misstatement. Key elements of these forms include clear identification of the client and auditor, specific requests for information, client authorization, and explicit instructions to the financial institution. Utilizing a well-designed template ensures consistency, reduces errors, and facilitates efficient communication between all parties involved.

The proper use of these standardized forms contributes significantly to the integrity and reliability of the audit process. As financial reporting requirements evolve and technological advancements offer new methods of communication and data exchange, maintaining a focus on clear, accurate, and efficient confirmation procedures remains essential for upholding the quality and trustworthiness of financial information.