Utilizing such a framework offers several key advantages. It promotes transparency and accountability by documenting the rationale, costs, and expected benefits of major investments. This structured approach streamlines the approval process, reducing delays and ensuring efficient allocation of resources. Furthermore, it allows for standardized reporting and analysis of capital expenditures, enabling organizations to track performance and optimize investment strategies. A well-defined process also helps mitigate risks by requiring thorough evaluation and justification before committing substantial funds.

This article will further explore the key components of these crucial documents, offering practical guidance on their development and implementation, and highlighting best practices for effective capital expenditure management. Topics covered will include typical content sections, strategic considerations, approval workflows, and the role of these documents in overall financial planning and control.

Key Components of a Capital Expenditure Request

A comprehensive request ensures that decision-makers have the necessary information to evaluate the merits of a proposed investment. Several key components contribute to a well-structured and effective submission.

1. Executive Summary: A concise overview of the proposed investment, highlighting key justifications and expected benefits. This section should provide a clear and compelling rationale for the expenditure.

2. Project Description: A detailed explanation of the project’s scope, objectives, and deliverables. This should include a clear articulation of the problem or opportunity being addressed and how the investment will contribute to organizational goals.

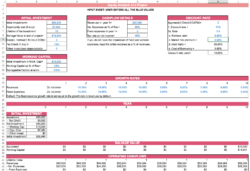

3. Financial Analysis: A thorough assessment of the project’s financial implications, including projected costs, return on investment (ROI), payback period, and other relevant metrics. Supporting documentation, such as cost estimates and financial projections, should be included.

4. Risk Assessment: An identification and evaluation of potential risks associated with the project, along with proposed mitigation strategies. This section demonstrates an understanding of potential challenges and proactive planning to address them.

5. Implementation Plan: A detailed timeline outlining key milestones, responsible parties, and resource requirements. This provides a roadmap for project execution and ensures accountability.

6. Alternatives Analysis: An exploration of alternative solutions to the problem or opportunity being addressed, along with a justification for the chosen approach. This demonstrates due diligence and consideration of various options.

7. Strategic Alignment: An explanation of how the proposed investment aligns with the organization’s overall strategic objectives. This section connects the project to broader organizational goals and demonstrates its contribution to long-term success.

By incorporating these elements, organizations can ensure that capital expenditure requests are thoroughly vetted, strategically aligned, and financially sound, ultimately leading to more effective resource allocation and improved organizational performance. A well-structured request facilitates informed decision-making and contributes to the overall success of capital investment initiatives.

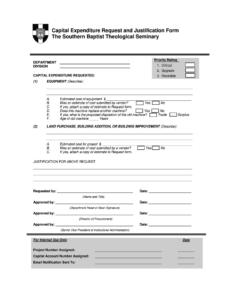

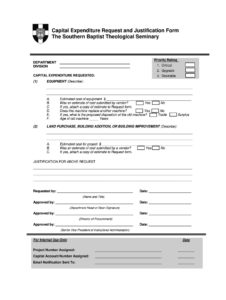

How to Create a Capital Appropriation Request Template

Creating a standardized template ensures consistency and efficiency in the capital appropriation request process. A well-designed template guides requesters, providing a clear framework for presenting essential information and facilitating thorough evaluations.

1. Define Scope and Objectives: Clearly outline the purpose and intended use of the template. Consider the types of capital expenditures it will cover and the specific information required for effective evaluation.

2. Structure Key Sections: Organize the template into logical sections corresponding to the key components of a comprehensive request. This typically includes sections for an executive summary, project description, financial analysis, risk assessment, implementation plan, alternatives analysis, and strategic alignment.

3. Develop Clear Instructions: Provide detailed instructions for completing each section of the template. Explain the purpose of each section, the type of information required, and any specific formatting guidelines.

4. Incorporate Financial Metrics: Include fields for essential financial metrics such as projected costs, return on investment (ROI), payback period, and net present value. Ensure clear guidance on calculating and presenting these metrics.

5. Include Risk Assessment Framework: Incorporate a structured framework for identifying and assessing potential risks. This might include prompts for identifying risks, evaluating their potential impact, and outlining mitigation strategies.

6. Align with Strategic Goals: Integrate a section that explicitly addresses the project’s alignment with organizational strategic objectives. This ensures that capital expenditures contribute to overall strategic priorities.

7. Establish Approval Workflow: Define the approval process for capital appropriation requests, including designated approvers and required documentation. This streamlines the review and approval process.

8. Test and Refine: Pilot test the template with a representative group of users to gather feedback and identify areas for improvement. Refine the template based on feedback to ensure its effectiveness and usability.

A well-designed template promotes transparency, streamlines the approval process, and facilitates informed decision-making regarding capital investments. Regular review and updates ensure the template remains aligned with evolving organizational needs and best practices in capital budgeting.

Standardized forms for requesting capital appropriations provide a crucial framework for managing significant investments. They ensure that proposals are thoroughly evaluated, strategically aligned, and financially sound. Key components such as executive summaries, detailed project descriptions, comprehensive financial analyses, risk assessments, and implementation plans contribute to informed decision-making. Developing a robust template with clear instructions, relevant financial metrics, and a structured risk assessment framework streamlines the process and promotes transparency.

Effective capital expenditure management is essential for organizational success. Leveraging structured processes and standardized documentation empowers organizations to make sound investment decisions, optimize resource allocation, and achieve strategic objectives. Regular review and refinement of these processes are crucial for adapting to evolving business needs and maximizing the value of capital investments.